The Canadian retail scene is not looking great these days. Just days ago, we saw the impact that the incoming tariffs are having on small businesses in Canada. But despite this, online business facilitator Shopify (TSE:SHOP) is actually carrying on well. In fact, despite the souring retail picture in Canada, Shopify shares edged up fractionally in Friday morning’s trading.

Canadian consumers were being careful when it came to shopping, reports noted, continuing a streak that started last month and is carrying on into this month without incident. The holidays, of course, brought their customary boost, which was helped out by a temporary halt in federal sales taxes. But once that break was gone, so too were retail shoppers.

Retailers lost 0.6% in January, the reports noted, and that continued on into February, where retailers lost another 0.4% on top of that. This is the first time that there has been back-to-back months of retail sales decline since the middle of 2023, which is in turn getting some concerned about a recession in the making.

Boycott Brewing

As if that were not bad enough news for Shopify, the hits kept on coming as Augustus Media in Dubai called for a Shopify boycott. Apparently, Shopify President Harley Finkelstein offered up some comments about media coverage of the Israel-Hamas war, specifically suggesting that Hamas claims about casualty figures may, in fact, not be accurate. This did not sit well with Augustus Media, who apparently believes everything that Hamas says about anything, and thus it called on its readership to boycott Shopify stores.

Augustus Media, via its Smashi platform, offered a list of six alternatives to Shopify. Given that Shopify has around 25,000 customers in the Middle East—and particularly, oddly enough, in the United Arab Emirates—that could be a significant blow to Shopify, particularly if anyone takes this seriously enough to follow through.

Is Shopify Stock a Buy or Sell?

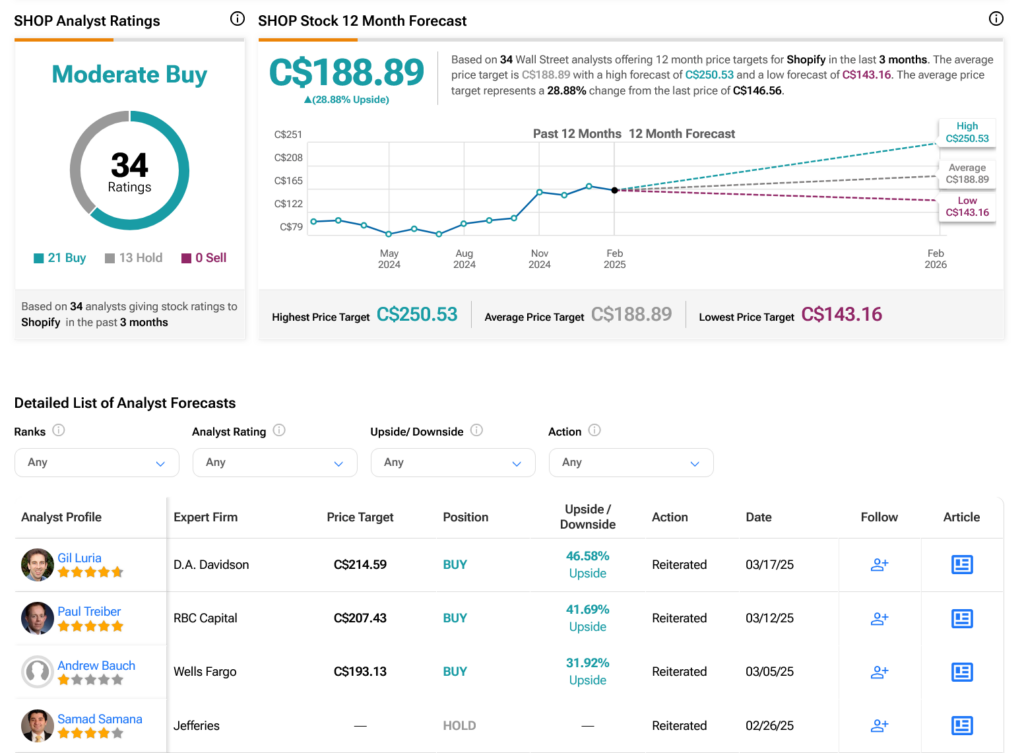

Turning to Wall Street, analysts have a Moderate Buy consensus rating on Shopify stock based on 21 Buys and 13 Holds assigned in the past three months, as indicated by the graphic below. After a 36.56% rally in its share price over the past year, the average SHOP price target of C$188.89 per share implies 28.88% upside potential.