Dividend ETFs remain a favorite among income-seeking investors, but not all are created equal. Using TipRanks’ High Dividend Yield ETFs tool, we have shortlisted three ETFs: J.P. Morgan Nasdaq Equity Premium Income ETF (JEPQ), NEOS Nasdaq 100 High Income ETF (QQQI), and Goldman Sachs Nasdaq 100 Core Premium Income ETF (GPIQ) that offer high dividend yields of over 8%.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For context, a dividend ETF (Exchange-Traded Fund) is a fund that holds a basket of dividend-paying stocks and trades on an exchange like a regular stock.

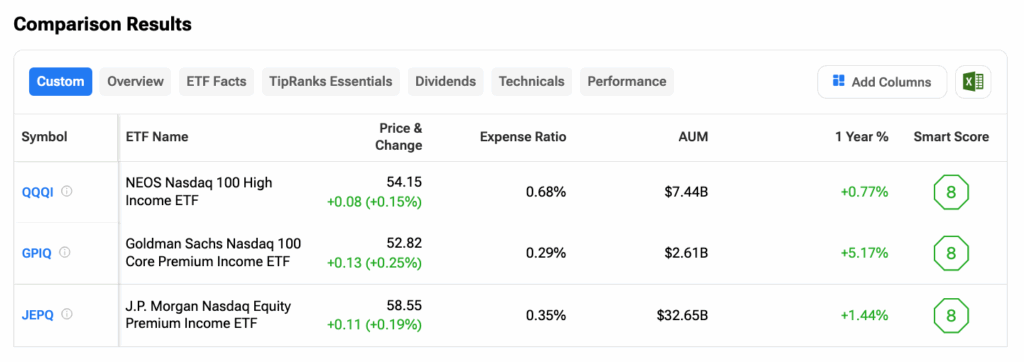

Quick Comparison: Top Dividend ETFs

For those interested in ETFs, TipRanks also offers powerful comparison features. TipRanks’ ETF Comparison Tool lets investors compare funds across metrics such as AUM (assets under management), expense ratios, technicals, dividend analysis, etc.

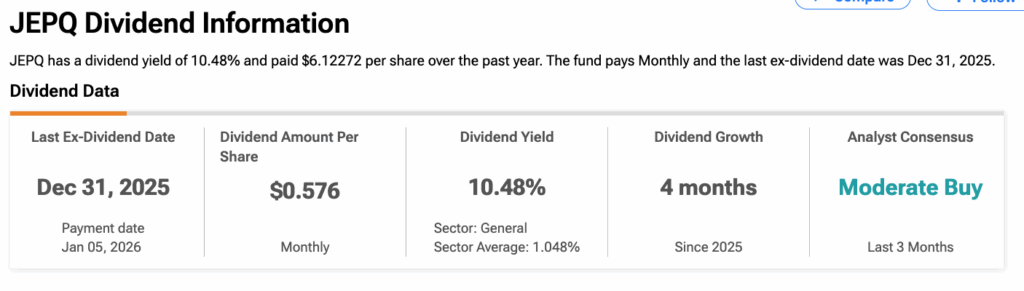

J.P. Morgan Nasdaq Equity Premium Income ETF (JEPQ)

JEPQ gives investors access to large, well-known Nasdaq companies while aiming to generate steady income, making it suitable for those seeking both growth potential and regular payouts.

JEPQ offers a dividend yield of 10.48%, paying a monthly income of $0.576 per share. The ETF has a moderate expense ratio of 0.35%. In terms of holdings, JEPQ holds 96 stocks with $33.03 billion in assets. Its largest positions are Nvidia (NVDA) at 9.20%, Apple (AAPL) at 8.11%, and Microsoft (MSFT) at 7.50%.

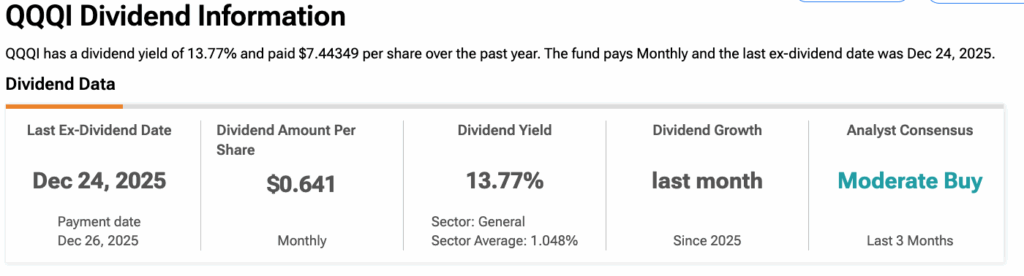

NEOS Nasdaq 100 High Income ETF (QQQI)

QQQI gives investors exposure to leading large-cap stocks in the Nasdaq-100 while using options strategies to generate high monthly income, with a dividend yield of 13.77%. Its tax-efficient structure may help improve after-tax returns for income-focused investors.

The ETF pays a monthly dividend of $0.641 per share and distributed $7.44 per share over the past year. However, QQQI has the highest expense ratio among the three ETFs at 0.68%. Meanwhile, QQQI holds 104 stocks, with total assets worth $7.44 billion. Its largest positions include NVDA (9.6%), AAPL (8.48%), MSFT (7.41%), Amazon (AMZN) (5.10%), and Tesla (TSLA) (3.94%).

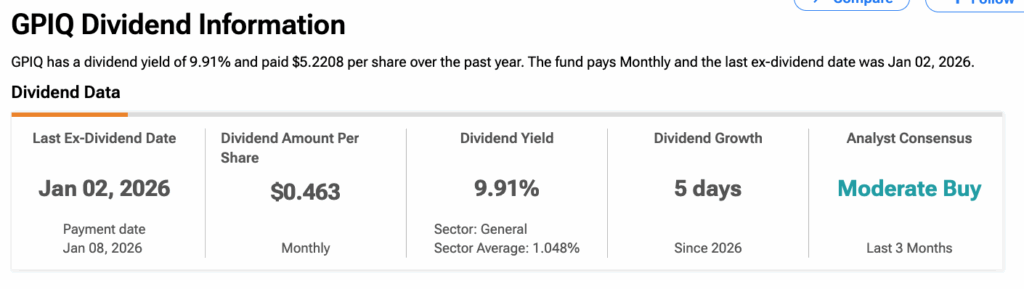

Goldman Sachs Nasdaq 100 Core Premium Income ETF (GPIQ)

GPIQ offers exposure to top Nasdaq-100 companies while targeting both growth and income, using Goldman Sachs’ flexible covered-call strategy to generate steady income and participate in market upside.

GPIQ offers a compelling high dividend yield of about 9.91%, making it attractive for income-focused investors. The ETF pays monthly dividends of $0.463 per share. It also carries a low expense ratio of 0.29%, helping investors keep more capital invested for long-term compounding.

In terms of holdings, GPIQ gains from the strong performance of top tech companies. Currently, GPIQ holds 102 stocks with total assets worth $2.6 billion. Its top 3 holdings are Nvidia, Apple, and Microsoft.