The news hasn’t been great for CoreWeave (NASDAQ:CRWV) over the past few days, as its intended acquisition of Core Scientific – and its 1.3 gigawatts of power – has attracted some heated opposition.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Indeed, one of Core Scientific’s key shareholders, Two Seas Capital, recently posted a presentation against the deal titled “A Flawed Process, a Deficient Structure and an Inadequate Price.” Gullane Capital, the company’s third-largest shareholder, is also planning on voting against the merger.

The past few months have included a number of pressure points for CRWV. These include concerns over the company’s high debt-to-equity ratio, the expiration of a post-IPO lockup that led to a spurt of selling, and a bottom-line earnings miss with its Q2 2025 earnings report.

All told, CRWV has lost almost 27% since hitting a peak in late June. Though top investor Harsh Chauhan acknowledges this downward trend, he is anything but deterred.

“Investors looking to buy a top growth stock that’s capitalizing on the booming demand for AI infrastructure can consider taking advantage of the dip in CoreWeave stock as it seems on track to deliver big gains in the next five years,” explains the 5-star investor, who is among the very top 1% of stock pros covered by TipRanks.

The rabid demand for AI cloud computing is a strong selling point for CRWV, notes Chauhan, who cites the company’s multibillion-dollar contracts with major tech firms such as OpenAI, Meta Platforms, and Nvidia.

Chauhan posits that CoreWeave now possesses a revenue backlog that could be worth more than $50 billion – not too shabby for a company that brought in some $3.5 billion in revenues for the past year.

Moreover, CoreWeave is actively working to develop more capacity. While it had 470 megawatts of active data center power when Q2 concluded, the company possesses an “impressive” 2.2 gigawatts of contracted power capacity.

“Don’t be surprised to see CoreWeave turn its massive backlog into revenue as it brings more data center capacity online,” adds Chauhan.

Though its valuation is expensive, the investor notes that CoreWeave’s Price-to-Sales ratio of 19x compares favorably with Nvidia’s 28x. Moreover, CRWV’s 1-Year Forward Price-to-Sales slides down to an even lower 5.4x.

“CoreWeave’s valuation is attractive when you take its outstanding growth potential into account,” explains Chauhan. (To watch Harsh Chauhan’s track record, click here)

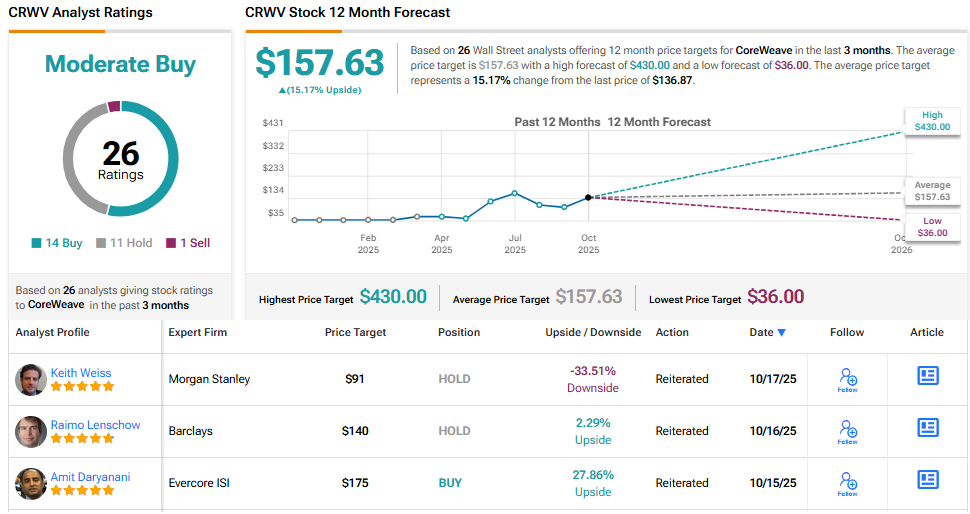

Though it is not unanimous, Wall Street tends to agree with Chauhan. With 14 Buys, 11 Holds, and 1 Sell, CRWV enjoys a Moderate Buy consensus rating. Its 12-month average price target of $157.63 implies gains of 15%. (See CRWV stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.