As investors look ahead to 2026, market leadership may come from unexpected places. While Wall Street analysts often focus on consensus favorites, some of the most compelling opportunities emerge where fundamentals tell a different story than prevailing sentiment. Archer Daniels Midland (ADM), UniFirst (UNF), and Kennametal (KMT) all carry Outperform ratings and high TipRanks Smart Scores, indicating strong financial and operational foundations. Yet, despite these strengths, Wall Street analysts broadly classify them as Sell or Moderate Sell.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This disconnect between quantitative fundamentals and analyst sentiment creates a rare setup: high-quality businesses trading under a cloud of skepticism. Each of these companies is quietly executing, improving margins, strengthening cash flows, and positioning itself for durable long-term growth. For patient investors, ADM, UNF, and KMT may represent overlooked outperformers heading into 2026.

Archer Daniels Midland (NYSE:ADM)

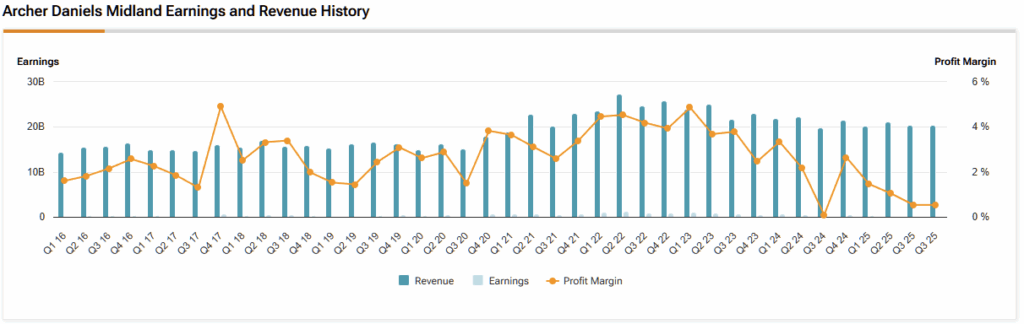

Archer Daniels Midland stands as one of the most durable franchises in global agribusiness, yet its stock remains surprisingly underappreciated. Despite macro concerns around commodities and agricultural cycles, ADM continues to demonstrate why it has remained relevant—and profitable—for more than a century.

One of the company’s most compelling strengths is its robust cash generation. Cash flow from operations before working capital changes reached $2.1 billion year-to-date, underscoring ADM’s financial resilience even amid volatile input prices. This steady cash flow not only supports reinvestment in the business but also underpins ADM’s exceptional shareholder-return track record.

That reliability is best illustrated by its dividend history. ADM recently announced its 375th consecutive quarterly dividend, a milestone few companies can match. This consistency signals management confidence in long-term earnings power and makes ADM particularly attractive to income-focused investors seeking stability in uncertain markets.

Operationally, ADM continues to sharpen efficiency. Ag Services and Oilseeds crush volumes increased 2.6% sequentially and 2.2% year-over-year, reflecting disciplined execution and strong demand. Meanwhile, the long-challenged Animal Nutrition segment has staged a notable turnaround, with operating profit surging 79% year-over-year as ADM shifts toward higher-margin products.

Building on this momentum, Flavors North America reported record quarterly revenue, driven by robust growth across both the Flavors and Animal Nutrition portfolios. Taken together, ADM’s diversified earnings streams, improving margins, and fortress-like balance sheet suggest the market may be underestimating its earnings durability heading into 2026.

UniFirst (NYSE:UNF)

UniFirst is steadily rebuilding momentum after a challenging period, and recent results suggest the company’s fundamentals are turning decisively in the right direction—despite lingering analyst skepticism. What looks modest on the surface reveals a business strengthening its core, improving customer relationships, and unlocking new growth vectors heading into 2026.

From a top-line perspective, UniFirst reported full-year revenues of $2.4 billion, representing 2.1% year-over-year growth after adjusting for the additional operating week in the prior fiscal year. While this pace may appear restrained, it marks a clear return to normalized growth and reflects improving execution across the organization rather than one-time tailwinds.

More importantly, UniFirst is seeing meaningful improvements in customer retention, a critical metric for a recurring-revenue business. After two years of lost accounts, fiscal 2025 showed notable progress, with key leading indicators trending positively. Net Promoter Scores (NPS) improved, and the number of customers under contract increased—both strong signals that service quality and customer satisfaction are rebounding. In an industry where long-term relationships drive profitability, this shift has outsized implications for future margins and cash flow stability.

A particularly bright spot is UniFirst’s First Aid and Safety Solutions segment, which reported nearly 10% growth in fiscal 2025. Management expects this segment to accelerate further, projecting double-digit growth in fiscal 2026. As workplace safety regulations expand and employers prioritize compliance and employee well-being, this higher-growth, higher-margin business provides an increasingly important diversification benefit beyond traditional uniform rentals.

Financially, UniFirst continues to demonstrate discipline and resilience. The company generated $296.9 million in operating cash flow, reinforcing its ability to fund growth initiatives, invest in infrastructure, and maintain balance-sheet strength without overleveraging. This cash-generation capacity supports long-term compounding, even during periods of uneven economic activity.

Kennametal (NYSE:KMT)

Kennametal is showing clear signs of emerging from a prolonged period of market weakness, and recent performance suggests the company may be entering the early stages of a cyclical and operational upswing. While many analysts remain cautious due to Kennametal’s exposure to industrial demand cycles, the underlying fundamentals are improving faster than consensus expectations.

One of the most encouraging developments is strong project execution and market share gains across multiple end markets. Kennametal’s Infrastructure segment secured two large project wins within Earthworks, complemented by additional wins in Energy, Aerospace and Defense, and Transportation. These successes are not only adding incremental revenue but also expanding the company’s footprint in higher-growth, higher-value sectors, reinforcing its competitive position as customers prioritize performance, reliability, and expertise in advanced materials.

Reflecting this traction, management raised its fiscal 2026 sales and EPS outlook. The improved guidance incorporates modestly better market conditions, incremental pricing actions, and stronger-than-expected first-quarter performance. This upward revision is particularly notable given the cautious tone still prevalent across much of the industrial sector, suggesting Kennametal’s internal momentum is outpacing broader market trends.

Operationally, the company delivered a key milestone: 3% year-over-year organic sales growth, marking the first quarter of organic growth in two years. After an extended period of broad-based demand softness, this return to organic growth signals that end-market pressure is easing and that Kennametal’s streamlined portfolio is better aligned with current customer needs.

Profitability trends are moving in the right direction as well. Adjusted EBITDA margin expanded to 15.3%, up from 14.3% in the prior-year quarter. This improvement was driven by a combination of effective pricing, restructuring savings, and disciplined cost management. As volumes recover, Kennametal stands to benefit from additional operating leverage on a leaner cost base.

Fundamentals Set to Shine Despite Wall Street Doubts

As the market looks beyond short-term narratives and into 2026, Archer Daniels Midland, UniFirst, and Kennametal stand out as classic examples of stocks where fundamentals are diverging meaningfully from sentiment. Each company is executing tangible improvements—whether through stronger cash generation and dividends, improving customer retention and higher-growth adjacencies, or renewed organic growth and margin expansion—yet all remain weighed down by cautious or outright bearish analyst views.

For investors willing to look past consensus ratings and focus on cash flow durability, operational momentum, and strategic positioning, these under-the-radar names offer a compelling risk-reward profile. If execution continues and macro conditions stabilize, ADM, UNF, and KMT may prove that some of the most attractive outperformers of 2026 are hiding in plain sight.