Albertsons (ACI) stock gained over 1% in yesterday’s regular trading session after it reported better-than-expected results in the second quarter of Fiscal 2024. Strong growth in digital and pharmacy sales supported the company’s performance in the quarter.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

ACI’s Q2 adjusted earnings of $0.51 per share surpassed Street’s expectations of $0.48. However, the reported figure compared unfavorably with $0.63 in the prior-year quarter. This decrease can be attributed to higher operating expenses.

ACI is an American grocery company. It should be noted that the company has an impressive earnings surprise history, as it has missed estimates in only one quarter since 2021 (for a thorough assessment of ACI stock, go to TipRanks’ Stock Analysis page).

ACI Revenue Benefits from Loyalty Program Growth

During the reported quarter, net sales and other revenue climbed by about 2% to $18.6 billion and came in slightly higher than the consensus estimates of $18.5 billion. The top line benefited from strong performance in its loyalty program as membership increased 15% to reach 43 million.

Additionally, digital sales soared by 24% year-over-year in Q2. Moreover, the company’s omnichannel shopping initiatives and ongoing growth in its retail media segment, Albertsons Media Collective, contributed to ACI’s strong performance.

ACI’s CEO Highlights Challenges Ahead

Despite the positive results, Albertsons CEO Vivek Sankaran anticipates that the company will continue to face challenges from higher investments and a shift towards lower-margin pharmacy and digital businesses. Furthermore, the increasingly competitive retail landscape is expected to be another headwind.

Merger Uncertainty Clouds ACI’s Guidance

Given the pending $24.6 billion merger with Kroger (KR), Albertsons opted not to provide financial guidance for the rest of the year or host a conference call to discuss its earnings.

This decision comes amidst ongoing uncertainty surrounding the proposed merger, as the companies await a decision from a federal judge in Oregon regarding the FTC’s attempt to block the deal. In addition, they are facing legal challenges from the attorneys general of Colorado and Washington state.

Is ACI a Good Buy?

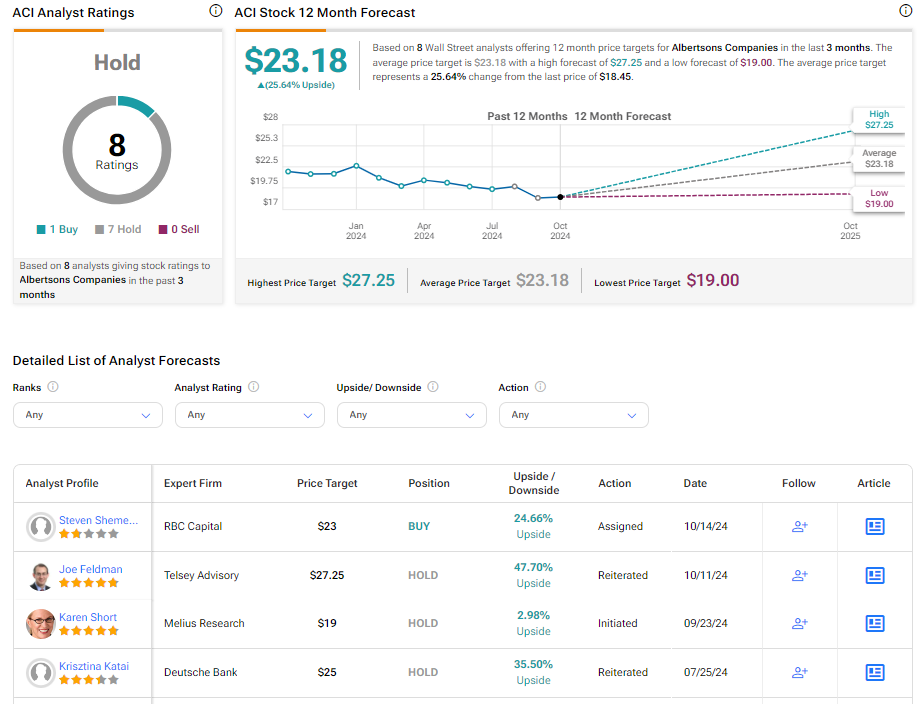

Turning to Wall Street, ACI has a Hold consensus rating based on one Buy and seven Holds assigned in the last three months. At $23.18, the average Albertsons price target implies 25.64% upside potential. Shares of the company have gained more than 18% year-to-date.