Meta Platforms (META) delivered strong results for the September quarter, exceeding expectations across the board. However, the initial market reaction was negative, largely due to concerns over increased AI spending. As a long-term Meta bull, I’ll use this article to highlight several bullish factors that indicate further upside potential for Meta—along with one cautionary point to consider—even though the stock has already gained 62% year-to-date.

Let’s start by exploring the bullish points, followed by a final look at the cautionary aspects.

1. Strong Revenue Growth and Expanding Profit Margins

The first point underscoring the bullish outlook on Meta is its robust performance in both the top and- bottom lines. Meta exceeded EPS estimates with $6.03 (a 37% year-over-year increase) and reported revenues of $40.6 billion, marking a 19% year-over-year growth. In comparison, other ad-supported companies that have reported earnings, including Alphabet (GOOGL) and Snap (SNAP), achieved revenue growth of 15%. By this measure, Meta had a standout quarter.

Building on the quarter’s strong performance, Meta’s operating profit margin expanded from 40% to 43%, underscoring the profitability of its business model, which I have long regarded as highly lucrative. Meta’s reliance on user-generated content is, in my view, what makes its business model so compelling: it primarily offers its platform to users for free, leveraging their engagement to drive ad revenue.

2. Growing User Base and Engagement

Meta’s expanding, highly engaged user base is a major driver of its performance, supporting its top-and- bottom-line growth. The Meta family of apps—Facebook, Instagram, WhatsApp, and Threads—now has 3.3 billion daily active users, up 5% year-over-year. This growth benefits from Meta’s network scalability, making it increasingly challenging for competitors to capture market share.

User engagement metrics further underscore Meta’s momentum: ad impressions increased by 7% year-over-year, while the average price per ad rose by 11%. These figures reflect strong user engagement and steady advertising demand, both key contributors to sustained revenue growth.

3. Investment in AI for Future Growth

A key aspect of Meta’s bullish investment thesis centers on its substantial investment in AI. This point has drawn some debate but is now beginning to pay off, particularly in ad targeting and user engagement. With advanced AI capabilities, Meta can deliver more relevant content, boosting user time spent on its platforms and increasing ad opportunities.

Backed by nearly $71 billion in cash reserves, Meta is well-positioned to make these investments, which should deliver higher returns than its cash holdings alone. This commitment to AI innovation and its massive user base gives Meta a long-term competitive edge.

AI-driven improvements are already notable: video recommendations are driving mid-to-high-single-digit growth in time spent on the platform, ad impressions are up by a high-single-digit percentage, and ad prices have increased by 11% (as mentioned in the topic before). Meta’s LLaMA model, with over 500 million uses, enhances user engagement and monetization, generating substantial profits that support reinvestment and sustainable growth—fueled by robust cash flows, as I’ll discuss further below.

4. Cash Flows and Valuation

The final bullish point for Meta lies in its strong cash flow generation. In Q3, cash flow from operations rose to $24.7 billion, up from $20.4 billion in the same quarter last year. For the first nine months of 2024, cash flow reached $63.3 billion, up from $51.7 billion. Free cash flow also significantly increased to $15.5 billion, up nearly 14% year-over-year.

Maintaining robust free cash flow growth is especially critical for major AI players like Meta, which are making substantial CapEx investments. Strong free cash flow demonstrates that the company generates enough cash from its core operations to cover its CapEx, indicating strong operational health. This is why I believe free cash flow could become a key metric for valuing Meta and other AI-focused tech giants.

Meta has traded at a price-to-cash flow ratio of 17.1x over the last twelve months, which is lower than other hyperscalers such as Amazon (AMZN) (18.3x) and significantly below Alphabet and Microsoft (MSFT), which trade at 19.7x and 24.9x, respectively. This suggests that, based on this metric, Meta may be the most undervalued of the Big Tech giants—even though it doesn’t offer a public cloud platform as a service like some of its peers.

The Cautious Point on Meta’s Investment Thesis

To balance the earlier bullish points, one cautious note contributing to Meta Platforms’ stock’s 4% post-Q3 drop is its updated guidance on capital expenditures (CapEx) and headcount growth.

Meta now projects full-year 2024 CapEx to be around $38–40 billion, up from the previous $37–40 billion range. Additionally, Meta announced it expects CapEx to increase further in 2025, potentially reaching $50–60 billion. The company also reported a 9% year-over-year increase in headcount, reversing the recent trend of leaner operations across Big Tech following the layoffs in 2022 and 2023.

These updates have raised concerns about potential margin pressure and the sustainability of Meta’s growth. The increased expenses suggest Meta may need to sustain a larger workforce and ongoing high investment levels to maintain revenue growth. If revenue slows or if these investments do not generate expected returns, this could weigh on profitability and investor sentiment.

Is Meta a Buy, According to Wall Street Analysts?

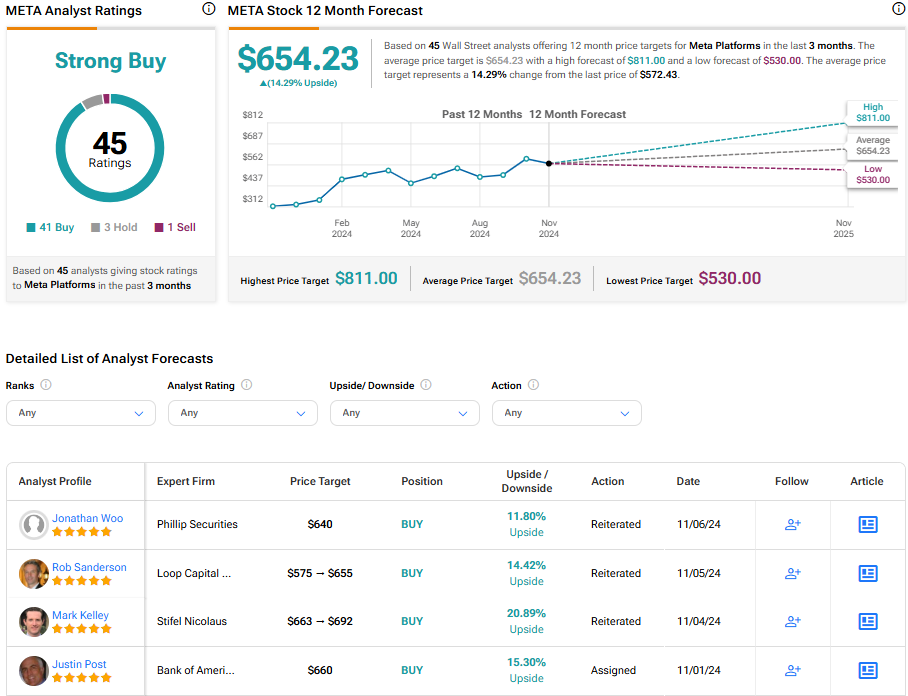

According to TipRanks, Wall Street analysts are highly bullish on META. Of 45 ratings, 41 are Buy recommendations, three are Hold, and only one is a Sell, resulting in a Strong Buy consensus. The average price target is $654.23, implying an upside potential of 14.29%.

Conclusion

The third quarter proved that Meta Platforms is still on top of its game, supporting my Buy stance. The company showcased impressive financial performance, with strong revenue growth, expanding profit margins, and smart investments in AI for future gains.

Certainly, concerns regarding increased CapEx and a growing workforce may cause some apprehension among investors in the short term. However, with solid cash flows and a strong market position, Meta looks more than ready to tackle these challenges. Plus, the market might not give the company the credit it deserves regarding this crucial metric.