Major tech giants reported resilient results for the March quarter despite the ongoing pressures related to tariffs and concerns of a potential recession. While tariffs continue to be a major overhang, Wall Street remains bullish on many tech giants due to their massive scale, ability to navigate challenges with strong execution, solid track record, and attractive growth potential. Using TipRanks’ Stock Comparison Tool, we placed Apple (AAPL), Amazon (AMZN), and Meta Platforms (META) against each other to find the most attractive stock, according to Wall Street analysts.

Apple (NASDAQ:AAPL)

Apple stock has declined 18% so far in 2025. The iPhone maker exceeded analysts’ revenue and earnings expectations for the second quarter of Fiscal 2025. However, investors were disappointed as Apple’s Services revenue fell short of estimates. Moreover, CEO Tim Cook said that it is very difficult to estimate the impact of tariffs beyond June because he is not “sure what will happen with tariffs.”

For the June quarter, Apple expects tariffs to increase costs by $900 million, assuming no changes occur. The company has been diversifying its manufacturing to reduce its reliance on China. Apple is already sourcing about 50% of its iPhones for the U.S. from India and most of its other products for the U.S. from Vietnam, where tariffs are lower than those imposed on China. That said, the company still makes the “vast majority” of its products for other countries in China, Cook stated in an interview with CNBC.

Is Apple a Buy, Sell, or Hold?

In reaction to the Q2 FY25 results, Morgan Stanley analyst Erik Woodring reaffirmed a Buy rating on AAPL stock with a price target of $235. The analyst stated that while Apple’s Q2 FY25 results and June quarter outlook were largely in line with estimates, he thinks that management’s underlying commentary was better than expected. In particular, Woodring highlighted the double-digit year-over-year growth in iPhone upgraders, flat (on constant currency basis) China revenue, Apple featuring in the top 2 selling smartphones in Urban China, and no demand or channel pull-forward in the March quarter, and none assumed in the June quarter outlook.

Furthermore, Woodring highlighted that despite being over-indexed to China, Apple faces only $900 million of tariff costs in the June quarter. This indicates that the company’s South East Asia production diversification is working. However, he pointed out that management didn’t offer any segment-level guidance for the June quarter and didn’t commit to how much product would come from India/Vietnam in the September quarter and beyond.

Overall, Wall Street has a Moderate Buy consensus rating on Apple stock based on 17 Buys, six Holds, and four Sells. The average AAPL stock price target of $229.95 indicates about 12% upside potential.

Amazon.com (NASDAQ:AMZN)

E-commerce and cloud computing giant Amazon reported better-than-expected results for the first quarter of 2025. However, revenue from the company’s AWS (Amazon Web Services) cloud business lagged expectations. AWS is the leading provider of cloud infrastructure and carries a higher margin than Amazon’s retail business.

Further, the company issued soft guidance for the second quarter of 2025 amid pressures due to tariffs and trade policies and recessionary fears. Amazon’s retail business faces notable risk from tariffs, with many sellers on its third-party marketplace relying on China to make or assemble their products. However, most analysts remain optimistic about Amazon’s prospects due to its vast network and ability to continue to offer products at attractive prices by focusing on driving further efficiencies. They are also bullish on AWS due to AI-related tailwinds.

What Is the Target Price for Amazon Stock?

Following the Q1 print, Bank of America Securities analyst Justin Post increased the price target for Amazon stock to $230 from $225, while reiterating a Buy rating. The 5-star analyst noted that the company has “material” 3P (third-party) seller revenue exposure to China and other imports, and that AWS lost some ground to Microsoft’s (MSFT) Azure in the first quarter.

That said, he highlighted that Amazon has shown good stability in 2025 so far. He thinks that AMZN stock is well-positioned to gain from any trade agreements over the next three months. He cautioned that Cloud growth could be lumpy, and AWS is not seeing the benefit of ChatGPT usage like Azure. Nevertheless, Post pointed out that corporate spend remains steady, and AWS growth could likely accelerate in the second half of the year as capacity ramps up.

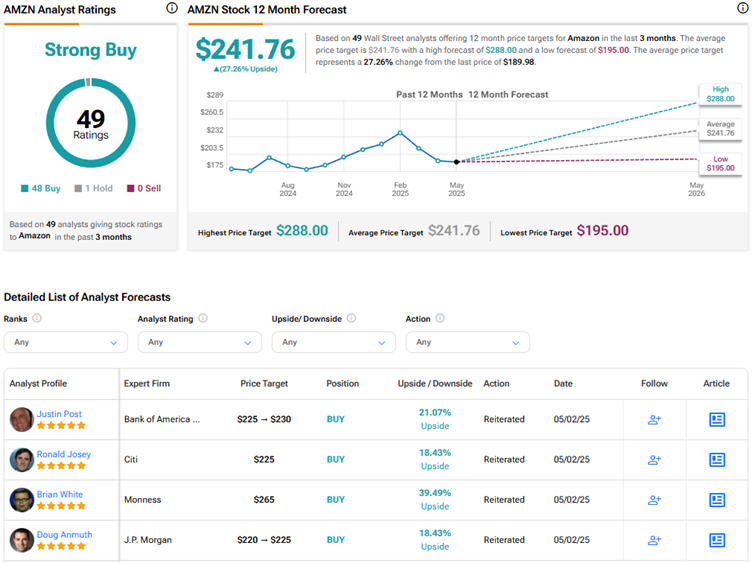

With 48 Buys against one Hold recommendation, Amazon stock scores a Strong Buy consensus rating on TipRanks. The average AMZN stock price target of $241.76 implies 27.3% upside potential. AMZN stock has declined 13.4% year-to-date.

Meta Platforms (NASDAQ:META)

Social media giant Meta Platforms recently reported upbeat results for the first quarter of 2025 and offered Q2 outlook that met the Street’s expectations. The company’s daily active users reached 3.43 billion, exceeding analysts’ estimate of 3.39 billion. Despite an uncertain macro backdrop, Meta’s ad revenue of $41.39 billion also surpassed expectations.

However, the company cautioned that it is seeing some reduced ad spend from Asian e-commerce exporters. Meanwhile, Meta Platforms lowered its full-year total expenses outlook range but raised its capital expenditure guidance due to additional data center investments to support its AI initiatives and an increase in the expected cost of infrastructure hardware.

Overall, Meta Platforms is confident about delivering strong performance despite ongoing macro challenges.

Is Meta Platforms a Good Stock to Buy?

Following the Q1 print, JPMorgan analyst Doug Anmuth raised his price target for Meta Platforms stock to $675 from $610 and maintained a Buy rating. Anmuth noted that the company reported solid Q1 results and Q2 outlook and provided clarity on its AI roadmap.

The 5-star analyst continues to believe that Meta Platforms is well-positioned for a challenging macro environment, given its scaled advertiser base, robust platform, and “vertical agnostic” inventory.

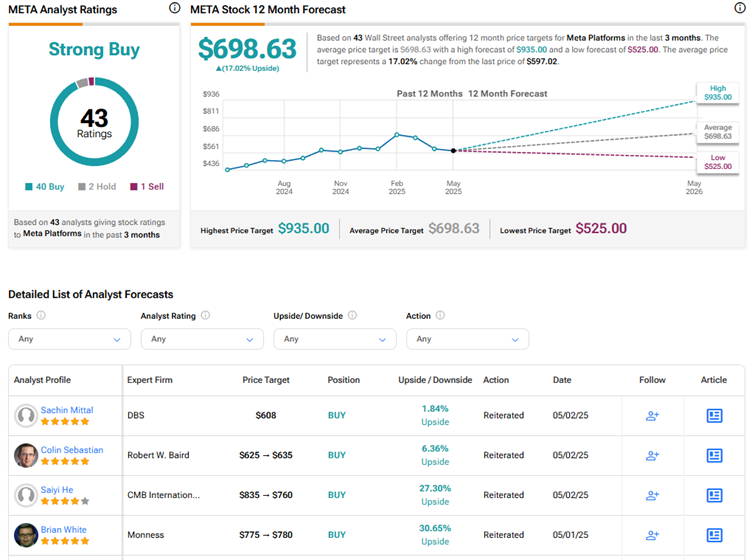

Wall Street has a Strong Buy consensus rating on Meta Platforms stock based on 40 Buys, two Holds, and one Sell recommendation. The average META stock price target of $698.63 implies 17% upside potential. META stock has risen about 2% year-to-date.

Conclusion

Wall Street is highly bullish on Amazon and Meta Platforms stock but cautiously optimistic on Apple. Analysts see higher upside potential in Amazon stock than in the stocks of the other two tech giants. Despite worries around tariffs, analysts are optimistic about Amazon due to its dominant position in e-commerce and cloud computing, extensive scale, growing ad revenue, and strong execution.