Despite recent market swings, 2025 saw several standout winners. Well‑known companies in AI hardware, data storage, fintech, and next‑gen connectivity posted massive gains as investors chased growth tied to artificial intelligence, digital infrastructure, and consumer platforms. But with valuations stretched and expectations rising, investors might wonder whether these stocks can keep climbing in 2026.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s look at five of 2025’s strongest performers and what may support their growth in the year ahead.

1. Lumentum (LITE)

Lumentum was one of 2025’s most explosive movers, having gained about 369%. The upside was fueled by strong demand for optical components used in AI data centers. As hyperscalers raced to build out GPU clusters, Lumentum’s lasers and high‑speed optical modules became crucial.

If AI infrastructure spending remains strong and Lumentum continues to win design slots with major cloud providers, positive momentum is expected to carry into 2026.

2. Western Digital (WDC)

Western Digital surged as the world’s largest tech companies expanded their data‑center footprints. Demand for high‑capacity HDDs and advanced flash memory hit multi‑year highs, pushing WDC 230% higher in 2025.

WDC’s upside in 2026 depends on pricing power in the memory market and whether AI‑driven storage demand continues to rise. If the supply/demand balance holds, WDC could see another strong year.

3. AST SpaceMobile (ASTS)

AST SpaceMobile captured investor attention with its ambitious plan to build the world’s first space-based cellular broadband network. Successful satellite launches and early carrier partnerships helped fuel the stock’s rise of 276% in 2025.

ASTS stock can grow further in 2026 if the company is successful in scaling its network and securing more commercial agreements. While the long‑term story remains compelling, the company still faces high costs and technical hurdles.

4. Robinhood (HOOD)

Robinhood witnessed a rebound in 2025 as retail trading activity picked up and the company expanded into new products such as retirement accounts, credit offerings, and crypto services. Improved profitability and user growth helped boost investor optimism, leading to HOOD stock rising 221% this year.

Whether HOOD can keep its momentum will depend on retail traders staying active and the company making money from its new products.

5. Celestica (CLS)

Celestica was another surprising winner of 2025. Shares surged 234% over the year, outpacing many better-known tech names. The company benefited from massive demand for AI data center hardware, including servers, switches, and networking equipment.

If AI hardware demand remains robust and Celestica continues expanding its manufacturing footprint, the company could remain a top performer in 2026.

Concluding Thoughts

As investors look ahead to 2026, these companies will face higher expectations but also bigger opportunities. This is because AI, connectivity, and digital finance continue to transform the global economy.

Investors will be looking for continued AI spending, stronger margins and profitability, solid execution on new product launches, and how well these companies handle rising competitive pressures in fast-moving tech markets.

What Are the Best Stocks to Buy Now?

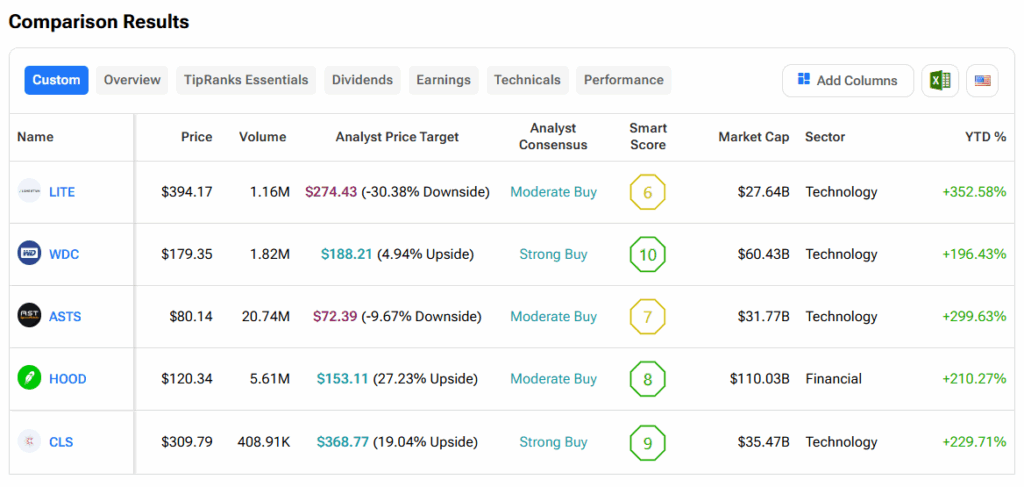

Using the TipRanks’ Stock Comparison tool, let’s see how Wall Street analysts are rating LITE, WDC, ASTS, HOOD, and CLS, and which stock they believe has the strongest upside.