Dividend ETFs remain a favorite among income-seeking investors, but not all are created equal. Using TipRanks’ High Dividend Yield ETFs tool, we have shortlisted three ETFs: iShares Emerging Markets Dividend ETF (DVYE), First Trust Dow Jones Global Select Dividend Index Fund (FGD), and Global X MSCI SuperDividend Emerging Markets ETF (SDEM) that offer high dividend yields of over 5%.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For context, a dividend ETF (Exchange-Traded Fund) is a fund that holds a basket of dividend-paying stocks and trades on an exchange like a regular stock.

Quick Comparison: Top Dividend ETFs

For those interested in ETFs, TipRanks offers powerful comparison features. TipRanks’ ETF Comparison Tool lets investors compare funds across metrics such as AUM (assets under management), expense ratios, technicals, dividend analysis, etc. Below is a screenshot for reference.

Let’s look at the details.

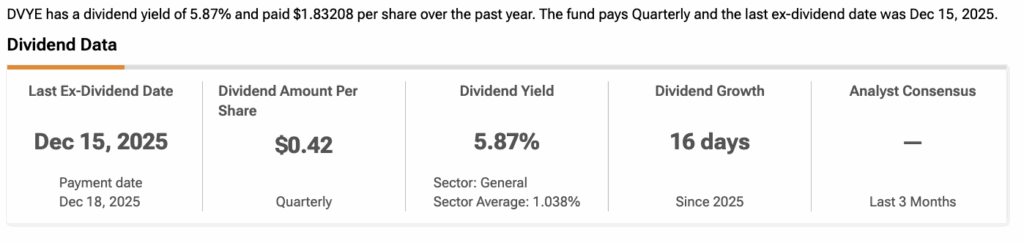

iShares Emerging Markets Dividend ETF (DVYE)

The iShares Emerging Markets Dividend ETF aims to track the Dow Jones Emerging Markets Select Dividend Index. This index follows a dividend-weighted methodology to select roughly 100 stocks from emerging markets. This focus on companies in emerging economies helps the fund deliver attractive dividend yields.

DVYE currently pays a quarterly dividend of $0.42 per share, leading to a 5.87% yield, while maintaining a low expense ratio of 0.50%. Importantly, an ETF with an expense ratio around 0.50% is often considered attractive, ensuring that the investor keeps more of the income generated. Additionally, DVYE holds 96 stocks with $1.01 billion in AUM.

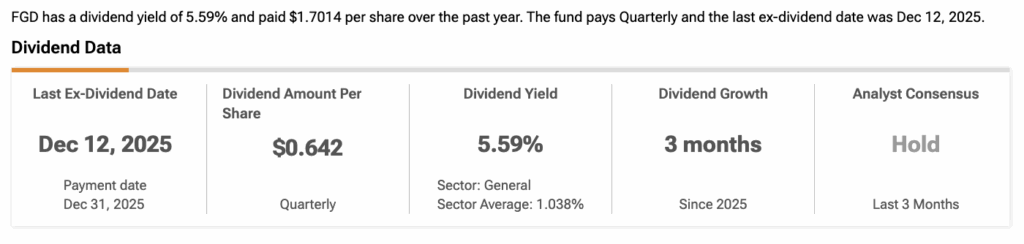

First Trust Dow Jones Global Select Dividend Index Fund (FGD)

The First Trust Dow Jones Global Select Dividend Index Fund is an ETF designed for investors seeking high income through high dividend yields. By tracking the Dow Jones Global Select Dividend Index, FGD offers a hand-picked selection of top dividend-paying stocks with global exposure.

FGD pays a quarterly dividend of $0.642 per share, reflecting a yield of 5.59%. FGD also has an expense ratio of 0.56%. In terms of holdings, FGD has a total of 99 stocks with total assets of $1.01 billion.

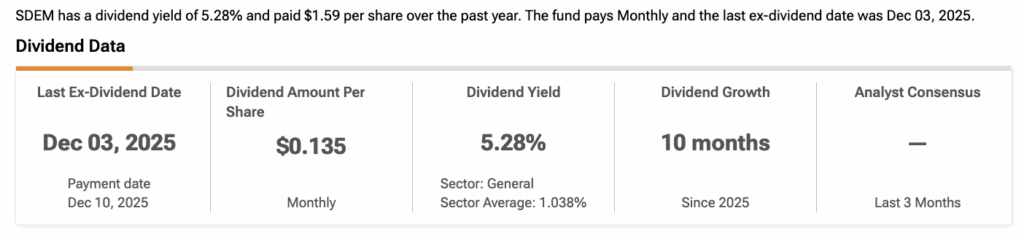

Global X MSCI SuperDividend Emerging Markets ETF (SDEM)

The Global X MSCI SuperDividend Emerging Markets ETF is an exchange-traded fund for investors who want steady income from emerging-market stocks. SDEM holds a wide mix of high-dividend firms across industries in places like Asia, Latin America, and Eastern Europe.

SDEM currently pays a monthly dividend of $0.135 per share, leading to a 5.28% yield, while maintaining an expense ratio of 0.68%. Notably, the ETF holds 52 stocks with $42.70 million in AUM.