Archer Aviation stock (ACHR) is up over 160%% in the past year, fueled by growing optimism around electric vertical takeoff and landing (eVTOL) aircraft. The company is building a global presence, with pre-orders worth $6 billion and recent expansion deals in the UAE, Indonesia, and Ethiopia. Its Midnight aircraft, priced at $5 million per unit, is expected to begin commercial operations in 2025. If Archer can live up to its deadline, then the sky is the limit.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Strong Vision, But Zero Revenue

Investors are betting that Archer will become a leader in urban air mobility, offering short, quiet air taxi rides across congested cities. The company has garnered support from United Airlines (UAL), the Abu Dhabi Investment Office, and other notable entities. It also has a manufacturing facility in Georgia, which will supply aircraft for its initial rollout.

However, Archer has yet to generate any revenue. Its business model is still evolving. It aims to sell aircraft and operate taxi services, but both paths come with major financial and operational challenges. Operational figures are tight. For instance, if each aircraft flies 10 trips a day at $100 per passenger and carries four people per flight, it could generate around $1.46 million annually. With a $5 million price tag and additional costs such as pilot salaries, maintenance, and infrastructure, the break-even timeline could extend for years.

Valuation Already Pricing In a Lot

The company recently raised $850 million in new capital, bringing total liquidity to about $2 billion. Still, with $450 million in negative free cash flow reported this year, funding needs are likely to continue. Any delay in FAA certification could further push back revenue.

Archer’s market cap is around $6.5 billion. Some analysts suggest that if the company eventually delivers 100 aircraft per year, this would result in $500 million in annual revenue. Assuming a 15% net margin and a P/E of 30, that would imply less than $2.5 billion in valuation, far below today’s levels.

Is Archer Aviation Stock a Good Buy?

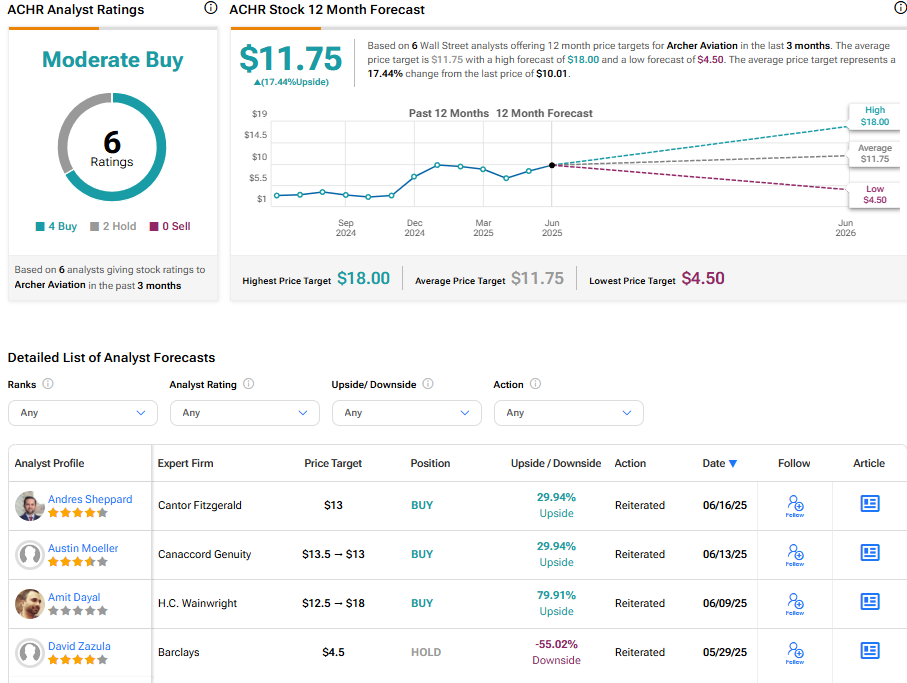

ACHR, no doubt, has momentum, but it’s also speculative. Regulatory delays, manufacturing risk, and high capital burn make the investment case complex. The Street’s analysts currently rate it as a Moderate Buy, with an average ACHR stock price target of $11.75, suggesting a 17.44% upside.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue