The chaos around tariffs has shaken the magnificent 7 stocks. These Magnificent 7 stocks: Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA), are prominent tech companies that are known for their market dominance, innovation, and influence on the NASDAQ (NDAQ) and S&P 500 (SPX) indices. Despite the ongoing tariff turmoil and macro pressures, Wall Street is bullish on some Magnificent 7 stocks. Using TipRanks’ Stock Comparison Tool, we will compare three Magnificent 7 stocks to pick the one that is most attractive, according to Wall Street analysts.

Apple (NASDAQ:AAPL)

Tech giant Apple is significantly exposed to tariffs, given that the company relies heavily on its supply chain partners in Asia for the manufacturing and assembly of its products. The 90-day hold on reciprocal tariffs helped AAPL stock rebound to some extent, but it is still down about 21% year to date. Moreover, the announcement on late Friday that smartphones, computers, and many other tech devices and components would be exempt from reciprocal tariffs is expected to boost Apple’s stock in the week ahead.

Nonetheless, Apple’s vulnerability to trade wars due to its exposure to China can’t be ignored. Experts debate that it will take Apple years and cost billions to move production to the U.S. Also, it will result in a notable jump in the price of the iPhone. Perhaps, the company’s high-margin Services business could help to drive Apple’s performance and mitigate the impact of potential tariffs. Also, Apple has been diversifying its supply chain to countries like India to reduce its dependence on China.

Is Apple Stock a Buy, Sell, or Hold?

Prior to Trump’s latest decision to exempt smartphones and other electronic devices from reciprocal tariffs, Bank of America Securities analyst Wamsi Mohan reiterated a Buy rating on AAPL stock with a price target of $250. The 5-star analyst noted that clients’ focus has shifted to the feasibility of manufacturing Apple products, like iPhones, in the U.S.

Mohan thinks that while Apple can find labor to assemble iPhones in the U.S., majority of the sub-assemblies would still be manufactured elsewhere, assembled in China, and imported to the U.S. This is because moving the entire iPhone supply chain would be a much bigger process and would likely take many years while pushing the manufacturing costs higher. Despite the tariff turmoil, Mohan remains bullish on Apple due to its stable cash flows, earnings resiliency, and the favorable impact from the use of AI on edge devices.

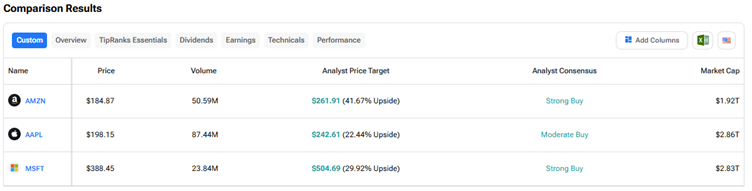

Given the current scenario, Wall Street has a Moderate Buy consensus rating on Apple stock based on 17 Buys, 12 Holds, and four Sell recommendations. The average AAPL stock price target of $242.61 implies 22.4% upside potential.

Amazon (NASDAQ:AMZN)

Amazon stock has declined about 16% so far this year due to worries about the impact of tariffs on the e-commerce giant, as many sellers on the platform source their goods from China. Moreover, a potential economic slowdown due to tariffs is expected to impact enterprise spending and adversely hit the company’s AWS (Amazon Web Services) cloud computing unit.

While many analysts lowered their price target on AMZN stock due to tariff headwinds, they remain bullish on its long-term growth potential, given its vast network, e-commerce leadership, AI-led tailwinds in the AWS unit, and the growing advertising business.

What Is the Price Target for AMZN Stock?

Baird analyst Colin Sebastian reduced the price target to $215 from $260 on AMZN stock and reiterated a Buy rating. The 5-star analyst currently expects a modest revenue and margin impact from tariffs on Amazon’s marketplace. He added that tariffs may also lead to higher prices for AWS infrastructure, while a broader macro slowdown would unfavorably impact most areas of the enterprise.

That said, Sebastian believes that Amazon’s increasingly diversified business, greater mix of services, higher-margin revenue streams from AWS, 3P Marketplace, advertising, and Prime subscriptions can protect revenue and margins to some extent. The analyst now expects revenue of $698 billion (9.5% growth) compared to the prior estimate of $705 billion in 2025. He expects online stores, AWS, and advertising revenue to grow by 5.6%, 16.9%, and 15.9%, respectively.

Overall, Amazon stock scores a Strong Buy consensus rating based on 46 Buys versus just one Hold recommendation. The average AMZN stock price target of $261.91 implies about 42% upside potential from current levels.

Microsoft (NASDAQ:META)

Microsoft and Meta Platforms (META) stocks have been resilient compared to other Magnificent 7 stocks. MSFT stock is down 8% so far this year. Investors have been worried that a potential recession might impact Microsoft’s growth. Moreover, the news that Microsoft is slowing or pausing some of its data center projects, including a $1 billion project in Ohio, raised concerns about the ongoing macro pressures on the company’s business.

Despite ongoing challenges, most Wall Street analysts remain bullish on Microsoft stock due to its solid fundamentals, AI tailwinds, growth prospects of its cloud computing platform Azure, and a vast enterprise customer base.

Is Microsoft a Buy, Hold, or Sell?

Recently, Cantor Fitzgerald analyst Thomas Blakey reiterated a Buy rating on Microsoft stock. Following his firm’s recent checks, Blakey noted that Azure commentary was relatively upbeat, with one partner calling Microsoft the best-equipped vendor to withstand the current macro environment, given its business lines like productivity and security.

The 4-star analyst added that checks indicated that performance in the March quarter (Q3 FY25) were overall strong, with partners meeting or surpassing expectations due to accelerating Azure growth, driven by AI. In fact, checks highlighted that they are not seeing any discounting in the Azure business, with Microsoft bundling other solutions as a “pseudo discount” for Azure.

Regarding data center cancellations and lessening capacity, checks revealed that no such trend is being observed. For Microsoft Copilot, partners are witnessing healthy activity from customers in purchasing Copilot seats, though with heavy discounting as an incentive along with bundling of other Microsoft offerings.

With 32 Buys and three Holds, Wall Street has a Strong Buy consensus rating on MSFT stock. The average MSFT stock price target of $504.69 implies about 30% upside potential.

Conclusion

Currently, Wall Street is highly bullish on Amazon and Microsoft but cautiously optimistic on Apple. Analysts see higher upside potential in AMZN stock compared to AAPL and MSFT stocks. Amazon’s dominance in e-commerce and cloud computing, AI tailwinds, and the growing ad business are expected to drive the company’s future growth.