In the world of business, growing sales are better and slowing numbers are worse. In that sense, the Q4 delivery numbers for Rivian Automotive (NASDAQ:RIVN) weren’t so encouraging.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Indeed, Q3’s delivered vehicles numbered 13,201, while the figure from Q4 veered downward to 9,745.

That’s not the entire story, however, as the expiration of a $7,500 EV tax credit at the end of September very likely pulled some of the potential Q4 purchases into the previous quarter. Moreover, production figures from both quarters were fairly consistent, coming in at 10,974 in Q4 and 10,720 in Q3, respectively.

Still, the company’s full-year 2025 deliveries of 42,247 – though in line with the company’s expectations – were down from the 51,579 it delivered in 2024.

As the new year starts, the company is gearing up for the launch of its R2 model, slated for deliveries in the first half of 2026. Could this be the year that Rivian pushes its way into the black?

Top investor Daniel Sparks has his doubts.

“To date, however, Rivian hasn’t proven it’s capable of profitability,” explains the 5-star investor, who is among the top 1% of stock pros covered by TipRanks.

Sparks points out that even with the tax credit-enhanced deliveries in Q3, the company still had an adjusted EBITDA loss of $602 million for the quarter. Full-year adjusted EBITDA losses are expected to fall between $2 and $2.25 billion.

It’s not all doom and gloom, however. Rivian had more than $7 billion in cash, cash equivalents, and short-term investments at the end of Q3, which Sparks notes provides some leeway as the company seeks to maneuver towards profitability.

In that vein, the investor is encouraged by the company’s focus on the R2 and “a potentially meaningful product cycle.” Though he is concerned that the lower-priced model could pressure margins, he understands the strategy of building R2 demand and production to achieve economies of scale.

He’s just not sure it’ll happen in the near future, and that leaves Sparks a bit blue about RIVN and its “risky financial profile.”

“Overall, I think shares are overvalued – even if we ignore the noise of disappointing fourth-quarter deliveries and look forward to the launch of the R2,” sums up Sparks. (To watch Daniel Sparks’ track record, click here)

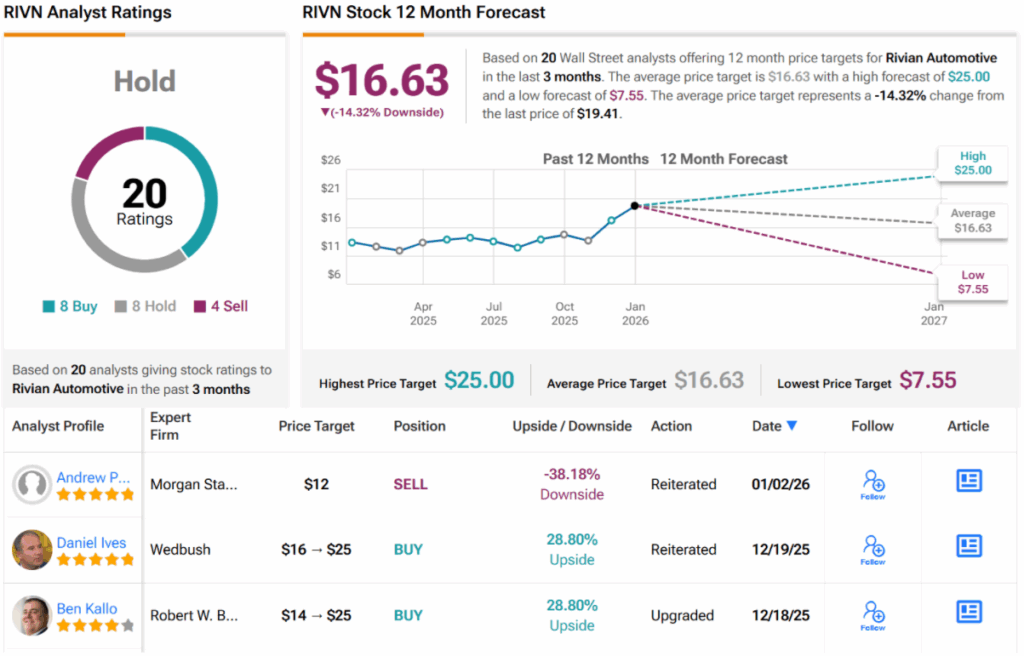

Wall Street, for its part, is a bit divided on whether RIVN will be a winner in 2026. With 8 Buys, 8 Holds, and 4 Sells, RIVN carries a consensus Hold (i.e., Neutral) rating. Its 12-month average price target of $16.63 would translate into losses of ~14%. (See RIVN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.