AbbVie (ABBV) stock was on the move after the pharmaceutical company announced the approval of a new cancer drug. The drug, EMRELIS, received accelerated approval from the Food and Drug Administration (FDA) as a treatment for adult patients with locally advanced or metastatic, non-squamous non-small cell lung cancer (NSCLC) with high c-Met protein overexpression (OE), who have received prior systemic therapy.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

AbbVie has the potential to reach a large market with EMRELIS, as around 85% of all lung cancer cases are NSCLC. This type of cancer also remains the leading cause of cancer-related deaths globally. However, EMRELIS’s ongoing approval is contingent on the results of confirmatory trials. That’s due to the accelerated approval being based on the company’s Phase 2 LUMINOSITY study, and not a Phase 3 clinical trial.

Jonathan Goldman, MD, professor of medicine, director of thoracic oncology clinical trials at UCLA, highlighted the potential of EMRELIS. He stated, “People with c-Met overexpressing NSCLC have poor prognosis and limited treatment options, and EMRELIS is a first-in-class ADC that can address a critical unmet need for this patient population.”

Analyst Downgrade Hinders ABBV Stock

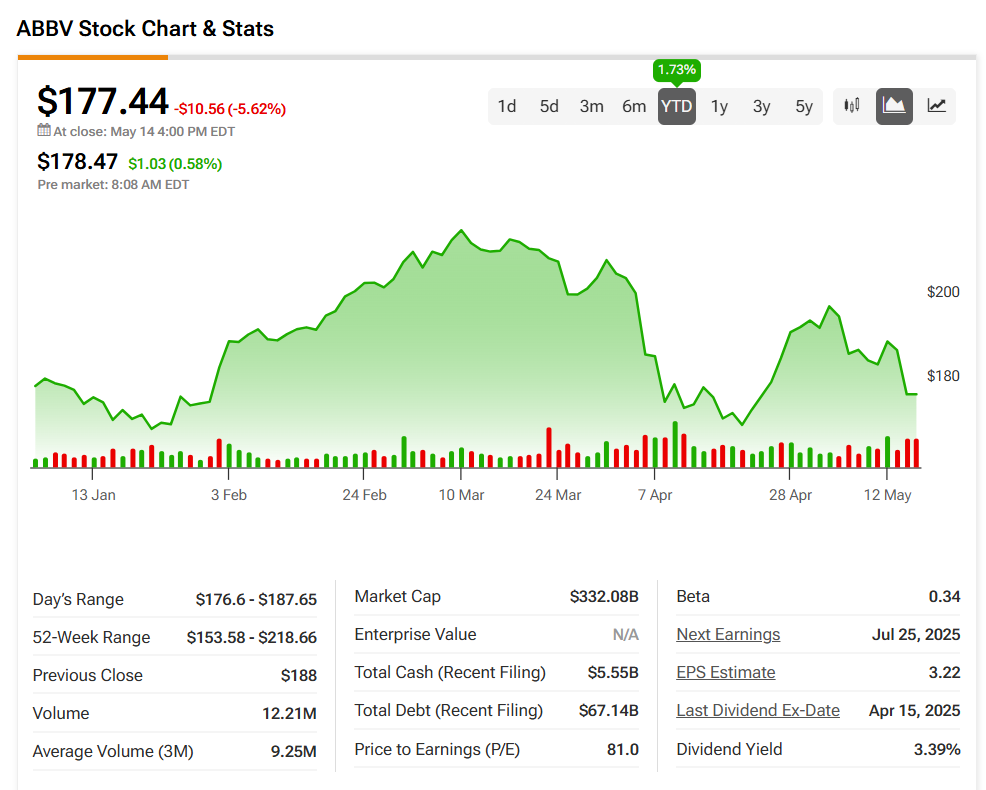

Despite the FDA’s accelerated approval, shares of ABBV stock dropped 5.62% on Wednesday. That also came with heavy trading, as some 12.21 million shares changed hands, compared to a three-month daily average of 9.25 million units.

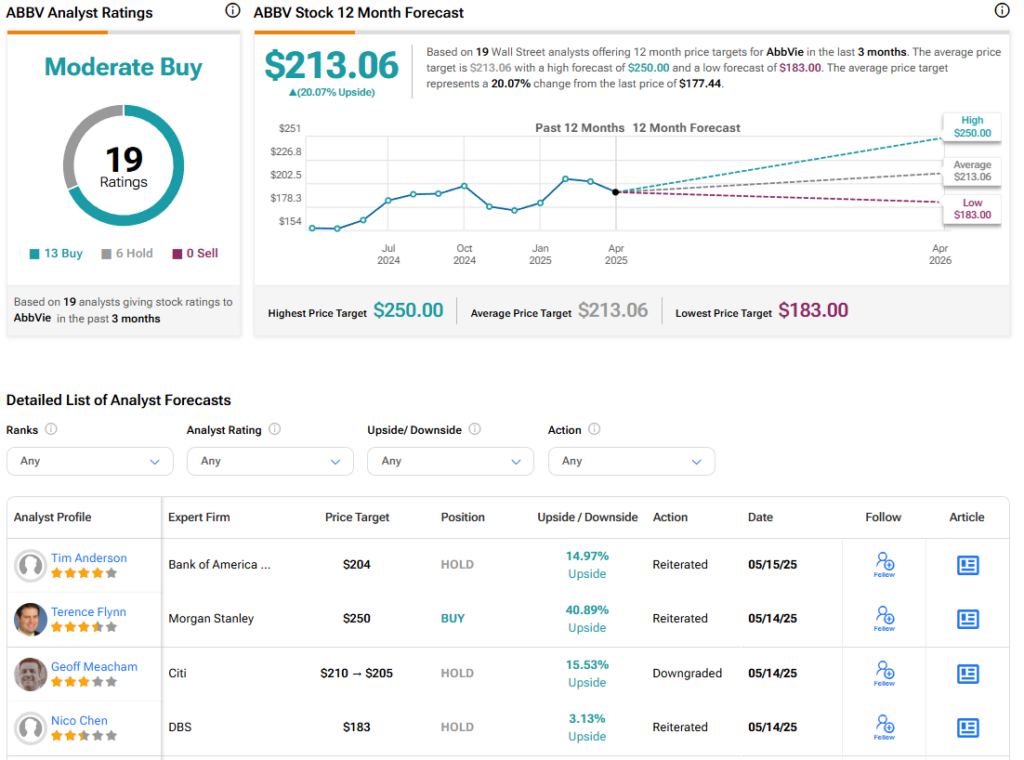

The bad news for ABBV stock came from Citi analyst Geoff Meacham. He downgraded the shares to Neutral from Buy and cut his price target to $205 from $210, which still represents a potential 15.53% upside. Meacham’s concerns include lacking late-stage drug pipeline, limited earnings beats, and tariffs.

Investors will note that other analysts also updated their coverage of ABBV stock yesterday. Morgan Stanley’s Terence Flynn reiterated a Buy rating and $250 price target, while four-star Bank of America Securities analyst Tim Anderson maintained a Hold rating and $204 price target.

Is ABBV Stock a Buy, Hold, or Sell?

Turning to Wall Street, the analysts’ consensus rating for AbbVie is Moderate Buy, based on 13 Buy and six Hold ratings over the last three months. With that comes an average ABBV stock price target of $213.06, representing a possible 20.07% upside for the shares.

See more ABBV stock analyst ratings.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue