Dividend stocks provide investors with a regular source of income and an opportunity for capital appreciation over time. Historically, these stocks have exhibited lower volatility than the overall market, making them a prudent option for risk-averse investors. To help investors identify the best dividend stocks, we’ve employed TipRanks’ Stock Screener tool.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

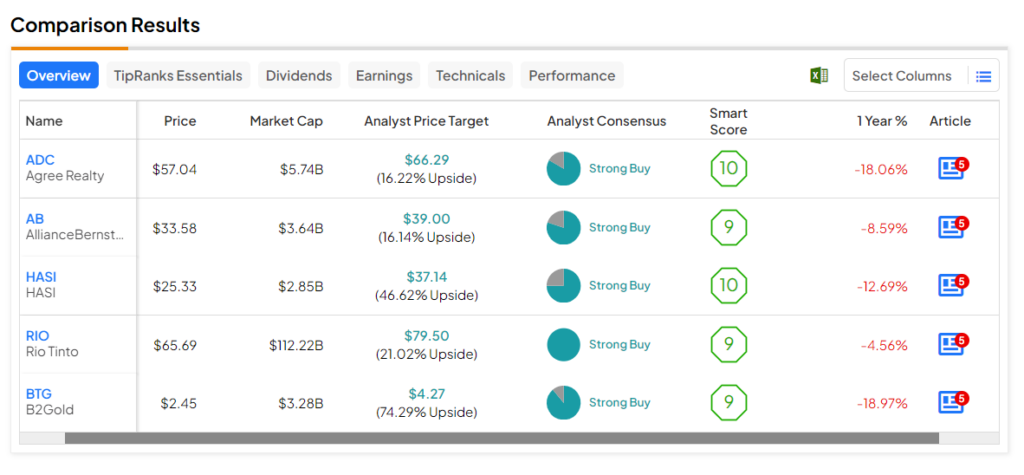

These stocks have garnered Strong Buy ratings from analysts and boast an Outperform Smart Score (8, 9, or 10) on TipRanks, indicating their potential to beat the broader market. Additionally, analysts’ price targets suggest an upside potential exceeding 15%. Also, these stocks have a dividend yield of over 5%.

Here are five stocks for investors to consider.

- Rio Tinto (NYSE:RIO) – Rio Tinto is a multinational mining and metals company, and producer of iron ore, aluminum, copper, and other metals. Its price forecast of $79.50 implies a 21% upside. Also, the stock has a Smart Score of nine and boasts a dividend yield of 5.8%.

- HASI (NYSE:HASI) – This company is focused on solutions that reduce carbon emissions by providing capital and specialized expertise to energy companies. HASI stock’s price forecast of $37.14 implies a 46.6% upside and has a “Perfect 10” Smart Score. The company offers a reliable dividend yield of 6.09%.

- B2Gold (NYSE:BTG) – BTG is a Canadian mining company that owns and operates gold mines in Mali, Namibia, and the Philippines. BTG’s average price target implies a consensus upside of 74.3% and carries a Smart Score of nine. Additionally, the stock has an impressive dividend yield of 6.33%.

- Agree Realty (NYSE:ADC) – The stock of this real estate investment trust has an analyst consensus upside of 16.2%. Also, ADC stock has a Smart Score of “Perfect 10” and offers a dividend yield of 5.19%.

- AllianceBernstein (NYSE:AB) – This global investment management firm provides diversified investment strategies and personalized wealth management services. The stock’s average price target implies 16.1% upside potential. Also, its Smart Score of nine and dividend yield of 8.04% are encouraging.