Shares of Advance Auto Parts (NYSE:AAP) are in focus today after the automotive aftermarket parts provider swung to a loss in the fourth quarter but issued an optimistic financial outlook. During the quarter, revenue ticked lower by 0.4% year-over-year to $2.46 billion, missing estimates by $10 million. Further, the company reported a net loss per share of $0.59 compared to an EPS of $2.88 in the year-ago period. Analysts had estimated an EPS of $0.20 for the period.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

AAP is focusing on driving performance and operational efficiency in the current business environment. In Q4, the company undertook annualized selling, general, and administrative (SG&A) cost reductions to the tune of $150 million. It has launched further actions to lower costs by $50 million on an annualized basis. AAP is also consolidating its supply chain into a single unified network.

In Q4, AAP’s comparable store sales declined by 1.4%, and gross profit declined by nearly 12% to $950.8 million. Further, lower net income and working capital resulted in its net cash from operating activities declining to $300 million from $700 million in the year-ago period. For Fiscal Year 2024, AAP expects net sales in the range of $11.3 billion to $11.4 billion. EPS for the year is anticipated in the range of $3.75 to $4.25. In addition, comparable store sales growth is expected in the flat to 1% bracket.

Is AAP a Good Stock to Buy?

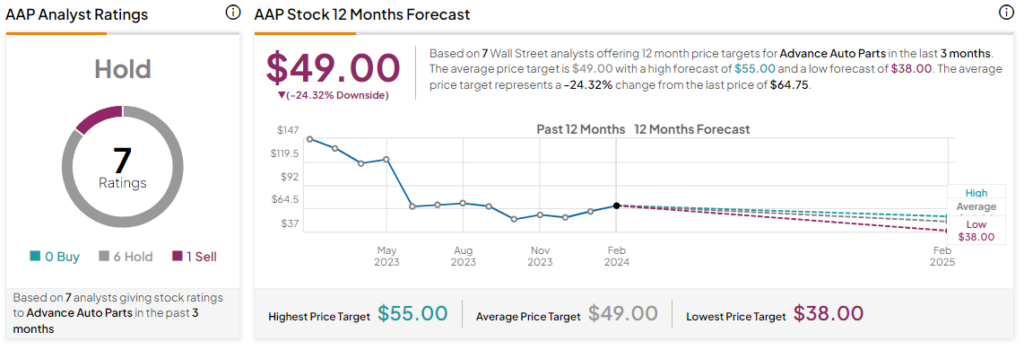

AAP’s stock price has rallied by nearly 28% over the past three months. Still, the stock remains nearly 54% lower over the past year. Overall, the Street has a Hold consensus rating on Advance Auto Parts alongside an average price target of $49. However, analysts’ views on the stock could see a revision following today’s earnings report.

Read full Disclosure