Five-star investor, the Alpha Analyst, continues to view Archer Aviation (ACHR) as a high-risk story where vision is moving faster than results. In simple terms, this investor believes Archer’s expanding narrative has not yet solved its most significant challenge: execution.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The core concern is that Archer remains pre-certification and pre-revenue. While the company has announced several new partnerships, these steps do not shorten the path to FAA approval. As a result, the business still depends on future milestones that remain uncertain.

Meanwhile, ACHR shares rose a significant 8.11% on Friday to close at $8.13. The stock remains in the green in pre-market trading.

Partnerships Add to the Story, Not Revenue

First, the investor points to Archer’s growing list of defense and government-related collaborations. These include work with Anduril Industries and foreign aviation bodies. While these deals support long-term potential, they do not create near-term cash flow. Therefore, they add to the story but not to earnings visibility.

Next, Archer continues to outline future urban air taxi networks, including routes in Miami. However, these plans remain conditional on certification and fleet readiness. According to the Alpha Analyst, this means investors are still paying today for outcomes that may take years to materialize.

Valuation Faces Market Scrutiny

Meanwhile, the investor highlights valuation risk as markets shift away from long-duration themes. Archer’s market value rose sharply over the past year despite limited operating progress. Even after recent pullbacks, the stock still reflects high expectations.

In contrast, peers such as Joby Aviation (JOBY) are viewed as further along in certification and production readiness. As a result, the Alpha Analyst favors a pair trade approach that is short Archer and long Joby, rather than a direct bearish bet.

In addition, regulatory uncertainty remains a factor. Recent aviation safety scrutiny in the U.S. could add delays or stricter oversight. While Archer designs already meet many safety standards, the approval process remains complex.

Overall, the five-star investor maintains a Sell view on Archer. The conclusion is not that the vision is broken, but that the timing and execution risks remain high. As a result, the stock may remain volatile until clearer revenue paths emerge.

Is Archer Aviation Stock a Good Buy?

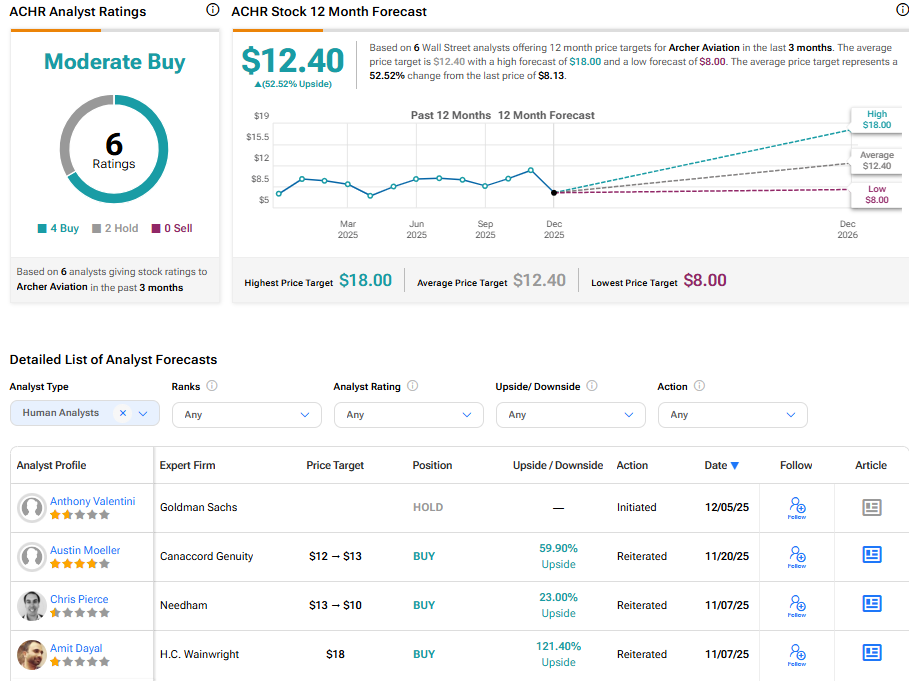

Despite volatility in Archer’s shares in 2025, Street analysts remain optimistic about the company’s prospects. Based on six recent ratings, Archer Aviation boasts a “Moderate Buy” consensus with an average ACHR stock price target of $12.40. This implies a 52.52% upside from the current price.