Brent crude is hovering around $61 a barrel today, with WTI near $56, following a gradual decline over recent years, while the EIA now expects most of 2026. We have inventories edging higher, supply growth still surprising to the upside, and on top of that, Washington has effectively taken control of Venezuela’s export tap, authorizing sales of up to 50 million stranded barrels, adding another catalyst to keep prices depressed.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Given the topsy-turvy conditions in the hydrocarbon sector, I believe we are entering a supply-constrained market in which producers may struggle, but the companies that control the pipes—earning toll-like fees on volumes under long-term contracts—are positioned to thrive. That dynamic is why Enterprise Products Partners (EPD), MPLX (MPLX), and Energy Transfer (ET) remain compelling investments despite oil prices on the floor, especially in light of their substantial dividend yields.

Enterprise Products Partners (NYSE:EPD)

Enterprise Products had a very stable year, and 2026 should prove another strong year of profits and growing payouts. In Q3, the partnership generated $2.4 billion of adjusted EBITDA and $1.8 billion of distributable cash flow, covering its distribution 1.5x, while for Q4, I see sequential growth with adjusted EBITDA of ~$2.5 billion to $2.6 billion and DCF between ~$2.1 billion and $2.2 billion. Due to its ~80% gross operating margin from fee-based activities, much of it under take-or-pay-style contracts, the real driver is throughput rather than whether Brent closes at $55 or $70.

Those volumes are increasingly pulled by export demand. Enterprise is commissioning its Bahia NGL pipeline out of the Permian, a 550-mile system to its Mont Belvieu hub, with Exxon (XOM) taking a 40% stake, and capacity is targeted to rise from 600,000 to 1 million barrels a day by early 2026. Extra Venezuelan barrels routed to Gulf Coast refiners would only deepen the role of EPD’s storage caverns and docks.

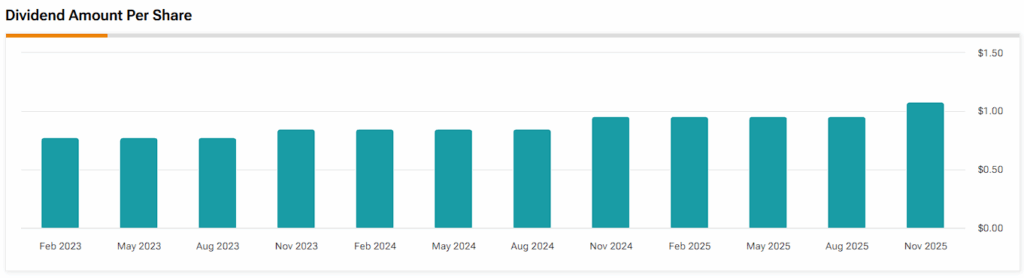

Yet EPD units yield about 7% and trade at 10x forward EV/EBITDA despite conservative leverage and consistent retained cash for growth. I believe this is a cheap multiple for an infrastructure whose economics are mostly pre-sold. If anything, given EPD’s excellent track record, including 28 consecutive years of raising its distributions, a premium would be well-deserved.

Is EPD Stock a Buy, Hold, or Sell?

Analyst sentiment remains fairly positive on EPD. The stock carries a Moderate Buy consensus rating, based on six Buy, four Hold, and one Sell ratings on Wall Street. In addition, Enterprise Products’ average stock price target of $35.36 implies ~10% upside potential over the next twelve months.

MPLX (NYSE:MPLX)

Similar to Enterprise Products, MPLX’s results have been very stable lately, posting $1.8 billion of adjusted EBITDA and $1.5 billion of DCF last quarter, comfortably covering its quarterly distribution, which has been raised 12.5% for two consecutive years. In fact, MPLX has a long track record of payout growth, boasting 13 consecutive raises.

The resilience here is mostly contractual. Roughly 80% of MPLX’s revenue is backed by minimum-volume commitments. These have an average remaining term of around 13 years, and about 88% of crude and product logistics revenue is anchored by its sponsor, Marathon Petroleum (MPC).

On the gas and NGL side, management is expanding into the Marcellus, Utica, and Permian through systems such as Northwind and full ownership of the BANGL NGL line. This should stitch together a “wellhead-to-water” chain that connects producers directly to the Gulf Coast and LNG demand.

Today, MPLX trades at a forward EV/EBITDA of 10.6x. The stock may not be in distress territory, but this valuation is still attractive for a quality asset base that offers an 8%-plus cash yield, mid-single-digit expected growth over the medium term, and unusually long contract visibility.

Is MPLX Stock a Good Buy?

On Wall Street, MPLX stock features a Moderate Buy consensus rating, based on four Buy and four Hold ratings. Notably, not a single analyst rates MPLX stock a Sell. Moreover, MPLX’s average stock price target of $58.14 implies almost 10% upside potential over the next 12 months.

Energy Transfer (NYSE:ET)

Energy Transfer is another worthwhile name in the space. Last quarter, its adjusted EBITDA was $3.84 billion, and management’s outlook targets $16.1–$16.5 billion for 2025 and $17.3–$17.7 billion for 2026, with roughly 90% of that fee-based across NGLs, crude, products, and gas. The business depends much more on volumes and contract renewals than on daily moves in crude.

In the meantime, ET’s growth capital expenditure appears to be on the right track. They have shelved the Lake Charles LNG project and are redirecting approximately $5–5.5 billion of 2026 CapEx to various lucrative projects. These include natural-gas pipelines, Permian processing plants like Mustang Draw, and NGL export capacity at Nederland, all aimed squarely at data-center and power-sector load growth in Texas and the broader South.

That is a very different risk profile from speculative LNG. This aligns with what power and technology customers are already requesting: firm gas transport and processing for baseload and backup generation.

Despite this shift, ET units trade at around 7.7x forward EV/EBITDA and carry an 8%-plus distribution yield due to past missteps. However, management is targeting 3–5% annual distribution growth and leverage drifting down into the high-3x range. If ET simply spends within cash flow and sticks to contracted pipes serving visible demand, investors are being paid generously while they wait for the valuation to admit the story has grown up.

Is ET Stock a Good Buy?

On Wall Street, ET stock has a Moderate Buy consensus rating, based on six Buy and four Hold ratings. Similar to MPLX, no analyst rates the stock a Sell. Also, Energy Transfer’s average stock price target of $20.50 implies ~21% upside potential over the next 12 months, reflecting the more underpriced opportunity among the trio.

Midstream Stability in a Cheap-Oil World

Low crude prices and tight U.S. oversight of Venezuelan barrels may weigh on upstream energy equities. Paradoxically, those same forces could prove supportive for midstream operators by boosting throughput volumes and enhancing cash-flow visibility.

Enterprise Products Partners stands out for its robust export backbone. MPLX adds long-dated, sponsor-anchored cash flows. Energy Transfer offers a discounted, higher-beta alternative.

Whichever best fits an investor’s risk appetite, all three present compelling opportunities—delivering high, largely contract-backed yields in an oil market that may remain cheaper for longer than most investors expect.