Analog Devices (NASDAQ:ADI) shares are higher today after the global semiconductor major delivered better-than-expected numbers for the first quarter. While revenue declined by 23% year-over-year to $2.51 billion, the figure came in ahead of expectations by $10 million. Similarly, EPS of $1.73 outpaced consensus by $0.02. Additionally, the company has hiked its dividend by 7%.

The quarter was marked by double-digit revenue declines across ADI’s Industrial, Communications, and Consumer end markets. Automotive was the sole silver lining during this period, with an uptick of 9%. While the macroeconomic backdrop remains difficult, Vincent Roche, the CEO and Board Chair of Analog Devices, expects customer inventory rationalization to substantially moderate in the second quarter. As a result, the CEO sees ADI entering the second half of this year “in a more favorable business backdrop.”

For the upcoming quarter, ADI expects revenue of $2.1 billion, +/-$100 million. EPS for the quarter is estimated at $1.26, +/-$0.10. Separately, ADI is hiking its quarterly dividend by 7% to $0.92 per share. The ADI dividend is payable on March 15 to investors of record on March 5.

Is ADI a Good Buy?

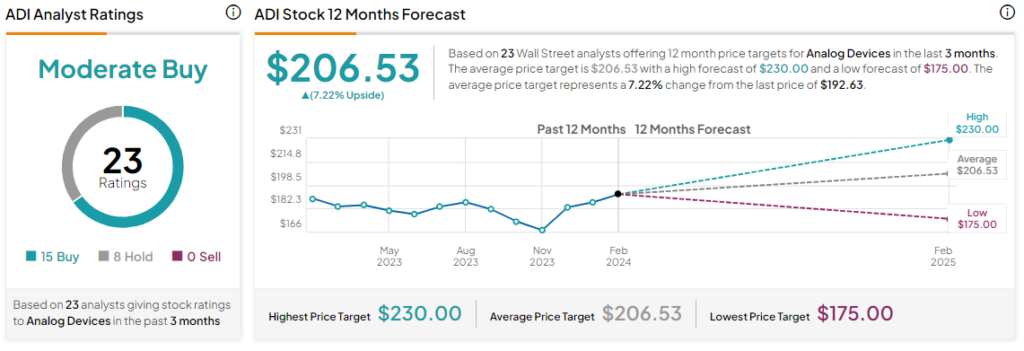

With today’s price gains, Analog Devices’ stock price has jumped by nearly 9% over the past six months. Overall, the Street has a Moderate Buy consensus rating on Analog Devices, and the average ADI price target of $206.53 implies a further 7.2% potential upside in the stock. However, analysts’ views on the stock could see a revision following today’s earnings report.

Read full Disclosure