The bidding process for control of entertainment giant Warner Bros. Discovery (WBD) continues, and so far, everyone has been sent back to their checkbooks to try the whole process again. And while the three firms fight for dominance, one proposition—according to filmmaker James Cameron—is a potential problem above all others. But this did not stop Warner shareholders from applauding, as shares shot up over 3.5% in the closing minutes of Wednesday’s trading.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Cameron did not mince words, declaring that Netflix (NFLX) buying Warner would be a “disaster” for Hollywood. The reason is mostly one of Netflix’s overall business model, and how that directly contradicts a century of film releasing.

Cameron elaborated, “Netflix would be a disaster. Sorry, Ted, but jeez. Sarandos has gone on record saying theatrical films are dead. It’s sucker bait. ‘We’ll put the movie out for a week. We’ll put it out for 10 days. We’ll qualify for Academy Awards consideration.’ I think that’s fundamentally rotten at the core.” This is, essentially, the same objection theater owners have with the notion of Netflix buying Warner, that they would be effectively rendered obsolete from one entire studio’s product. While Netflix has promised to uphold all Warner contracts, the future beyond the term of those contracts is much more in doubt.

Netflix’s Charm Offensive

Word from the New York Post, meanwhile, makes it clear Netflix is going down swinging. It is staging what reports call a “charm offensive” with both Warner and regulators, and both Paramount Skydance (PSKY) and Comcast (CMCSA) think it may be working.

Netflix is pushing a notion called “category ambiguity” in its pursuit of Warner, claiming that antitrust law may not actually apply to streaming services. Content on YouTube and social media in general basically precludes the notion, and thus, means that content cannot truly be cornered, or price-gouged, making standard antitrust arguments fall apart. Meanwhile, the notion that Netflix might be rendered too big by the deal is also coming under skepticism.

Is WBD Stock a Good Buy?

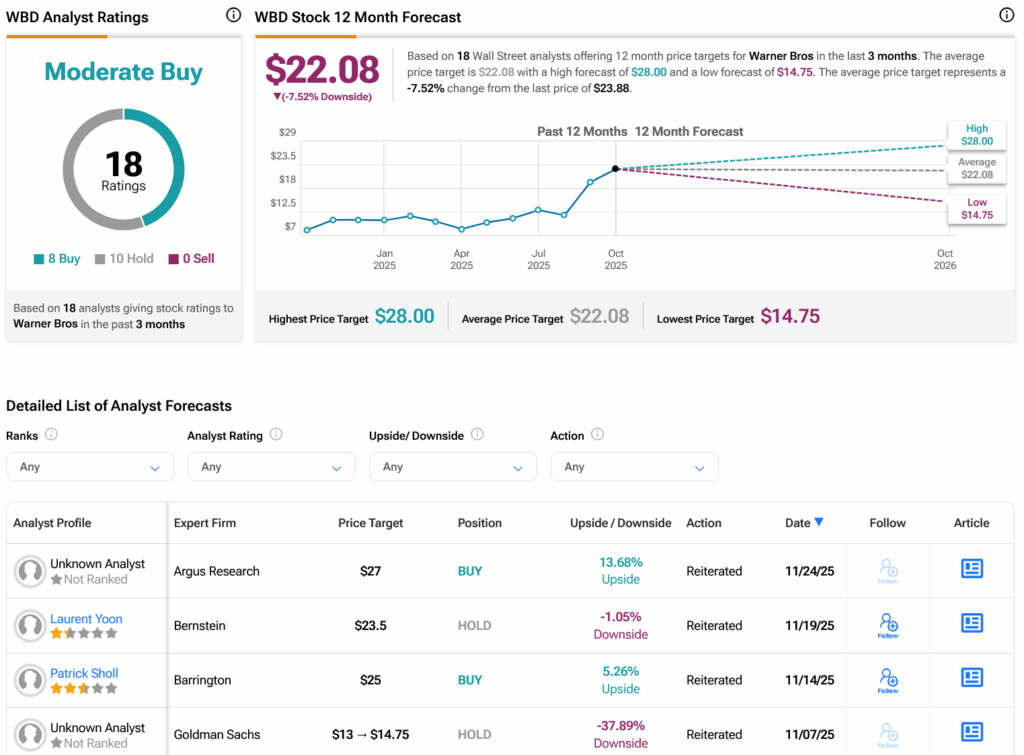

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on eight Buys and 10 Holds assigned in the past three months, as indicated by the graphic below. After a 121.19% rally in its share price over the past year, the average WBD price target of $22.08 per share implies 7.52% downside risk.