The data center industry is growing very quickly as demand for artificial intelligence computing power continues to surge. As a result, companies like CoreWeave (CRWV), Equinix (EQIX), and Hut 8 (HUT) all stand to benefit from this trend, though they play very different roles in the data center market. Indeed, each company has a distinct business model and risk profile, which means that they don’t provide the same type of AI exposure. Therefore, understanding these differences is important when deciding which stock fits a particular strategy.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

CoreWeave: The Pure-Play AI Specialist

To begin with, CoreWeave is the most direct, or “pure-play,” bet on AI infrastructure. In fact, it operates specialized data centers built specifically for GPU-heavy AI workloads and works closely with Nvidia (NVDA) as well as AI labs like OpenAI (PC:OPAIQ) and Anthropic (PC:ANTPQ).

Unsurprisingly, the company is growing extremely fast, with a reported revenue backlog of $55.6 billion as of Q3 2025, but it is still unprofitable and carries a higher degree of risk. Nevertheless, its value proposition is its technical edge and specialized infrastructure that incumbents struggle to match.

Equinix: The World’s Largest Data Center REIT

In contrast, Equinix sits at the opposite end of the spectrum. As the world’s largest data center REIT, with more than 260 facilities globally, it focuses on colocation and interconnection for a broad customer base. Equinix’s colocation allows companies to rent secure, high-tech space to house their computer servers instead of building their own expensive data centers.

Meanwhile, its interconnection services then act like a high-speed “private switchboard,” letting those companies instantly and securely link their data to partners, customers, and clouds without using the public internet. While not purely an AI company, Equinix is adapting by supporting high-density AI workloads and offering distributed AI infrastructure.

Hut 8: The Crypto Miner Turned AI Contender

Lastly, Hut 8 falls somewhere in between as a transition story. Formerly known as a Bitcoin miner, the company has been shifting toward energy infrastructure and AI-focused data centers. More specifically, it recently signed a 15-year, $7 billion lease deal for a 245-megawatt AI data center project in Louisiana, which shows just how aggressively it is pivoting into AI.

It even has support from partners like Anthropic and financial backing from Google (GOOGL). However, with a much smaller market capitalization than Equinix, Hut 8 comes with more volatility.

Which Data Center Stock Is the Better Buy?

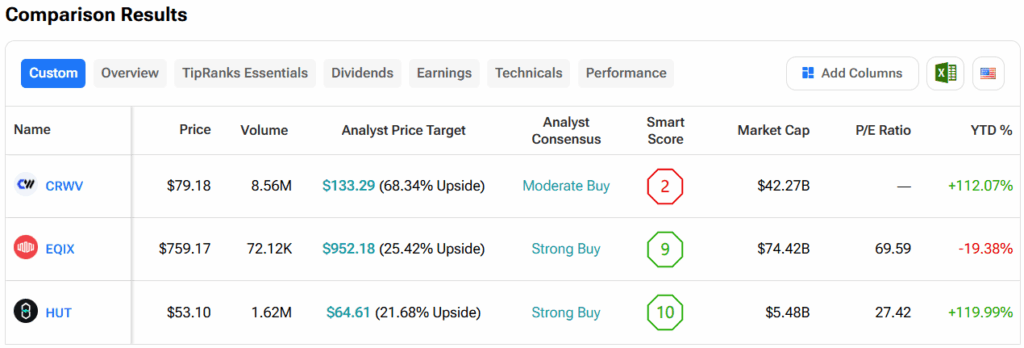

Turning to Wall Street, out of the three data center stocks mentioned above, analysts think that CRWV stock has the most room to run. In fact, CoreWeave’s average price target of $133.29 per share implies more than 68% upside potential.