American department store retailer Kohl’s Corp. (NYSE: KSS) has gained a lot of attention from its shareholders and Board over the possible turnaround strategies. One of its major investors, Macellum Advisors is pursuing the management to consider selling the company for the greater good of both shareholders and investors.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In an interesting turn of events yesterday, Kohl’s shares spiked more than 9% briefly on the news that Acacia Research Corp. (ACTG) has expressed interest in buying the company.

Kohl’s ended the day up 4.1% at $49.75 on January 18. Meanwhile, shares of ACTG, which engages in licensing infringed patents on behalf of clients, closed down 4.4% at $4.58.

Befitting Reply to Macellum

On Tuesday, activist hedge fund Macellum Advisors, which owns about 5% of Kohl’s outstanding common shares, suggested that Kohl’s must consider strategic alternatives, including a sale, if its attempts to improve profitability and stock price trajectory turn out to be unfruitful.

Kohl’s gave a befitting reply to Macellum’s statement and also reaffirmed its strategic progress. Last year, Kohl’s added three new independent directors to its Board, including two from the group’s nominees. Kohl’s stated that these new directors are veterans in the retail sector with experience in companies such as Lululemon (LULU), Walmart (WMT), Burlington Stores (BURL), and Kroger (KR).

Under their leadership, Kohl’s is undertaking a strategic turnaround of its business and is focusing on omnichannel capabilities. The company is also undertaking steps to effectively manage inventory, save costs, as well as apply favorable pricing for its products.

A positive impact of these steps was seen in its third-quarter performance, wherein Kohl’s revenue grew 16% year-over-year, outpaced Street expectations, and delivered a record high operating margin of 8.4%. The company’s full-year Fiscal 2021 outlook also represents an all-time high number.

Kohl’s has also accelerated its share buyback program and expects to buy back $1.3 billion in shares in 2021. The company stated that it will give more clarity on its updated financial framework and capital allocation strategy on its investor day scheduled on March 7, 2022.

Lastly, Kohl’s alleged Macellum of being unwilling to constructively engage in discussions that are in the best interest of the shareholders.

Acacia’s Interest in Kohl – Rumor or Fact?

According to a Reuters report, two sources from Acacia have claimed that the company has reached out to Kohl’s showing interest in buying the retailer. Acacia buys stakes in the technology and healthcare sectors. Activist investor Starboard Value has a majority hold in the company.

Acacia’s interest is only in the primary stages with no formal bid in place. As per sources, Acacia has around $1 billion in available capital and any further funding required for the bid would be provided by Starboard.

The sources also stated that Acacia and Starboard would try to sell off Kohl’s real estate holdings, which are valued between $7 billion and $8 billion, with the help of Oak Street Real Estate Capital LLC to aid in funding the transaction.

Neither are other details of Acacia’s supposed interest available as of now, nor are there any guarantees of the transaction transpiring. Only time will reveal whether Acacia will actively pursue its interest in buying the retailer, while investors await more clarity at Kohl’s Investor Day.

Kohl’s has been facing investors’ furry ever since the pandemic hit its operations and stock price performance. In December 2021, another activist hedge fund Engine Capital urged Kohl’s to split its digital and real estate businesses to improve the stock’s performance. This suggestion too, did not materialize since Kohl’s stated that its e-commerce business works in tandem with the stores.

Wall Street’s View

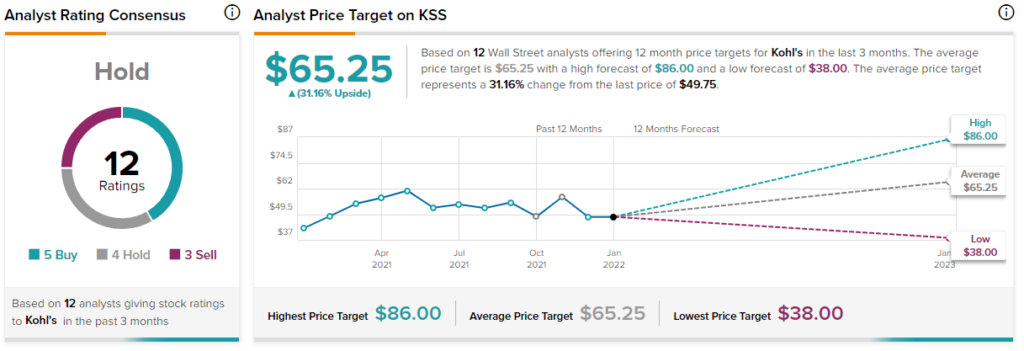

The Wall Street community has a Hold consensus rating on the Kohl’s stock with 5 Buys, 4 Holds, and 3 Sells. The average Kohl’s price target of $65.25 implies 31.2% upside potential to current levels. Shares have gained 16% over the past year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Ralph Lauren CEO Talks about Metaverse

Johnson & Johnson Settles Opioid Case with New Mexico

FAA to Review FedEx’s Proposal to Install Missile-Defense System