Cathie Wood is one of the most closely followed figures in modern investing. As the founder and CEO of ARK Invest, she’s earned a reputation for spotting transformational trends early, often long before Wall Street takes notice. Through ARK’s lineup of actively managed exchange-traded funds (ETFs), Wood champions innovation in areas ranging from artificial intelligence and genomics to robotics and fintech. Her every move is tracked by market watchers eager to see where the “Queen of Disruption” is placing her next wager.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

On Wednesday, October 15, Wood and her team were at it again, executing a round of trades across several ARK funds, including the flagship ARK Innovation ETF (ARKK), ARK Autonomous Technology & Robotics ETF (ARKQ), ARK Next Generation Internet ETF (ARKW), and the ARK Fintech Innovation ETF (ARKF).

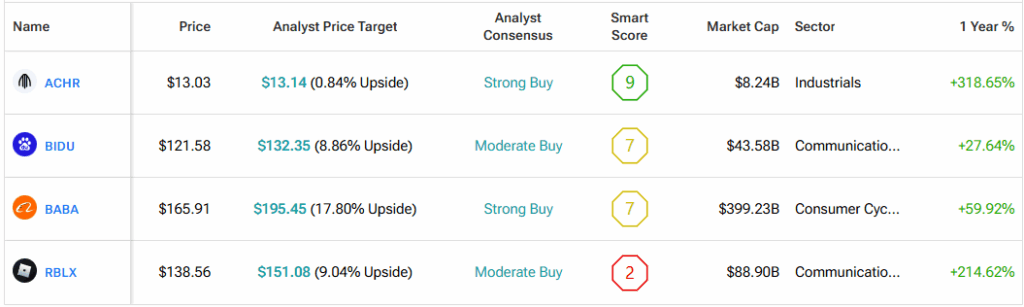

The day’s biggest move involved Archer Aviation (ACHR), ARK’s holding in the electric air mobility space. ARK Innovation ETF (ARKK) sold 302,280 shares of the company, trimming its position after a strong run over the past year. Archer is building electric vertical takeoff and landing (eVTOL) aircraft designed to revolutionize short-distance travel. Its Midnight aircraft is progressing toward commercial launch, and the company remains among the top contenders in the race to make air taxis a reality.

From the skies to the cloud, ARK’s buying activity centered on China’s leading tech names. Baidu (BIDU) was added across multiple ARK funds, including ARKK, ARKQ, ARKW, and ARKF, for a combined total of ~111,000 shares. The Chinese search and AI powerhouse has been making waves with its autonomous driving initiatives and its ERNIE AI model, which rivals OpenAI’s ChatGPT. Wood’s increased exposure suggests confidence in Baidu’s innovation pipeline despite the regulatory challenges facing China’s tech sector.

Continuing that theme, Alibaba Group (BABA) also featured among ARK’s top buys today. The e-commerce and cloud titan has been one of the standout performers this year, with shares nearly doubling in 2025. ARK’s ~75,000-share addition across funds underscores Wood’s confidence that Alibaba’s business momentum and global positioning can sustain further growth even as China’s broader economy remains uneven.

Meanwhile, ARK trimmed its position in Roblox (RBLX), selling a combined ~62,000 shares across the ARKK, ARKW, and ARKF ETFs. The gaming and metaverse platform has seen its stock surge about 240% over the past year, fueled by growing developer engagement and expanding brand partnerships. Wood’s decision to reduce exposure likely reflects profit-taking after the strong rally rather than a shift in conviction about Roblox’s long-term potential.

Elsewhere, smaller trades reflected ongoing portfolio fine-tuning. ARK Innovation ETF sold 30,514 shares of Teradyne (TER) and 16,213 shares of Brera Holdings (SLMT), while ARKW trimmed its stake in Palantir (PLTR) by 16,560 shares. In addition, ARKQ reduced its position in Kratos Defense (KTOS) by 28,145 shares. These moves likely represent short-term capital adjustments rather than changes in Wood’s broader conviction toward these companies.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.