As 2024 comes to an end, investor confidence is growing with hopes for tax cuts and lower interest rates in 2025. In this context, high-yield dividend stocks could become more attractive, offering steady income and potential tax benefits. Here are three dividend stocks – Rio Tinto (RIO), AES Corporation (AES), and Rithm Capital (RITM) – that boast a dividend yield of more than 5% and one-year upside potential of over 20%.

Also, all of these three stocks have a Smart Score of nine or “Perfect 10”, implying that these stocks are likely to outperform the market.

Here are the top three picks for 2025.

Rio Tinto

Rio Tinto is a mining company offering a high dividend yield, currently around 7.4%, surpassing the Materials sector average of 1.68%. The company has recently expanded its portfolio by investing in critical minerals like lithium, aiming to diversify and strengthen its operations. Additionally, Rio Tinto is set to acquire Arcadium Lithium for $6.7 billion, positioning itself as the world’s third-largest lithium miner.

Overall, Rio Tinto stock has a Strong Buy consensus rating based on four unanimous Buys. The average RIO stock price target of $85.94 implies a 45.2% upside potential.

AES Corporation

AES is a global energy company focusing on power generation and utility services, with an emphasis on renewable energy. The company offers a dividend yield of 5.3%, higher than the Utilities sector average of 2.89%. As of December 2024, AES has raised its dividend by 2%, continuing its track record of 11 years of steady dividend growth. With increasing demand for clean energy, AES’s work in battery storage and solar development positions it for potential growth in 2025.

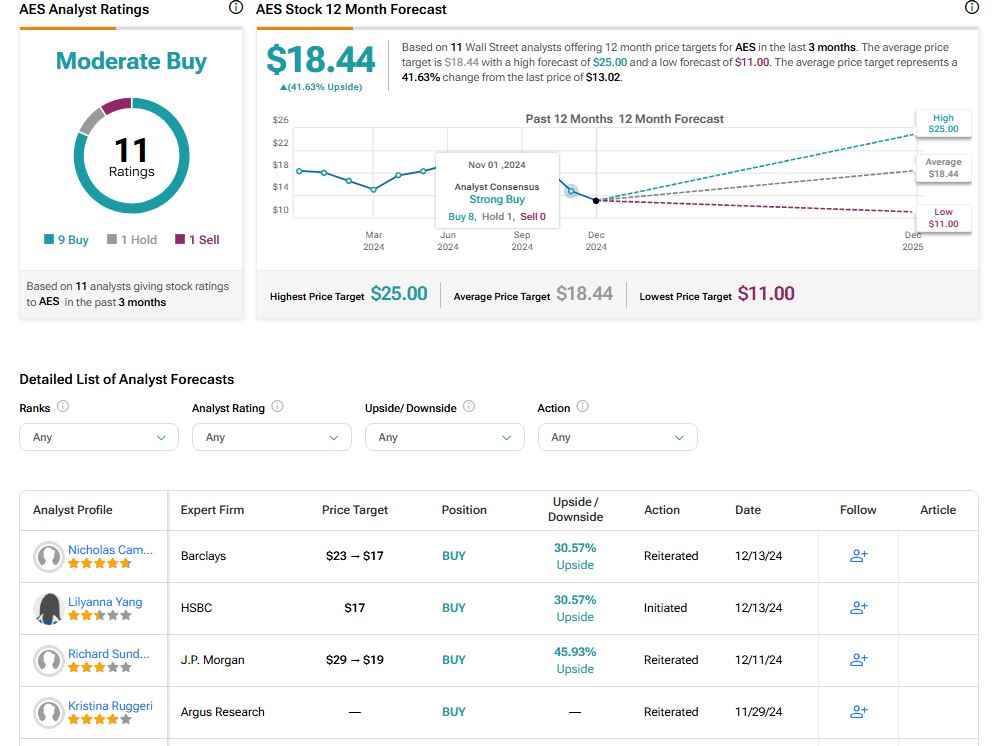

In a recent note, HSBC analyst Lilyanna Yang initiated coverage on the stock with a Buy rating and $17 price target. She sees the recent drop in the stock price, driven by the company’s conservative 2024 outlook and concerns over tax incentives in the U.S. renewables sector, as a buying opportunity. Yang believes strong demand for renewable energy from major corporations focused on decarbonization will support solid earnings growth for AES.

Overall, AES has a Moderate Buy consensus rating based on nine Buy, one Hold, and one Sell recommendations. Further, analysts’ average AES stock price target of $18.44 implies a 41.6% upside potential from current levels.

Rithm Capital

Rithm Capital is a diversified real estate investment firm focused on acquiring and managing income-generating properties and assets. The company offers a high dividend yield of around 8.99%, well above the Real Estate sector of 3.2%. It has been actively expanding its portfolio, with recent strategic moves such as the closing of a $461 million securitized financing backed by mortgage servicing rights (MSRs) in January 2024. This, along with a strong 19.1% year-over-year increase in interest income, positions Rithm Capital for growth in 2025.

Overall, Rithm Capital stock has a Strong Buy consensus rating based on three unanimous Buys. Among the bullish analysts, B. Riley analyst Matt Howlett maintained a Buy rating and $14 price target on Rithm Capital. He raised the 2024 EPS forecast following a strong Q3. Howlett expects RITM to maintain its quarterly dividend, supported by a resilient servicing portfolio, growing market share at Newrez, and strong liquidity.

Turning back to Rithm Capital, the average RITM stock price target is $13.17, implying about 20% upside potential.

Bottom Line

Heading into 2025, high-yield dividend stocks such as Rio Tinto, AES Corporation, and Rithm Capital present appealing income and growth opportunities for investors.