The potential for a buyout of entertainment giant Warner Bros. Discovery (WBD), whether it be from Paramount Skydance (PSKY), Netflix (NFLX), or someone else, is certainly catching attention. And new reports from the New York Post suggest that the cost to buy in could be a lot higher than anyone expected. Despite this, though, Warner shareholders were running for the hills, sending share prices down over 2% in the closing minutes of Wednesday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It turns out that Paramount Skydance is actively trying to assemble one serious war chest to go after Warner, reports note. It is turning to several sources and attempting to pull together a $60 billion bid package. One “veteran media analyst” who requested anonymity noted, “Look, the WBD deal might happen or it might not. But one thing I don’t see any time soon is Larry Ellison selling $60 billion of his Oracle (ORCL) stock to buy WBD.”

This being said, the ball is sort of in Netflix’s court at this point. If Paramount Skydance really is pulling together a $60 billion war chest to go after Warner, then Netflix will need a compelling offer to try and pull the rug out from under Paramount, if Netflix does indeed want Warner. One potential benefit that Netflix can offer is the fact that regulators are a lot less likely to bristle at Netflix—who does not currently own any news channels—trying to buy in than Paramount, who does.

Ad Handling

Meanwhile, though, Warner must carry on as though no one is trying to buy it, and to that end, Warner appointed Sky Media to handle its advertising sales in the United Kingdom and Ireland starting January 2026. The arrangement will be a multi-year deal, reports note, and allow Sky Media to handle both linear advertising and streaming advertising going forward.

Warner’s group senior vice president of ad sales and brand partnerships Mike Rich noted, “With the launch of HBO Max next year, combined with our strength in linear, streaming and live sport, this partnership simplifies and strengthens access to Warner Bros. Discovery’s inventory in market.”

Is WBD Stock a Good Buy?

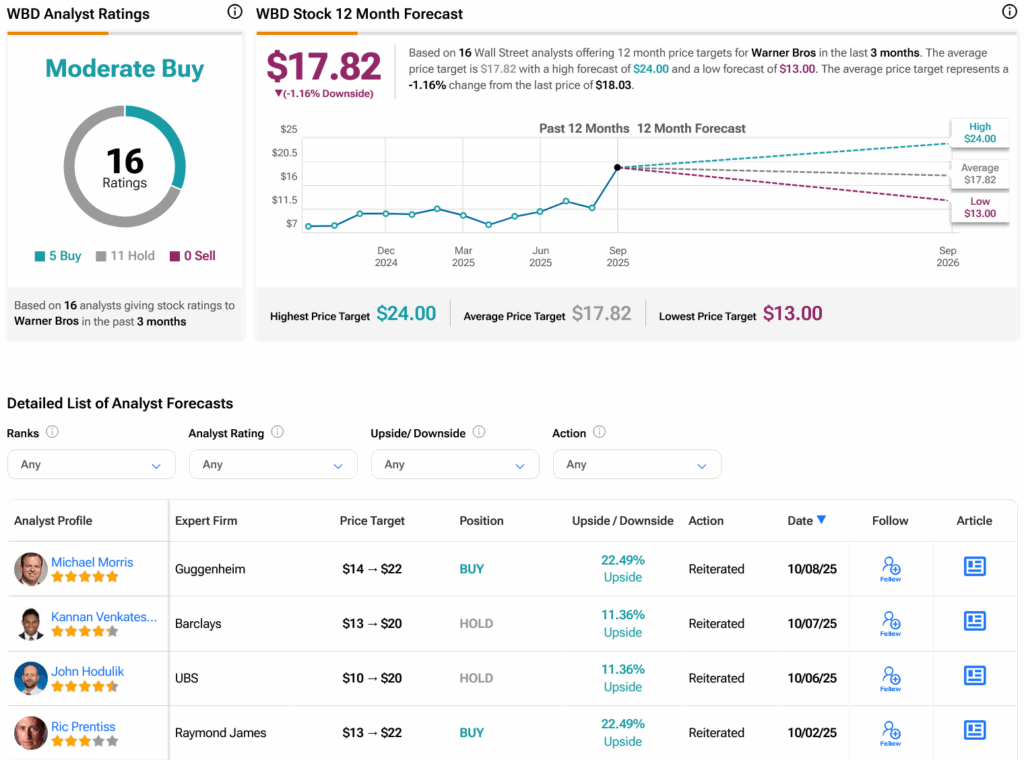

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on five Buys and 11 Holds assigned in the past three months, as indicated by the graphic below. After a 140.62% rally in its share price over the past year, the average WBD price target of $17.82 per share implies 1.16% downside risk.