Many seasoned investors expected 2025 to follow familiar patterns, but the markets delivered several unexpected twists, according to Yahoo Finance. One of the biggest surprises was the dramatic strength in precious metals, especially gold (GLD) and silver (SLV), which hit all-time highs. This rally in metals stood out because many analysts had anticipated risk-on behavior from stocks rather than a sharp pivot to safe-haven assets.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Another surprise came from how certain stocks and sectors performed relative to expectations. For instance, retail trading platforms and market-sensitive names, including companies like Robinhood (HOOD), posted much stronger gains than many professionals had forecast. That strength was driven by retail investors and excitement around digital assets. Meanwhile, some market leaders and more “obvious” winners underperformed, despite supportive economic forecasts. These uneven results highlighted how sentiment and investor behavior played a bigger role than fundamentals alone.

Finally, volatility itself proved harder to predict. In fact, market swings became sharper and faster, with rallies and pullbacks playing out more quickly than many models anticipated. Moreover, expectations around Federal Reserve policy, geopolitical developments, and sudden rotations between growth and defensive sectors all added to the uncertainty. As a result, even experienced strategists found themselves re-evaluating their assumptions about correlations and risk.

Is HOOD a Good Stock to Buy?

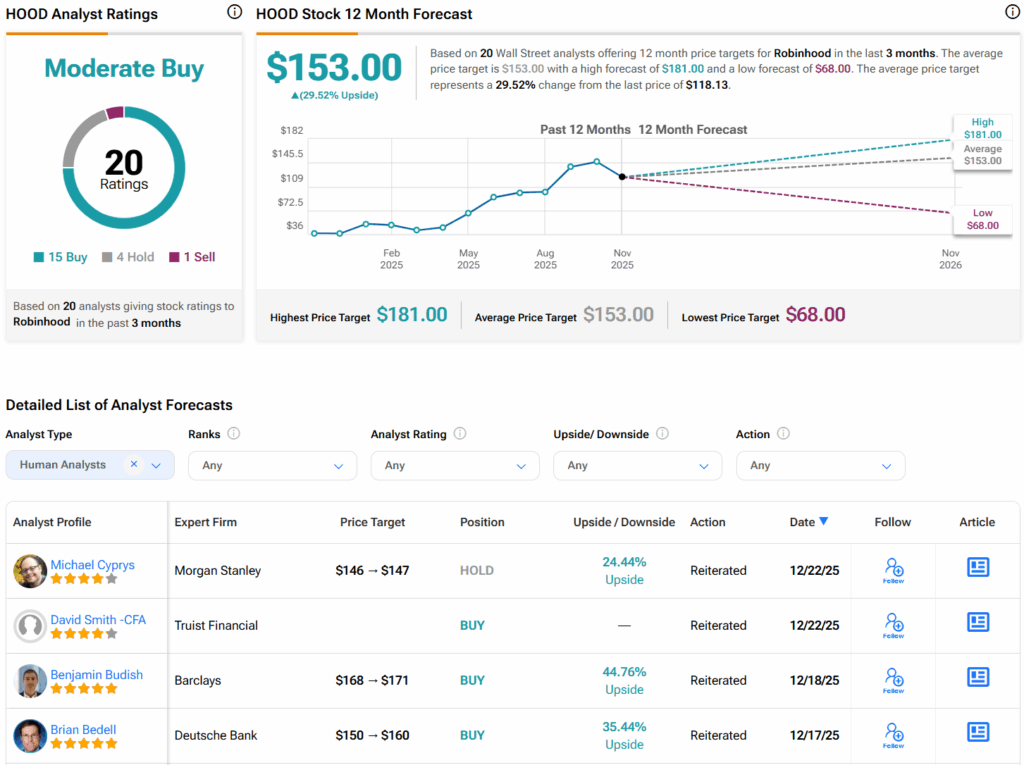

Overall, analysts have a Moderate Buy consensus rating on HOOD stock based on 15 Buys, four Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average HOOD price target of $153 per share implies 29.5% upside potential.