We all know that artificial intelligence (AI) is gaining ground in virtually every sector of the market. And not without reason, either; it has a great potential to do things we could never have imagined even just five years ago. And cybersecurity stock Cloudflare (NET) is gaining ground as well as analysts increasingly find value in its connection to AI. The analyst word translated into a slight improvement in share price, as shareholders sent Cloudflare shares up fractionally in Wednesday afternoon’s trading.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Word from Sevasti Balafas, CEO of Goalvest Advisory—according to a CNBC report—declared Cloudflare a “worldwide exchange pick.” Why? Because, Balafas noted, Cloudflare makes an excellent way to get connected with the AI trade from the cybersecurity angle. Balafas also noted that “…80% of their revenue is stable subscriptions-based and secure.” That certainly helps matters; not only is Cloudflare covered for today, but it is working on securing tomorrow as well.

Balafas continued, noting that Cloudflare “…has a broader platform that we like.” It covers cybersecurity, certainly, but it can do more than cybersecurity, including making websites perform better with access to a high-quality content delivery network (CDN).

And Then There’s the Email

Meanwhile, in a completely separate analysis, Forrester Research recently came out with positive word for Cloudflare as well, but specifically in the email vein. Forrester declared Cloudflare a “strong performer” in email security. In fact, it was a sufficiently strong performer that it was one of the top three providers in the “current offering” category, Cloudflare noted on its blog.

Forrester took a look at 10 different email security vendors, the report noted, and scaled them across 27 different criteria. Not only did Cloudflare come out as one of the three best overall, it also got the highest possible score in nine of the 27 different criteria. And with protective systems ranging from antimalware tools to sandbox systems to malicious URL detection and more, it really does cement why Cloudflare has a strong presence here. It also underscores Balafas’ assertions that Cloudflare has a “broad platform.”

Is Cloudflare a Buy, Sell or Hold?

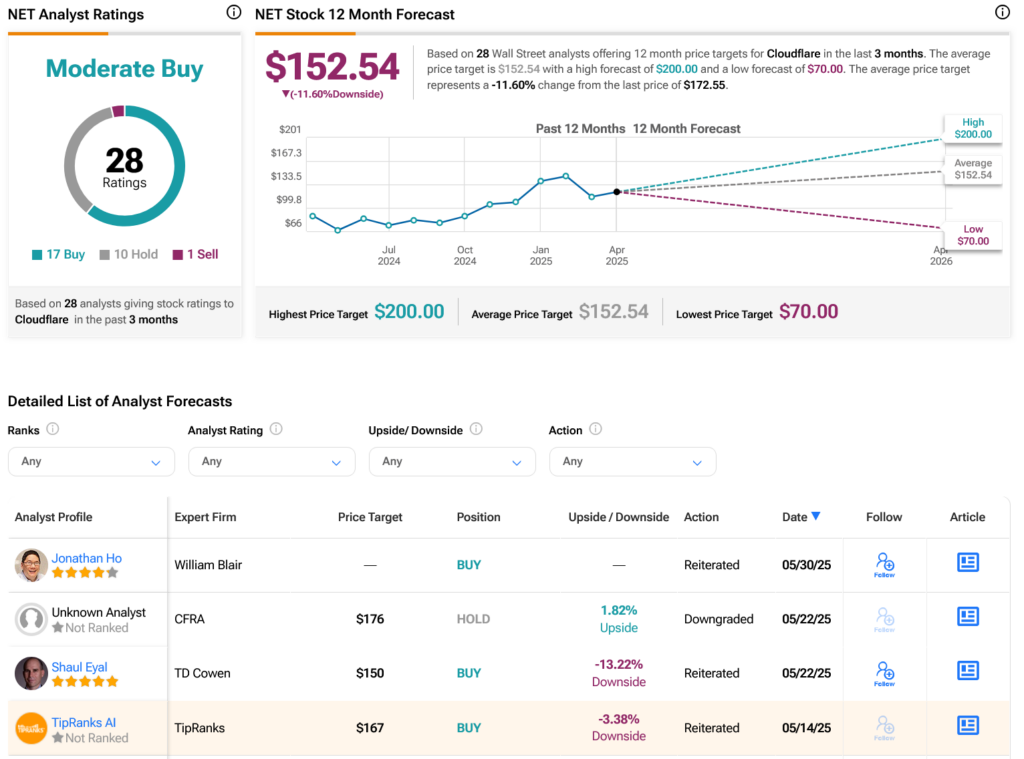

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NET stock based on 17 Buys, 10 Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 147.06% rally in its share price over the past year, the average NET price target of $152.54 per share implies 11.6% downside risk.