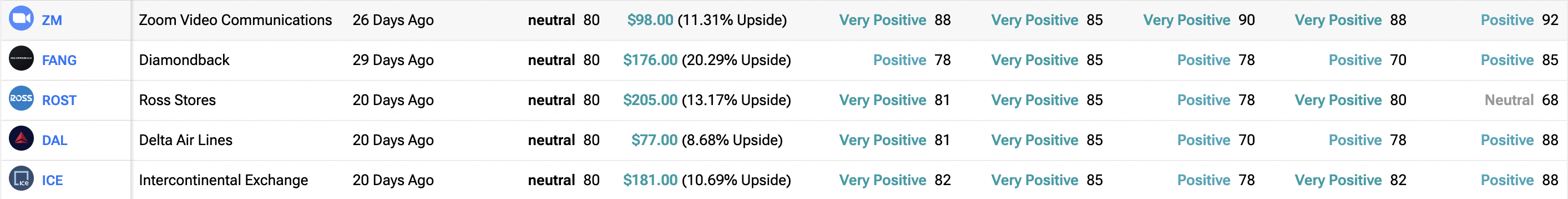

In today’s crowded market, finding stocks that are actually ready to grow takes more than just reading a few news headlines. That is why we are looking at five top picks from Spark, TipRanks’ AI Analyst, which scans millions of pages of data to find the best opportunities. By highlighting names like Zoom, Diamondback, and Ross Stores, all with a high AI score of 80, this system points out companies where strong finances and price momentum are finally lining up for 2026.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

1. Diamondback Energy (FANG)

Diamondback Energy (FANG), an oil & natural gas company, carries a solid AI Analyst score of 80, supported by an “AI Price Target” of $176.00, which implies a significant 20.29% upside potential. While its Financial Score of 78 is steady, the AI is particularly bullish on its internal fundamentals, awarding the energy player a “Very Positive” 85 for its Income Statement. Despite a “Positive” rather than “Very Positive” Cash Flow score of 70, the overall quantitative data suggests Diamondback is well-positioned to capitalize on energy market efficiency heading into 2026.

2. Ross Stores (ROST)

Ross Stores (ROST) joins the elite list with an AI Analyst score of 80 and a projected price target of $205.00, representing a 13.17% upside. The discount retailer shows exceptional strength in its core operations, earning “Very Positive” marks across the board, including an 85 for its Income Statement and an 81 for its overall Financial Score. The AI identifies Ross as a high-conviction retail play, noting its “Positive” 80 Cash Flow score as a key indicator of its ability to navigate shifting consumer spending habits.

3. Zoom Video Communications (ZM)

Zoom Video Communications (ZM) remains a top AI pick with a score of 80, as the engine predicts an 11.31% price jump to a target of $98.00. The communications technology company boasts some of the highest sub-scores in this group, including a “Very Positive” Financial Score of 88 and a near-perfect 92 Earnings Call Score. With a “Very Positive” Balance Sheet score of 88, the AI Analyst highlights Zoom’s robust fiscal health as it continues to expand its enterprise AI services.

4. Intercontinental Exchange (ICE)

Intercontinental Exchange (ICE), an American multinational financial services company, secures its spot with an AI Analyst score of 80 and a price target of $181.00, implying a 10.69% upside. The firm displays remarkably consistent fundamentals, earning “Very Positive” ratings for its Financial Score (82), Income Statement (85), and Balance Sheet (82). This data suggests that the exchange operator is maintaining high operational efficiency, backed by a “Positive” 88 Earnings Call score that reflects strong management execution.

5. Delta Air Lines (DAL)

Delta Air Lines (DAL) rounds out the top five with an AI Analyst score of 80 and a target of $77.00, suggesting an 8.68% upside potential. The airline shows “Very Positive” momentum in its Income Statement (85) and Financial Score (81). While its Balance Sheet score of 70 is the most conservative in this group, a “Positive” 88 Earnings Call score indicates that leadership is successfully navigating the complexities of the travel sector as we enter the new year.