AbbVie (ABBV) reported strong results in the third quarter and raised its FY24 earnings outlook. The pharmaceutical company’s adjusted earnings increased by 1.7% to $3 per share in Q3, above consensus estimates of $2.92 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

ABBV’s Q3 Revenues Driven by the Immunology Portfolio

Furthermore, the company’s revenues increased year-over-year by 4.9% on an operational basis to $14.46 billion in the third quarter. This surpassed Street estimates of $14.28 billion. ABBV’s Immunology drugs portfolio continued to drive its revenue growth. This business segment clocked revenues of $7.05 billion, up by 3.9% year-over-year and comprised more than 45% of ABBV’s total revenues.

ABBV Raises Quarterly Dividend

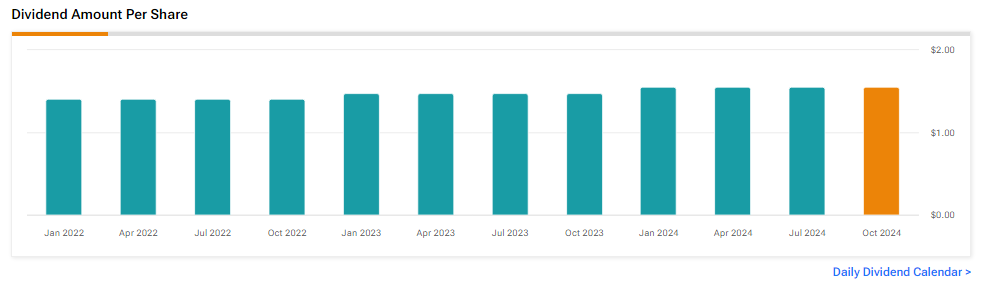

In addition, the company raised its quarterly dividend by 5.8% to $1.64 per share from $1.55 per share beginning with the dividend payable on February 14, 2025 to shareholders of record as of January 15, 2025. Notably, ABBV has raised its quarterly dividend by 310% from its inception in 2013.

ABBV Raises FY24 Earnings Guidance

Looking ahead, the company raised its adjusted earnings outlook for FY24 in the range of $10.90 to $10.94 per share, compared to its prior forecast between $10.67 and $10.87 per share. For reference, analysts were expecting the company to report earnings of $10.85 per share.

Is ABBV a Good Stock to Buy Now?

Analysts remain cautiously optimistic about ABBV stock, with a Moderate Buy consensus rating based on eight Buys and seven Holds. Over the past year, ABBV has increased by more than 30%, and the average ABBV price target of $205.17 implies an upside potential of 8.3% from current levels. These analyst ratings are likely to change following ABBV’s results today.