As the artificial intelligence race accelerates across corporate America, legacy industrial giants are under growing pressure to demonstrate that AI is not just experimental—but immediately useful. Few companies embody that urgency more clearly than 3M (MMM), which is using its forthcoming appearance at CES 2026 to showcase how AI is being woven directly into both its product lineup and its internal operating model.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

CES is an annual trade show organized by the Consumer Technology Association in the U.S. Held each January at the Las Vegas Convention Center in Nevada, the event showcases presentations and launches of new products and emerging technologies from across the consumer electronics industry.

For decades, 3M has been synonymous with applied science: adhesives, tapes, films, abrasives, and materials that quietly underpin the building trade and DIY. Now, the company is signaling that AI has become the next foundational layer of that tradition. At CES 2026, 3M is set to exhibit a pair of digital platforms designed to collapse design timelines, reduce prototyping costs, and push innovation cycles from months to “minutes.”

At the center of this effort is Ask 3M, a new AI-powered digital assistant built to help engineers navigate one of the most complex material portfolios in manufacturing. Using generative AI and advanced simulation, Ask 3M guides users through substrate selection, environmental constraints, assembly methods, and performance targets to recommend optimal adhesives and tapes. Rather than paging through technical datasheets or relying on trial-and-error prototyping, engineers can arrive at viable solutions almost instantly.

Ask 3M is being piloted within the company’s Safety & Industrial Business Group, where challenges are both technically demanding and commercially critical. The assistant runs on secure, scalable Amazon (AMZN) Web Services (AWS) cloud infrastructure, leveraging tools such as Amazon Bedrock and AgentCore. The result is an example of agentic AI—software that doesn’t merely answer questions, but actively navigates constraints and proposes solutions, according to 3M.

Complementing Ask 3M is an expanded 3M Digital Materials Hub, a platform that launched earlier in 2025 and is now being significantly upgraded. The hub allows engineers to collaborate directly with 3M scientists via a Workbench feature and enables “virtual materials sampling” for solutions that don’t yet physically exist. Through simulation-ready data cards, customers can digitally validate materials before investing in physical prototypes.

A major new addition to the hub is Optical Models, which simulate the performance of 3M optical films inside common engineering environments. For automotive, consumer electronics, and advanced manufacturing engineers, this means optical trade-offs can be evaluated far earlier in the design process. In 3M’s pilot programs, customers reported fewer iterations and faster decision-making—an outcome that speaks directly to the commercial promise of AI-enhanced engineering.

AI Arms Race Heats Up

Taken together, these tools highlight a broader narrative unfolding across large corporations: AI must prove its value quickly, or risk being dismissed as hype. Large firms are deploying robust financing, cloud partnerships, and early-stage development not just to experiment but to establish credibility. There is a quiet but intense race underway to be “first” to the AI party—not first in headlines, but first in delivering measurable returns.

3M’s approach stands out because it anchors AI to tangible outcomes. Engineers are not being asked to learn abstract machine learning concepts; instead, AI is embedded directly into workflows they already understand. As Holly Semerad, chief marketing officer for 3M’s Safety & Industrial Business Group, put it, the goal is to “move from design challenge to solution concept, then digital selection and simulation in minutes”—then accelerate physical testing with small-quantity purchase options.

This push into AI is also mirrored internally. The company’s recent operational results suggest that digital transformation is reinforcing, rather than distracting from, core execution. Organic sales growth reached 3.2%, marking the fourth consecutive quarter of gains across all business groups. Operating margins expanded by 170 basis points, while earnings per share climbed 10% to $2.19, marking the 11th consecutive quarter of beating analyst expectations.

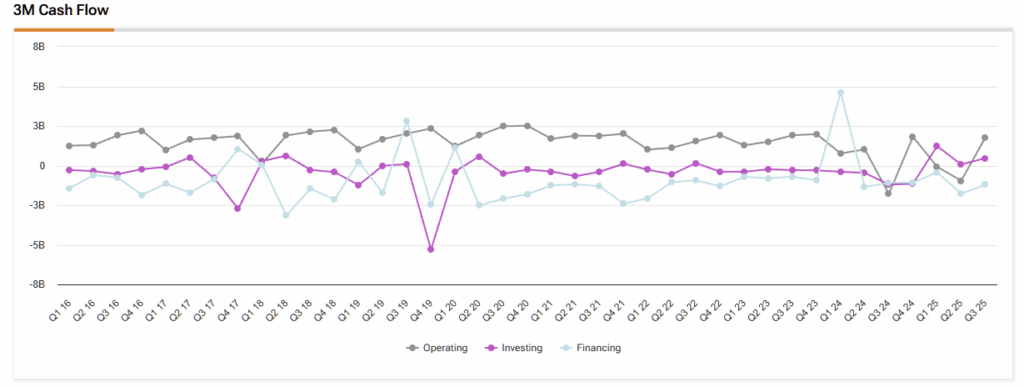

Meanwhile, MMM’s free cash flow now totals $1.3 billion with a conversion rate of 111%, giving the firm ample financial room to invest aggressively in AI while still returning capital to shareholders.

Innovation output has surged as well. The company launched 70 new products in the most recent quarter and nearly 200 year-to-date, with sales from products introduced in the last five years jumping 30%. Operational excellence metrics—such as the highest on-time performance in over two decades—suggest that AI-driven insights are being paired with disciplined execution on the factory floor.

That said, challenges remain. Automotive markets have softened, roofing granules face housing-related headwinds, and tariff impacts continue to weigh on costs. 3M has also agreed to divest a long-underperforming precision grinding business, underscoring a willingness to streamline even as it invests heavily in new technology.

Ultimately, 3M’s AI strategy may reflect a larger truth about the current moment. In an era of intense competition and rapid technological advances, standing still is not an option. By bringing AI directly into materials discovery, simulation, and collaboration—and by showcasing those capabilities at CES 2026—3M is making a clear statement: the future of industrial innovation will belong to companies that can turn AI from promise into practice, faster than everyone else.