So, what does the future look like for Airbnb (ABNB), the travel alternative website, after it reported Q3 earnings? There are some who look for positive developments, while others are concerned that the positives may still be quite a ways out. This dichotomy left investors shaken up, and shares were down nearly 8% in Friday afternoon’s trading.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Some concern emerged from Brad Erickson, internet equity analyst with RBC Capital Markets. Although Airbnb could expand into “…intriguing [and] potentially large businesses over the next few years,” such as property management operations, Erickson noted that it will take time for these investments to pay off. Therefore, their impact on revenue will be negligible at best and negative at worst in the near term.

It’s worth noting that Erickson is a five-star analyst with an average return of 21.5% per rating.

“Revenge Travel” Not Done

Meanwhile, a Bloomberg report suggests that the “revenge travel” concept may not be as doomed as some might have thought. In fact, Airbnb sees “strong demand trends” for the holiday travel season. That may not surprise anyone overly much, as the holiday travel season is usually pretty brisk.

But this still comes as a relief to investors who were concerned that the post-pandemic travel boom may be starting to run out. Indeed, several other travel firms also offered upbeat guidance. That suggests that Airbnb is not alone in this assessment, and with other business ventures coming into play, the end result is a bit of a soft present, but a potentially explosive future.

Is Airbnb a Good Buy Right Now?

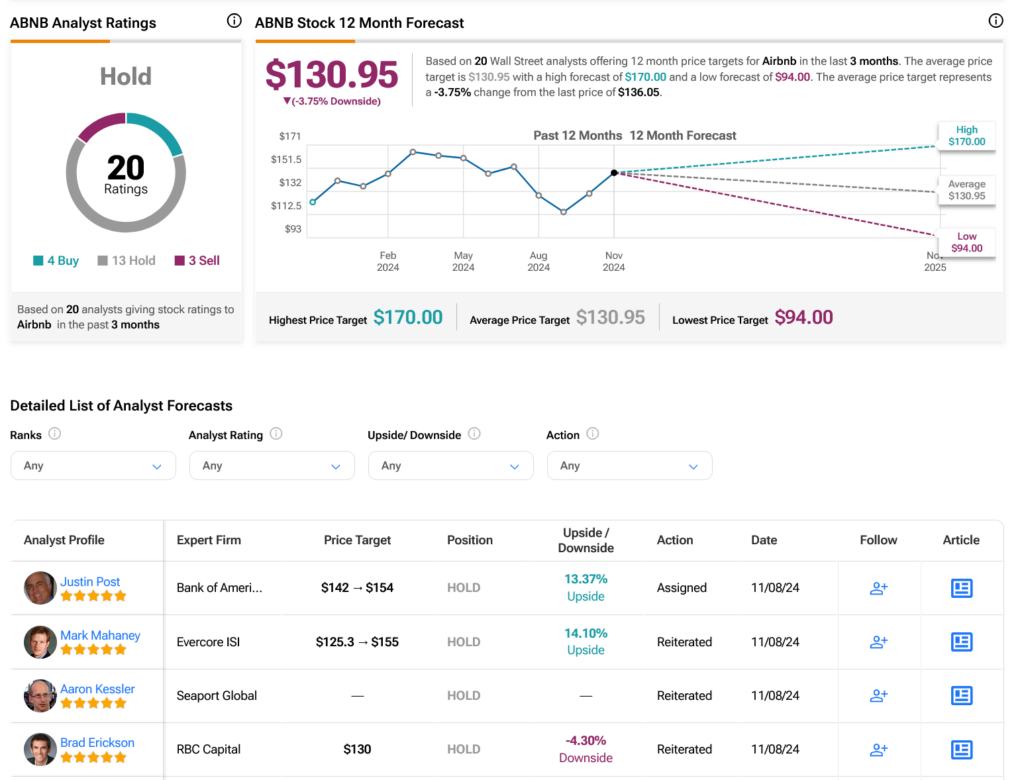

Turning to Wall Street, analysts have a Hold consensus rating on ABNB stock based on four Buys, 13 Holds, and three Sells assigned in the past three months, as indicated by the graphic below. After a 17.59% rally in its share price over the past year, the average ABNB price target of $130.95 per share implies 3.75% downside risk.