Acrivon Therapeutics’ (ACRV) shares lost their luster early Thursday despite encouraging results from the biopharma company’s cancer studies.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to the Massachusetts-based drug developer, its mid-stage study of ACR-368 (prexasertib), the experimental drug targeting endometrial or womb cancer, and its early-stage study for ACR-2316, another experimental drug designed to prevent cancer cells from repairing DNA damage, both returned positive results.

What Are the Cancer Drugs Under Investigation?

In the Phase 2b study for ACR-368 (used alone) among patients whose tumors carry a biomarker pattern that suggests they are more likely to respond to ACR-368, 39% of the patients saw their tumors shrink significantly. The shrinkage was even higher among patients who had undergone no more than two earlier treatments — 44% of such patients saw declines in the sizes of their tumors.

On the other hand, in the Phase 1 study for ACR-2316, nine out of 20 patients experienced tumor shrinkage when given a 120 mg or higher dose of the drug. In addition, the treatment provided early evidence of the partial effectiveness of the drug in treating endometrial cancer.

Acrivon Therapeutics Eyes New Drug Candidate

Meanwhile, Acrivon also disclosed that it has selected ACR-6840, its pill-based drug that targets the protein called CDK11 to stop cell division, thereby triggering programmed cell death. This process can help to prevent the growth and spread of cancerous cells.

The biopharmaceutical company noted that it plans to submit a formal request to the U.S. Food and Drug Administration during the fourth quarter of this year for permission to start clinical trials in humans for the drug.

Is Acrivon Therapeutics a Buy or Sell?

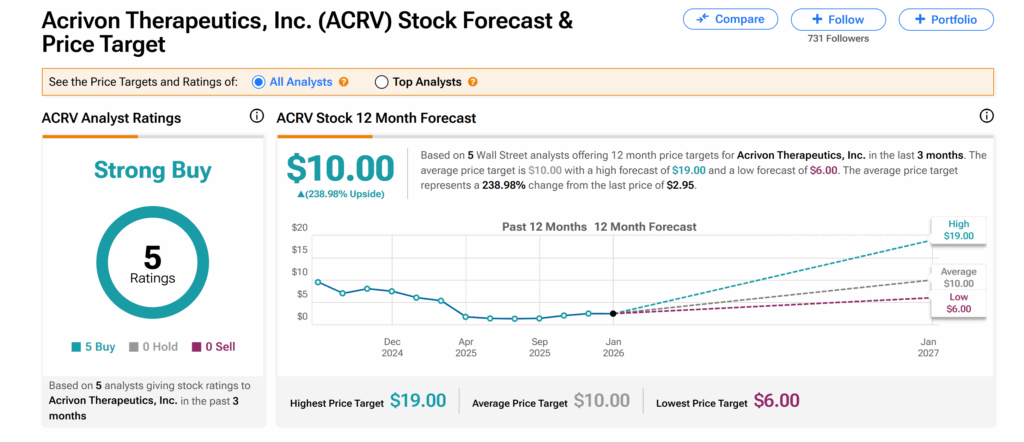

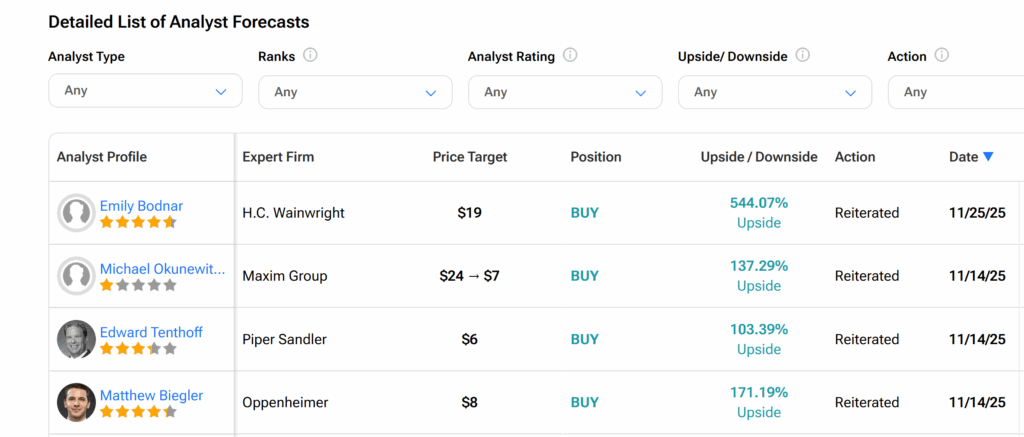

Turning to Wall Street, Acrivon Therapeutics’ shares currently boast a Strong Buy consensus rating from analysts. This is based on five Buys issued over the past three months.

In addition, the average ACRV price target of $10 per share implies a massive 239% upside from current trading levels.