Trump’s new import tariffs are upending global trade, but some U.S. companies—especially those anchored in America’s heartland—are rising with surprising strength. The president’s sweeping plan slaps a 10% baseline tariff on nearly all imports, and higher “reciprocal” rates on foreign-made goods, in a bold effort to revive U.S. manufacturing. Stocks initially tanked 11% before bouncing back after news of a 90-day pause on some levies. But even in this storm, some stocks look like rare winners.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Honeywell (HON) Strengthens on Diverse Manufacturing Edge

Honeywell (HON) has become a go-to for investors looking to sidestep tariff chaos. Its operations stretch across aerospace, defense, industrial automation, and building solutions—offering natural protection from global supply disruptions.

Analysts are firmly in the bull camp. Brett Linzey from Mizuho maintained a Buy rating with a price target of $245, pointing to Honeywell’s “robust financial health,” strong Q4 earnings, and double-digit growth in defense and space. Linzey also cited the company’s planned separation of its Aerospace and Automation segments as a smart move to boost operational focus and unlock future value. He expects margin growth and a rise in free cash flow to drive long-term upside.

TD Cowen’s Gautam Khanna also kept a Buy rating, though he lowered the price target to $205, citing tempered near-term expectations. Still, the overall sentiment is optimistic, and Honeywell holds a Strong Buy consensus across analyst platforms.

The stock has rebounded off recent lows and still trades well below its 52-week high, suggesting there’s room left on the runway.

Eaton Stock (ETN) Gains From Electrification Momentum

Eaton (ETN) is riding America’s electrification wave like it was built for it. The company makes power systems that support EV charging, grid upgrades, and industrial automation. All of these areas are seeing huge demand as the U.S. pushes for energy independence and domestic infrastructure revival.

Analyst support has been strong. Jefferies’ Stephen Volkmann, one of TipRanks’ top 100 analysts, kept a Buy rating in April with a $335 price target. He pointed to Eaton’s leadership in the Industrials space and its exposure to long-term growth sectors like vehicle electrification. Bank of America’s Andrew Obin also issued a Buy in March. Barclays took a more cautious stance, maintaining a Hold on March 26.

There’s been some insider selling. In January, board member Dorothy Thompson sold 285 shares worth $82,500. TipRanks flagged overall insider sentiment as negative this quarter. That hasn’t derailed the stock’s performance, though. It’s bounced off its yearly low of $255.65 and is now trading closer to $280.

Between analyst optimism, a real-world use case, and its central role in America’s infrastructure revamp, Eaton’s stock is looking firmly plugged in.

Ametek Stock (AME) Holds Steady with Strong Niche Positioning

Ametek (AME) isn’t flashy, but it’s dependable. The company builds high-precision instruments and electromechanical devices. It supplies sectors like defense, aerospace, and medical—industries that tend to hold up even when the broader market shakes.

KeyBanc analyst Steve Barger just reaffirmed his Buy rating. He lowered the price target from $215 to $195, reflecting more cautious market sentiment but not a change in confidence. According to Barron’s, Ametek is also seen as less exposed to international risk than many of its peers. That’s a key advantage right now, with tariffs disrupting global supply chains.

The stock has stayed relatively stable through 2025. Investors see it as a defensive name with reliable margins and less exposure to international supply chain risk. In an environment shaped by tariffs and reshoring, Ametek’s U.S.-leaning customer base helps it stand out.

It’s not the loudest stock on the list. But for those looking for slow and steady wins, Ametek continues to be a solid bet.

Vertiv (VRT) Taps Into Growing Data Center Demand

Vertiv (VRT) is the kind of company that benefits from a plugged-in economy—literally. It builds the power and cooling systems that keep data centers running. As AI tools and cloud infrastructure expand fast across the U.S., demand for Vertiv’s services is surging.

The analysts are paying attention. Justin Clare from Roth MKM just initiated coverage with a Buy rating and a $75 price target. The stock was trading at $69.61 last Friday. Goldman Sachs analyst Mark Delaney also issued a Buy on April 10. Barclays, on the other hand, held steady with a Hold rating earlier in the month.

Vertiv’s most recent earnings report showed quarterly revenue of $2.35 billion, up from $1.87 billion the year before. Net profit came in at $147 million, down from $232.6 million—but still healthy given the capital-intensive nature of the business.

Mizuho analysts also included Vertiv in a list of stocks best positioned to benefit from increased power demand, reshoring, and the AI boom. That’s a strong tailwind in the middle of a shaky trade environment.

Vertiv might not be a household name yet, but it’s quietly powering the future.

Ingersoll Rand (IR) Targets a Comeback with Pricing Power

Ingersoll Rand (IR) is starting to claw back from a rough patch. The company makes air compressors, pumps, and tools used across heavy industry. It’s not glamorous, but its strong product mix and pricing flexibility give it an edge when costs go up—like they do under a tariff regime.

Analyst confidence is holding strong. Barclays’ Julian Mitchell just reiterated a Buy rating with an $85 price target. According to TipRanks, Mitchell is a 4-star analyst with a 50.89% success rate. Wells Fargo also maintained a Buy rating earlier this week, setting their target at $80. The average analyst price target across the Street is $97.63. That’s a potential upside of over 33% from where the stock sits now.

The company’s latest earnings were solid. It posted $1.9 billion in revenue last quarter and matched its prior year’s net profit at $229.8 million. That consistency in the face of cost pressures is what’s keeping investor interest alive.

Still, there’s a cloud over insider activity. TipRanks flagged insider sentiment as negative. Back in February, Andrew Schiesl—one of the company’s top legal execs—sold over 13,000 shares worth $1.15 million. It’s not a dealbreaker, but it’s something investors are watching.

IR stock is trading around $73. That’s well off its 52-week high, but the analyst support and stable earnings suggest it could be setting up for a rebound. If tariffs stick around and cost pressure becomes the new normal, Ingersoll Rand might be one of the few names ready to thrive in it.

Weyerhaeuser (WY) Profits from Lumber Tariff Advantage

Weyerhaeuser (WY) is one of the rare companies benefiting directly from tariff policy. With 80% of its lumber production U.S.-based, it’s well protected from import costs that are hitting foreign competitors hard. That gives it pricing power—and a clear shot at growing its market share.

Analysts are taking notice. George Staphos from Bank of America Securities just reiterated a Buy rating with a $35 price target. He expects higher Timberlands EBITDA this quarter, which should help offset weaker results from the company’s Wood Products segment. According to TipRanks, Staphos is a 4-star analyst with a 50.56% success rate.

He also pointed to improving lumber sales prices this quarter and noted that Weyerhaeuser looks like a smart defensive pick ahead of a potential housing market rebound. If homebuilding heats up, demand—and prices—for lumber could follow. That would put Weyerhaeuser in an even stronger position.

Yes, the company is still facing cost pressures and lower volumes. But Staphos called those issues “not entirely unexpected,” and believes the stock’s current price still presents a compelling value relative to its upside target.

Right now, WY is trading in the mid-$20s. That leaves room for upside, especially with tariffs sticking and U.S. housing sentiment beginning to stabilize.

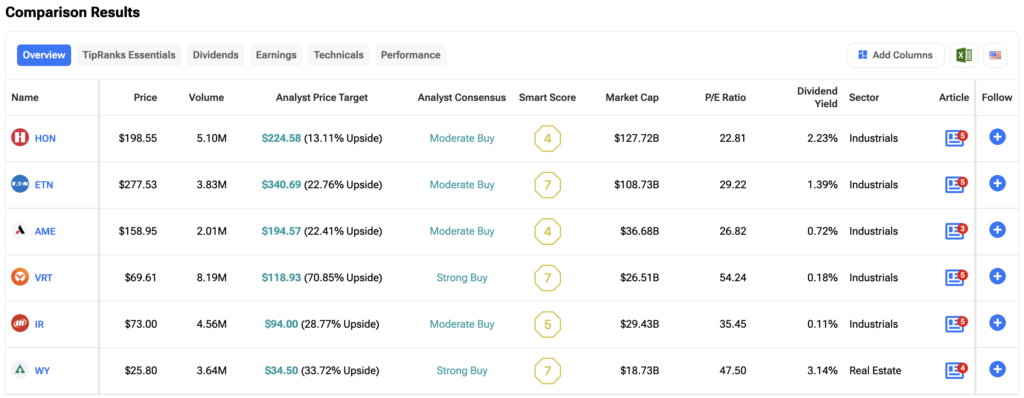

In short: the tariff tremors are real, but so is the opportunity—especially if you know where to look. Use the TipRanks Stock Comparison tool below to see which of these names could offer the biggest upside.