As meme stocks continue to draw heavy retail interest, Wall Street analysts are looking past the hype to identify names with real upside potential. Heading into 2026, a handful of popular meme stocks stand out for their improving fundamentals, growth catalysts, and bullish analyst outlooks. Here are three meme stocks that analysts believe could deliver higher upside over the next year.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For context, meme stocks are shares that surge in popularity among retail investors through social media buzz. Their prices are highly volatile, driven more by hype and online sentiment than by fundamentals.

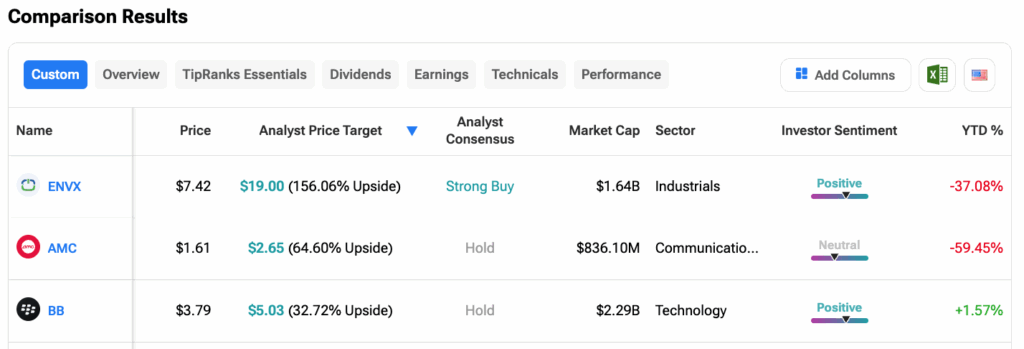

Meme Stocks: A Quick Comparison

Using the Meme Stocks tool, we’ve shortlisted three meme stocks that could offer higher upside in 2026. The tool allows users to compare up to ten trending meme stocks across key metrics such as analyst ratings, price targets, and investor sentiment.

Let’s dig deeper.

Enovix (ENVX)

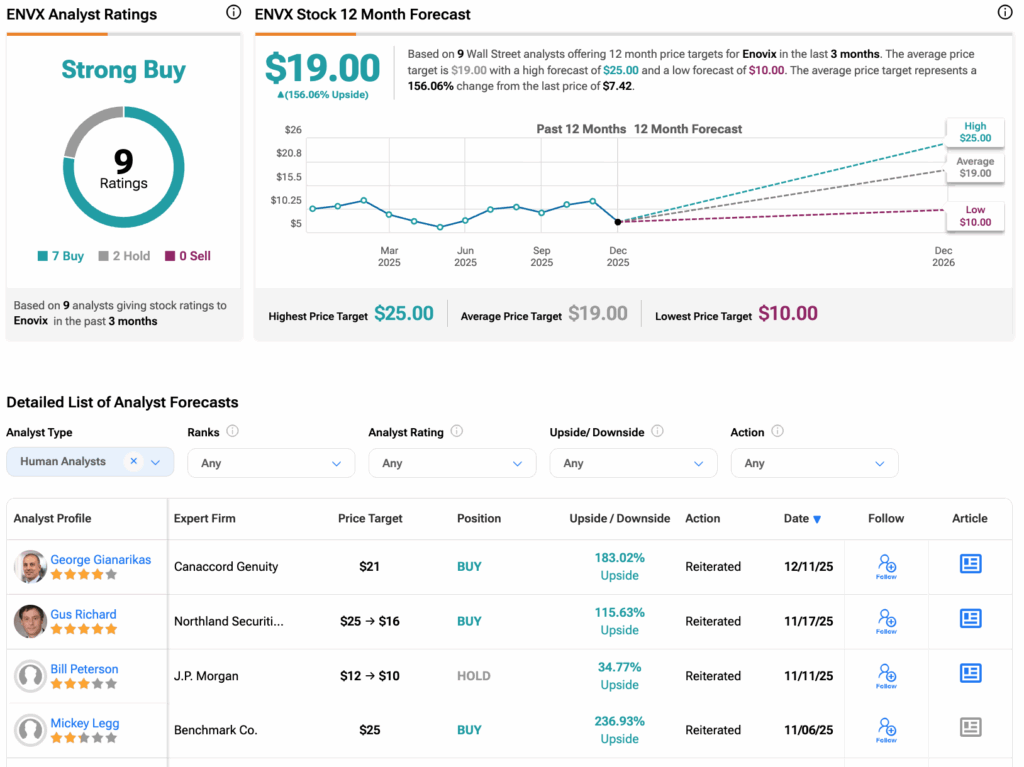

Enovix is an advanced battery technology company focused on developing high-performance lithium-ion batteries for next-generation devices. While the company’s battery technology shows promise, its stock often swings sharply on social media hype and sentiment. In 2025, ENVX stock is down about 32%.

Turning to Wall Street, analysts have a Strong Buy consensus rating on ENVX stock based on seven Buys and two Holds assigned in the past three months. Furthermore, Enovix’s average stock price target of $19.00 per share implies 156.06% upside potential.

AMC Entertainment (AMC)

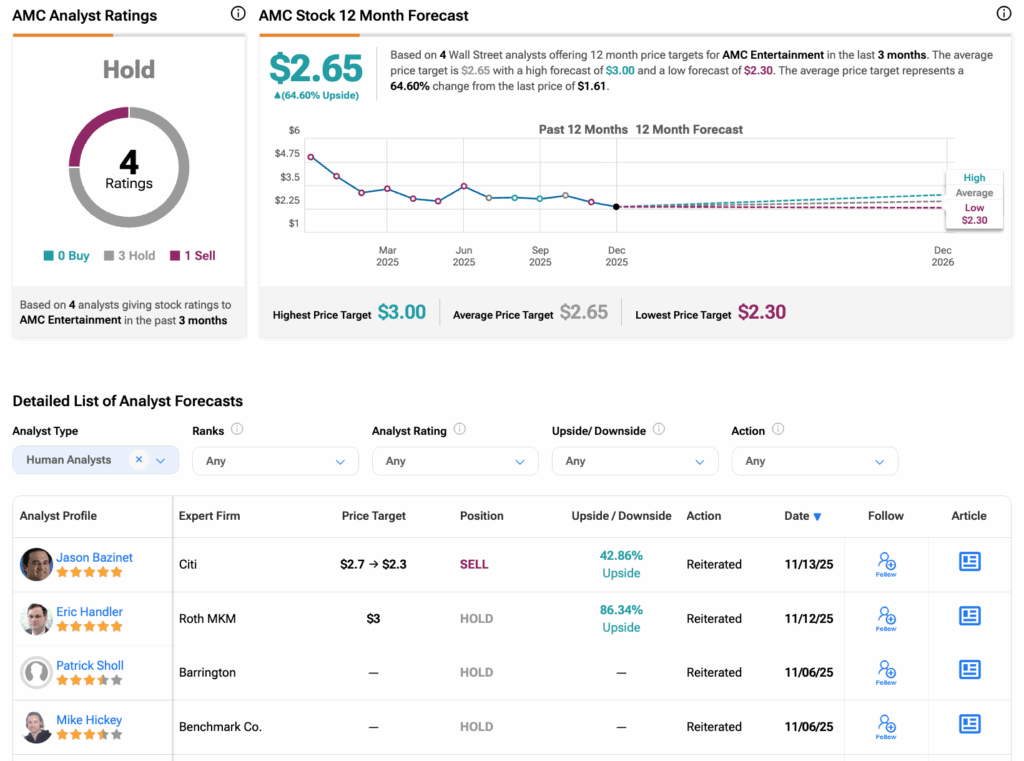

AMC Entertainment is the world’s largest movie theater chain and a favorite among retail investors. The company remains in focus as it works to manage debt, boost attendance, and capitalize on box office recoveries and streaming partnerships. Year-to-date, AMC stock has declined almost 60%.

Turning to Wall Street, analysts have a Hold consensus rating on AMC stock based on three Holds and one Sell assigned in the past three months. However, AMC’s average stock price target of $2.65 per share implies 65% upside potential.

BlackBerry (BB)

BlackBerry has evolved from a smartphone maker into a software and cybersecurity company, focusing on enterprise security and connected-car technology. Despite this shift, the stock remains a meme favorite, often seeing sharp price swings driven by retail investor hype rather than fundamentals. In 2025, BB stock gained 0.26%.

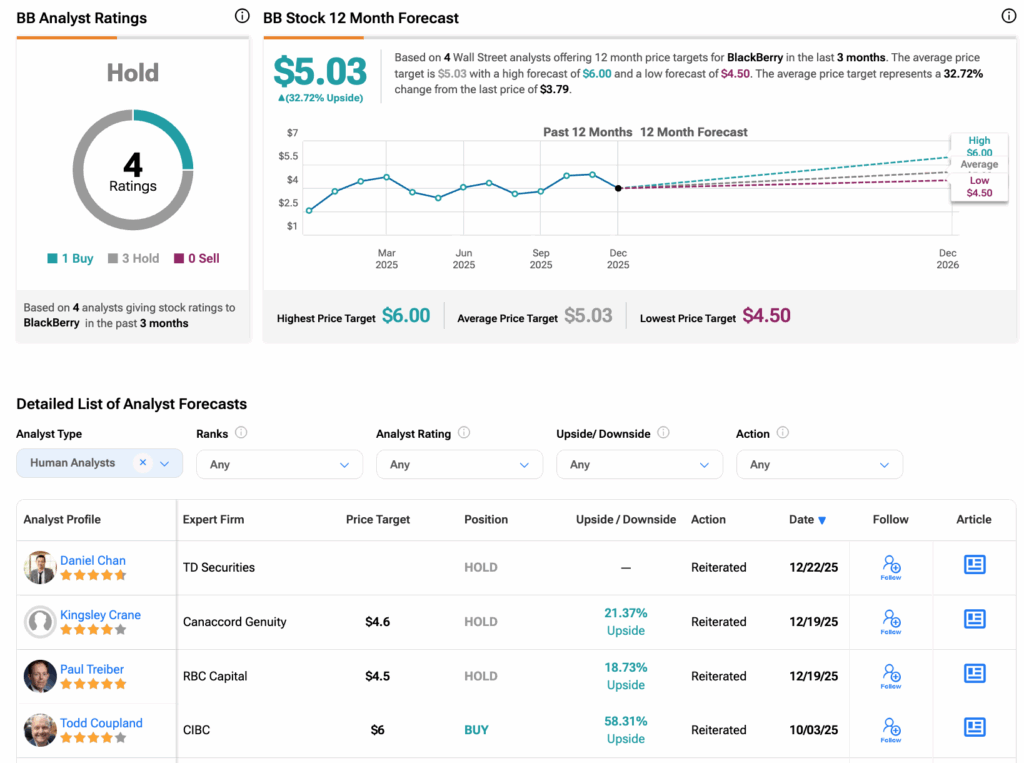

Looking ahead, analysts have a Hold consensus rating on BB stock based on three Holds and one Buy assigned in the past three months. However, BlackBerry’s average stock price target of $5.03 per share implies 33% upside potential.