VerifyMe, Mobix Labs, and Hyperscale Data are the 3 Penny Stocks to watch on January 6, 2026, based on TipRanks’ Penny Stock Screener tool. These stocks are usually priced at $5 or below and typically belong to companies with a market capitalization under $300 million.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Penny Stock Screener allows investors to identify stocks by applying a variety of filters, including Sector, Price Target Upside, Smart Score, Analyst Consensus, Dollar Volume, and Price Change.

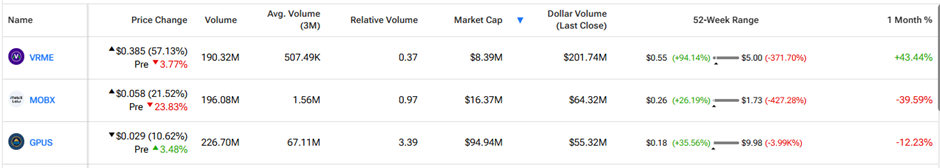

We leveraged the tool to identify the top three penny stocks with the highest Dollar Volume as of market close on January 5, 2026. Dollar Volume refers to the total value of shares traded in a day, calculated by multiplying the number of shares traded by the stock’s price.

VerifyMe (VRME) – VerifyMe offers brand protection and specialized shipping services. It safeguards products from counterfeiting and manages logistics for sensitive goods in food and healthcare. On January 5, VRME had a Dollar Volume of $201.74 million, while its share price skyrocketed by over 57%.

VerifyMe and Open World signed a non-binding letter of intent for a strategic merger. The deal includes a 60-day exclusivity period for due diligence and finalizing terms, with Open World’s shareholders owning roughly 90% of the combined Nasdaq-listed company post-closing.

Mobix Labs (MOBX) – Mobix Labs is a fabless semiconductor company specializing in advanced connectivity and sensing solutions. Yesterday, MOBX had a Dollar Volume of $64.32 million, accompanied by a stock price surge of 21.5%.

Mobix Labs announced plans to relocate to a bigger facility certified for military use. This move addresses rising demand by consolidating West Coast operations in one location, streamlining production, manufacturing, and daily activities for better efficiency and coordination. However, shares are down 26% in pre-market trading after the company announced a common stock offering, which stands to dilute shareholders’ equity. The net proceeds from the offering will be used for working capital and general corporate purposes.

Hyperscale Data (GPUS) – Hyperscale Data operates as a diversified holding company focused on data centers, Bitcoin mining, and AI infrastructure. The company manages facilities like its large Michigan campus for high-performance computing (HPC) and GPU services. On Monday, GPUS had a Dollar Volume of $55.32 million, while its stock price fell by 8.6%.

The share price decline seems to be a reversal from prior day’s rally when GPUS stock surged over 49%. Shares jumped after a recent SEC Form 4 filing revealed that Executive Chairman Milton C. Ault III and affiliated entity Ault & Company, Inc., acquired approximately 1.61 million shares of its common stock through late-December 2025 transactions.

To find more penny stocks like these, you can take a look at TipRanks’ Penny Stock Screener tool. It shows a list of all penny stocks, their price movement, and other vital data.