Shares of Analog Devices (NASDAQ:ADI) gained in trading after the company reported better-than-expected results in the Fiscal second quarter. The semiconductor company’s adjusted diluted earnings declined by 51% year-over-year to $1.40 per share but still surpassed consensus estimates of $1.26 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

On top of this, ADI’s revenues fell by 34% year-over-year to $2.16 billion but beat analysts’ expectations of $2.11 billion.

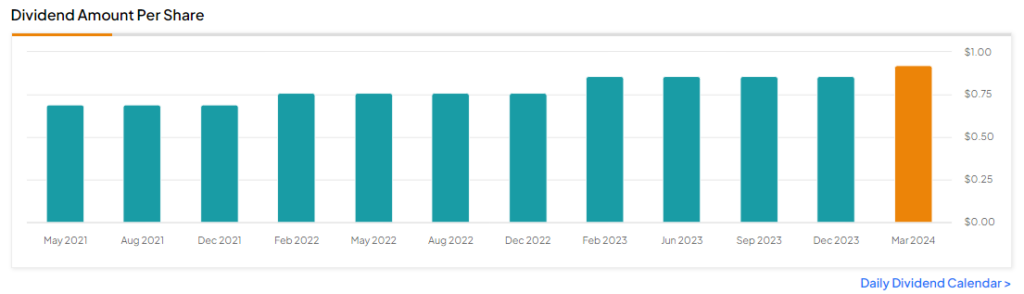

ADI’s Dividend Payment

The company’s Board of Directors has declared a quarterly cash dividend of $0.92 per share of common stock. The dividend will be paid on June 17 to all shareholders of record at the close of business on June 4, 2024.

ADI’s Fiscal Q3 Outlook

Looking forward, management now expects its Q3 revenue to be $2.27 billion, with an increase or decrease of $100 million, with adjusted earnings likely to be $1.50 per share. For reference, analysts have forecasted earnings of $1.35 per share on revenues of $2.16 billion.

Is ADI a Good Buy?

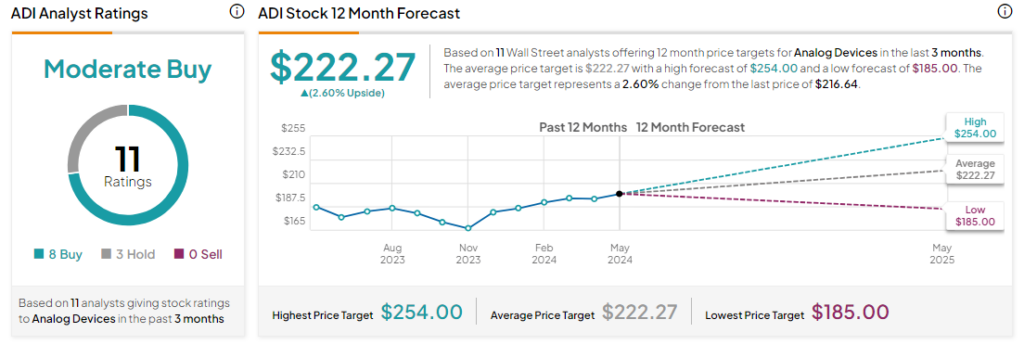

Analysts remain cautiously optimistic about ADI stock, with a Moderate Buy consensus rating based on eight Buys and three Holds. Over the past year, ADI has increased by more than 10%, and the average ADI price target of $222.27 implies an upside potential of 2.6% from current levels. These analyst ratings are likely to change following ADI’s Fiscal Q2 results today.