Tesla (NASDAQ:TSLA) hit the gas in Q3 2025, delivering 497,099 EVs – a new record for the company. Sure, some buyers rushed to snag their cars before the $7,500 EV tax credit expired, but that doesn’t tell the whole story. With Tesla rolling out more budget-friendly models, many analysts think the stronger sales trend has plenty of room to keep building from here.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

That’s not the only reason some investors were feeling giddy after last week’s Q3 earnings call. The company saw a massive 44% revenue growth with its energy storage business, robotaxi operations are expanding into multiple states, and its cash and cash equivalents jumped up to $41.6 billion.

Of course, CEO Elon Musk’s larger-than-life presence and planetary-sized ambitions always seem to be front and center. An investment in Tesla is akin to a leap of faith in Musk’s ability to guide the company toward the potential autonomous driving and humanoid robot bonanzas.

That’s exactly where caution enters the picture. Investor John Bromels is concerned that despite Tesla’s big-picture aspirations, its latest quarter also flashed a worrying signal that could jeopardize those long-term plans. As he puts it: “The company’s Q3 numbers contain a huge red warning light that could put Musk’s future plans in jeopardy.”

Specifically, Bromels fears that Tesla’s decreasing margins – GAAP earnings per share fell 37% last quarter – will keep slipping going forward, thereby drying up the well of funding required to fulfill Musk’s lucrative ambitions.

The investor notes that there is nothing wrong with using existing revenues to pursue technological advances elsewhere. In fact, major tech companies such as Microsoft and Meta are known for doing so with plenty of success. The problem is that Tesla’s record Q3 revenues of $28.1 billion only yielded a “meager” $1.6 billion operating profit. The company’s operating margin fell a full 5% year-over-year and now sits at just 5.8%. In contrast, both Microsoft and Meta enjoy margins in the 40% range.

Worse yet, there are reasons to believe this could get squeezed even further, points out Bromels. EV sales are widely expected to decrease in Q4 following the expiration of the EV tax credit, while lower-priced versions of Tesla’s Model 3 and Model Y vehicles will cut into gross profits.

“I wouldn’t be surprised to see gross profit cut in half (or worse) in Q4,” estimates Bromels.

It goes without saying that ramping up investments in self-driving and robotics won’t be cheap, meaning that the company’s $1.6 billion in R&D Q3 costs could very well expand in the quarters to come. In other words, the math might not be on Tesla’s side.

“Tesla could very well post a net loss next quarter,” warns the investor, who questions whether the company’s trillion-dollar valuation will hold steady if Tesla dips into the red. (To watch John Bromels’ track record, click here)

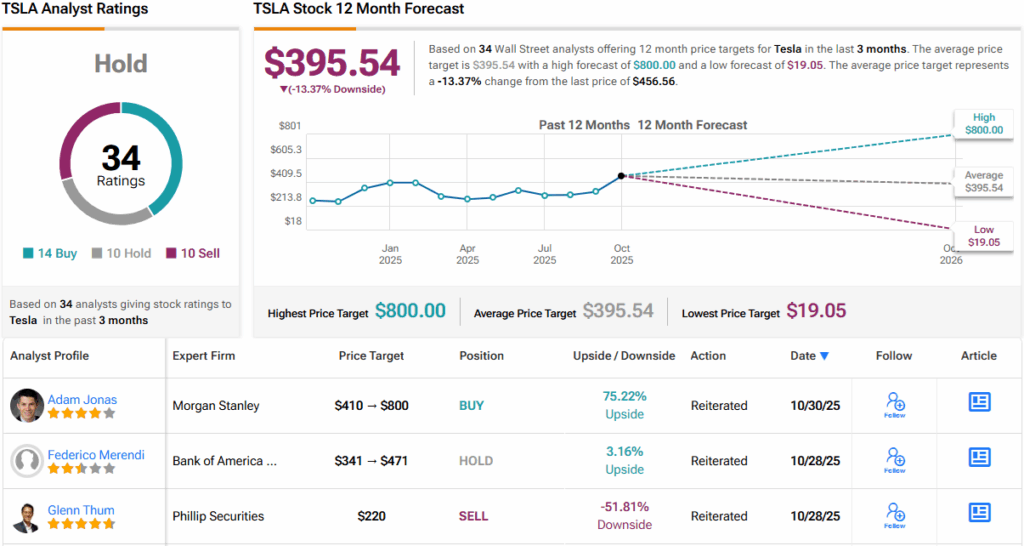

As for Wall Street’s view, the picture is far from unanimous. Analysts are split, with 14 Buys, 10 Holds, and 10 Sells, landing TSLA at a consensus Hold (i.e., Neutral) rating. The Street’s average 12-month price target of $395.54 suggests shares could slide ~13% from here. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.