It was yet another busy week for exchange-traded funds (ETFs), with big moves registered for both inflows and outflows. For the week ended May 24, 2024, investors dealt heavily in the semiconductor and technology sectors, with chipmaker Nvidia (NASDAQ:NVDA) reporting stellar Q1 performance and issuing robust guidance.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

At the same time, the mixed macro view, backed by cooling inflation but the potential delay in interest rate cuts, is pushing investors toward safe-haven investments such as bonds and cash. With this background in mind, let’s have a look at some of the top ETFs with large weekly inflows, as per TipRanks.

#1 T. Rowe Price U.S. Equity Research ETF (TSPA)

TSPA is an actively managed fund that seeks long-term capital growth by investing in U.S.-listed companies selected and weighted as in the S&P 500 Index (SPX). Currently, a majority of TSPA’s portfolio is allocated to the Technology sector, followed by the Financials and Healthcare industries.

TSPA witnessed massive inflows last week, including $283.84 million on May 24 and $10.3 million on May 23. TSPA’s assets under management (AUM) stood at $522.30 million on Friday. Its largest holdings include tech bigwigs, namely Microsoft (MSFT), Apple (AAPL), Nvidia, Alphabet (GOOGL), and Amazon.com (AMZN).

Interestingly, TSPA has a Moderate Buy consensus rating based on 293 Buys, 35 Holds, and one Sell rating on the stocks in its portfolio. The average T. Rowe Price U.S. Equity Research ETF price target of $37.14 implies 11.6% upside potential from current levels.

#2 Capital Group Core Bond ETF (CGCB)

CGCB is a high-quality core bond fund that invests primarily in corporate debt securities, U.S. and other government securities, mortgage-related securities, and cash. The fund’s investment objective is to provide as high a level of current income “as is consistent with the preservation of capital.”

In the past week, CGCB saw total inflows worth $301 million. These include $259.12 million on May 21, $26.28 million on May 22, and $15.44 million on May 23. An uncertain outlook on the U.S. interest rate cuts could have caused investors to direct their funds into safer high-yielding bonds. As of May 24, CGCB had an AUM of $575.79 million.

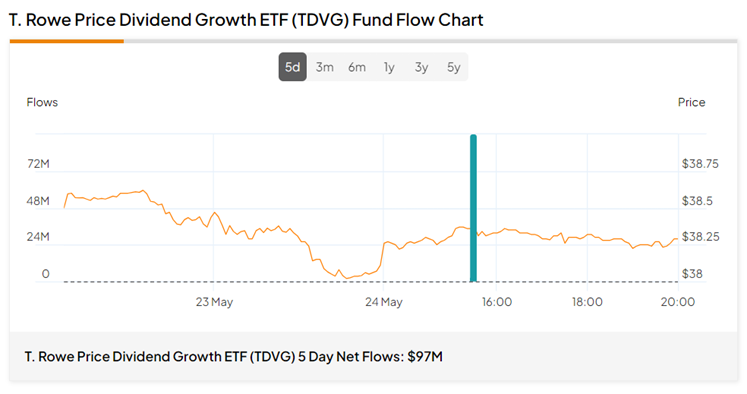

#3 T. Rowe Price Dividend Growth ETF (TDVG)

TDVG invests at least 80% of its funds in regular dividend-paying stocks or in equities of companies that are expected to pay dividends in the future. The idea behind investing in such companies is that they demonstrate solid financial health and growth prospects. The fund’s objective is to earn dividend income and seek long-term capital growth.

Last week, there was an inflow of $97 million into TDVG ETF. As of Friday, TDVG’s AUM stood at $521.16 million. Its largest five holdings include Microsoft, Apple, Visa (V), JPMorgan Chase (JPM), and GE Aerospace (GE).

Furthermore, TDVG has a Moderate Buy consensus rating on TipRanks, backed by 90 Buys and 14 Hold ratings. The average T. Rowe Price Dividend Growth ETF price target of $42.07 implies 9.9% upside potential from current levels.

#4 Direxion Daily Semiconductor Bear 3x Shares (SOXS)

The SOXS ETF provides a daily inverse 3x (or -300%) leverage to the NYSE Semiconductor Index, representing a bearish short-term stance on the semiconductor sector. The SOXS ETF currently pays a regular quarterly dividend of $0.41 per share, reflecting a premium yield of 14.92%.

Last week, SOXS witnessed net inflows of $126 million, including an inflow of $173.31 million on May 24 and an outflow of $46.1 million on May 23. While semiconductor bulls remain optimistic about the sector following upbeat results and solid guidance by leading player Nvidia, bears are taking an equally big bet on the sector’s underperformance.

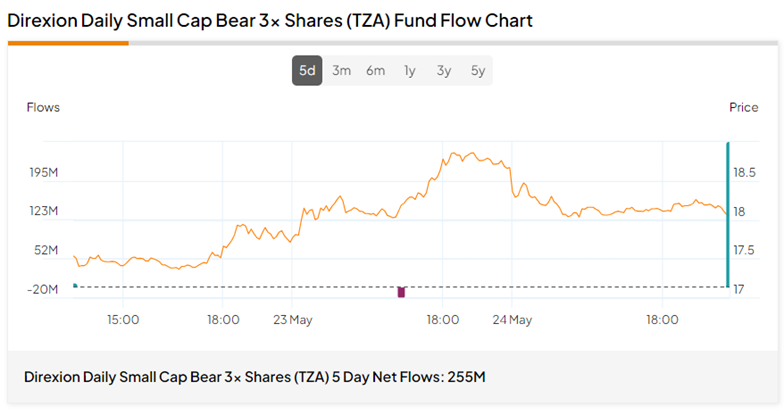

#5 Direxion Daily Small Cap Bear 3x Shares (TZA)

TZA provides a 3x daily short inverse exposure to a market-cap-weighted index of U.S. small-cap companies, as defined by the Russell 2000. As of date, TZA has most of its funds invested in cash and government securities, with an AUM of $708.95 million.

Last week, TZA saw net inflows of $255 million, comprising a $7.8 million inflow on May 22, a $19.54 million outflow on May 23, and a $266.28 million inflow on May 24.

Key Takeaways

ETFs are an attractive way to diversify your risk. Investors seeking exposure to ETFs can leverage the TipRanks ETF Screener tool to research and pick ETFs of their choice. They can also check the weekly inflows to track the ETFs that are in the spotlight.