Abbott (NYSE:ABT) reported Q2 earnings that topped analysts’ expectations on Thursday. The medical devices and healthcare company announced adjusted earnings of $1.14 per share in the second quarter, up by 5.6% year-over-year. This was above Street expectations of $1.10 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Abbott’s Revenue Breakdown

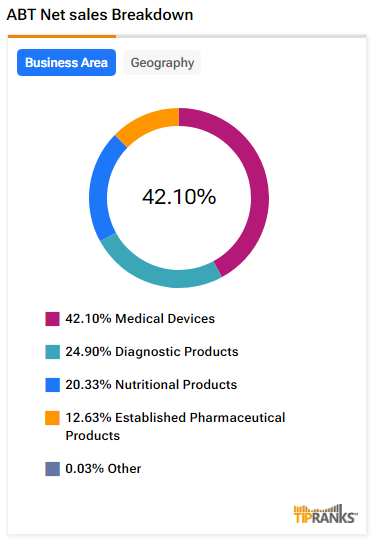

The company’s sales increased by 4% year-over-year, with revenue hitting $10.37 billion. This was in line with analysts’ expectations. Abbott’s growth in revenues was driven by a double-digit increase in the sales of its medical devices. The company clocked Q2 medical device sales of $4.7 billion, an increase of 10.2% year-over-year.

Medical device sales comprised more than 40% of ABT’s revenues in the second quarter.

ABT’s Dividend and FY24 Outlook

The company declared a quarterly dividend of $0.55 per share payable on August 15 to shareholders of record at the close of business on July 15, 2024.

Looking forward, Abbott raised its FY24 outlook and now expects adjusted earnings in the range of $4.61 to $4.71 per share, compared with its prior forecast of $4.55 to $4.70 per share. In the third quarter, the company has projected adjusted diluted earnings per share between $1.18 and $1.22. For reference, analysts are expecting Q3 earnings of $1.20 per share.

Is ABT a Good Stock to Buy?

Analysts remain bullish about ABT stock, with a Hold consensus rating based on nine Buys and one Hold. Year-to-date, ABT has declined by more than 3.5% and the average ABT price target of $126.30 implies an upside potential of 20.6% from current levels. These analyst ratings are likely to change following ABT’s Q2 results today.