Communications stock Verizon (VZ) found itself the subject of some good news today, especially for those looking to augment their home entertainment options at the time of year we are all most likely to be home. A new deal between Verizon and YouTube TV will bring sports packages and more scripted entertainment to homes at a time of year when household budgets are still recovering from Christmas. The news was welcome enough for investors, who gave Verizon a fractional boost in Tuesday afternoon’s trading.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

New subscribers will be able to get in on YouTube TV with Verizon for $62.99 a month for the first six months, though certain terms and conditions will, naturally, apply. Considering that the normal base plan costs $82.99 a month, that represents about $120 off for the term of the promotional agreement. Better yet, the plan can be canceled at any time, reports note, so those who are just looking to keep up with football games and the basketball season will be able to shut down before getting into April.

Elena Vasquez, a media consultant, offered some background, saying, “Discounts through telecom partners are becoming a key retention tool. For sports-heavy households, saving $120 over six months is significant, especially when it covers must-watch events like the NFL playoffs and March Madness.”

A Hitch in the Frontier Deal

That was when something unexpected happened as Verizon moved to conclude its acquisition of Frontier Communications (FYBR). The deal was ultimately approved back in May, but came with an unexpected condition. Verizon was told by courts in California that it had to do more in terms of diversity, equity and inclusion (DEI) in order to get the deal approved through its own auspices. The problem there, though, is that the federal government called on Verizon to dismantle DEI as part of its own approval processes.

California, for its part, argued that mere guidance from the Federal Communications Commission (FCC) does not override California state law. So now, Verizon is in the unenviable position of having to adjust commitments it made at the federal level to satisfy state requirements. A California judge offered up the idea of “reframing compliance around specific actions rather than broad corporate policies,” a move likely to end in lawsuits somewhere.

Is Verizon Stock a Good Buy Right Now?

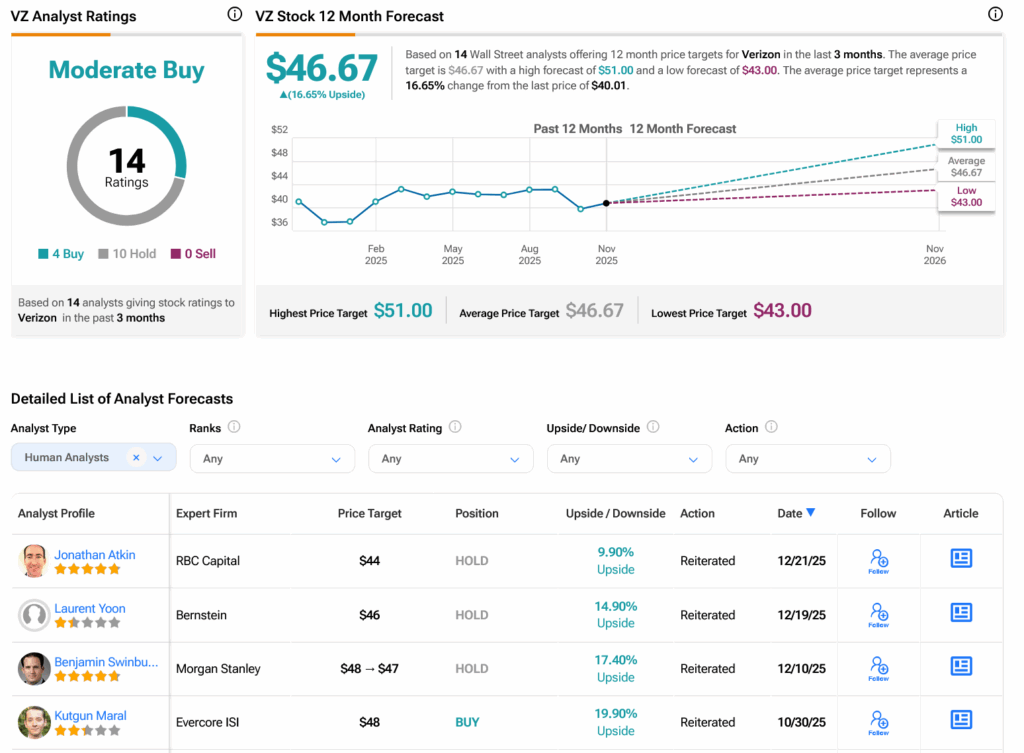

Turning to Wall Street, analysts have a Moderate Buy consensus rating on VZ stock based on four Buys and 10 Holds assigned in the past three months, as indicated by the graphic below. After a 0.45% rally in its share price over the past year, the average VZ price target of $46.67 per share implies 16.65% upside potential.