The 2026 market opened with a massive geopolitical shock after U.S. forces captured President Nicolás Maduro over the weekend. President Trump announced that the U.S. would temporarily “run the country” to stabilize its infrastructure and oil production. This move has triggered a “buy now, ask questions later” mentality among investors, who are pouring money into companies that will secure and rebuild the nation.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

While the broader market remains cautious about the legal fallout, specific industrial and defense players are hitting new highs. Here are the top stocks leading the rally:

1. Elbit Systems (ESLT)

Elbit Systems (ESLT), an Israeli defense giant, is a primary winner as global military tensions rise. Shares of ESLT hit an all-time high of $587 this morning. Investors are betting that the heightened “threat environment” in Latin America will lead to massive new contracts for drone surveillance and electronic warfare systems.

2. Halliburton (HAL)

Often called the “first boots on the ground,” Halliburton (HAL) is the main candidate to repair Venezuela’s crumbling oil wells. HAL stock jumped 9.5% in premarket trading. Unlike pure oil producers, Halliburton makes its money on the service and repair side, meaning they win even if it takes years for the oil to actually start flowing again.

3. Chevron (CVX)

Chevron (CVX) is the only U.S. oil major that has maintained a constant presence in Venezuela through legal exemptions. Shares surged almost 8% on the news because the company already has the “institutional knowledge” and existing pipes to ramp up production faster than any other competitor.

4. SLB (SLB)

Formerly Schlumberger, SLB (SLB) is considered the “brains” of the oil world. Their stock rose 9% because no other company has the technology needed to map Venezuela’s hard-to-reach heavy oil reserves. If the U.S. plans to “run the country,” SLB will likely be the one mapping out where the billions in investment should go.

5. Bharat Electronics Ltd (IN.BEL)

Indian defense stocks are following the global trend, with Bharat Electronics (IN:BEL) gaining over 2.5%. The stock has already gained 47% over the last year, and the Venezuela operation is providing a fresh catalyst as global defense budgets are expected to expand through 2026.

6. Valero Energy (VLO)

Valero (VLO) is a “destination” play. Their Gulf Coast refineries are specially designed to process the heavy, sour crude oil that Venezuela produces. VLO stock is climbing on the hope that a U.S.-led Venezuela will soon send cheaper, local oil directly to their Texas facilities, cutting out expensive imports from the Middle East.

Key Takeaway

The takeaway for investors in 2026 is that military action is now a primary driver of industrial growth. The rally in ESLT, HAL, and VLO is a direct result of the weekend raid that captured Maduro and President Trump’s subsequent vow to “run the country.” This operation has effectively turned the defense and energy sectors into the new infrastructure play of the decade.

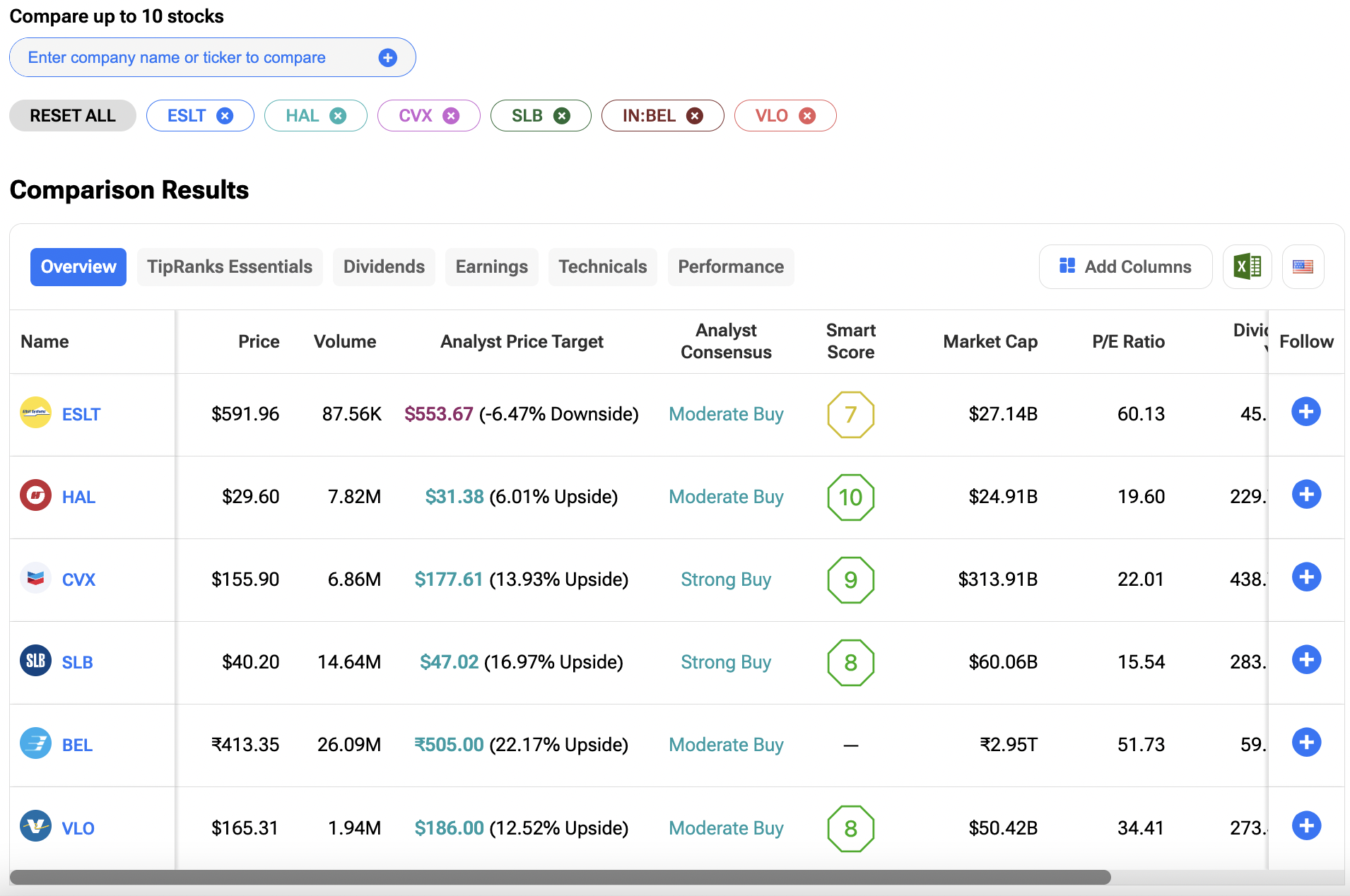

Investors can compare all 6 stocks side-by-side based on various financial metrics and analyst ratings on the TipRanks Stocks Comparison Tool. Click on the image below to find out more.