Shares of Analog Devices (ADI) gained in pre-market trading after the company reported better-than-expected Fiscal fourth-quarter results. The semiconductor company’s adjusted earnings dropped by 17% to $1.67 per share, still surpassing consensus estimates of $1.64 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Additionally, the company’s revenues declined by 10% year-over-year to $2.44 billion in the third quarter, exceeding Street estimates of $2.41 billion.

Vincent Roche, CEO and Chair, commented, “While unprecedented customer inventory headwinds drove a historic revenue decline during Fiscal 2024, we maintained operating margins above 40%, which is a testament to our business model’s resilience.”

ADI Announces Quarterly Dividend

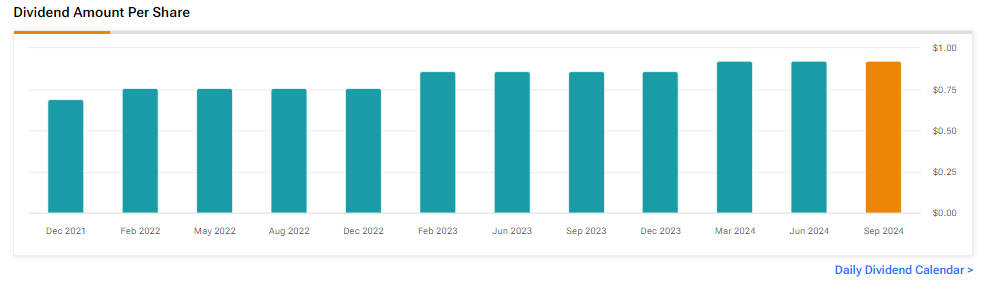

Moving on to dividends, ADI announced a quarterly cash dividend of $0.92 per outstanding share, payable on December 20 to shareholders of record as of the close of business on December 9, 2024.

ADI Issues Q1 Outlook

Looking ahead, the company expects Fiscal Q1 revenues of $2.35 billion, with a potential variation of $100 million. Furthermore, adjusted earnings are projected to be $1.53 per share, with a variance of $0.10 per share. For reference, analysts were expecting the company to report earnings of $1.57 per share on revenues of $2.34 billion.

Is ADI a Good Stock to Buy?

Analysts remain bullish about ADI stock, with a Strong Buy consensus rating based on six Buys and two Holds. Over the past year, ADI has increased by more than 20%, and the average ADI price target of $251.67 implies an upside potential of 12.6% from current levels. These analyst ratings are likely to change following ADI’s results today.