The stock of Abercrombie & Fitch (ANF) is down 16% after the clothing retailer provided updated financial guidance that disappointed analysts and investors.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

The Ohio-based company said in a news release that it expects its holiday quarter to be only slightly better than previously anticipated. Abercrombie raised its sales growth outlook to a range of 7% to 8%, which was only a little ahead of the top end of previous guidance that called for 5% to 7% growth.

Abercrombie & Fitch added that it now expects full-year sales growth of 15%. It previously forecast sales to grow 14% to 15% for all of 2024. The revised guidance is also lower than in 2023, when the fashion retailer’s sales grew 21% year-over-year. The tepid guidance raise is pressuring ANF stock.

Focus on Profits

The weak guidance comes after Abercrombie & Fitch’s sales rose significantly over the past two years, giving the company tough year-over-year comparisons to beat. In its news release, Abercrombie & Fitch CEO Fran Horowitz said that the company plans to focus more on boosting profits than sales going forward.

“Our goal is to leverage our healthy margin structure and balance sheet to grow operating income dollars and earnings per share at rates faster than sales,” said Horowitz in the release. ANF stock has gained 35% over the last 12 months and has risen nearly 300% in the past three years.

Is ANF Stock a Buy?

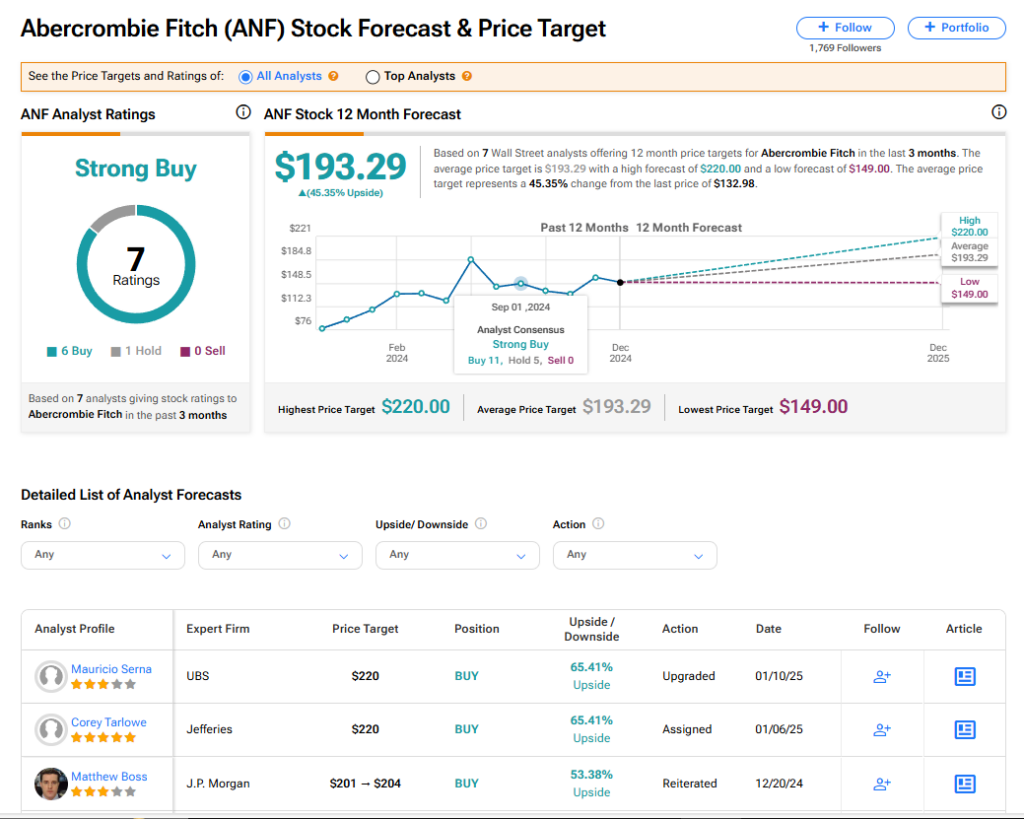

The stock of Abercrombie & Fitch has a consensus Strong Buy rating among seven Wall Street analysts. That rating is based on six Buy and one Hold recommendations issue in the last three months. The average ANF price target of $193.29 implies 45.35% upside from current levels.