When looking at exchange-traded funds (ETFs), relative volume serves as a key indicator of market interest and trading activity. It measures an ETF’s current trading activity against its three-month average, highlighting whether it is being actively traded. Using the TipRanks ETF Screener, we identified three ETFs with exceptionally high relative volumes, making them compelling buys for investors.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Higher relative volume often signals improved liquidity, enabling smoother transactions and easier entry or exit from positions. Additionally, increased trading activity narrows bid-ask spreads, reducing trading costs and benefiting investors.

In conclusion, ETFs with elevated relative volumes reflect strong market interest, positioning them as nice options for investors seeking efficiency and cost-effectiveness. These attributes make them attractive for investors seeking seamless and strategic trading opportunities.

Kraneshares CSI China Internet ETF (KWEB)

Kraneshares CSI China Internet ETF (KWEB) tracks a market cap-weighted index composed of overseas-listed Chinese Internet companies. This ETF is currently trading at 1.46 times its average trading volume over the past three months, indicating rising investor interest. The ETF has $5.32 billion of assets under management (AUM).

Overall, analysts remain cautiously optimistic about KWEB stock, with a Moderate Buy consensus rating based on 20 Buys, nine Holds, and one Sell. Over the past year, KWEB ETF has gained by more than 30%, and the average KWEB price target of $38.37 implies an upside potential of 25.6% from current levels.

T-Rex 2X Inverse NVIDIA Daily Target ETF (NVDQ)

T-Rex 2X Inverse NVIDIA Daily Target ETF (NVDQ) aims to provide twice the inverse exposure to the daily price movement of Nvidia (NVDA) stock, excluding fees and expenses. This ETF is currently trading at 1.34 times its average trading volume over the past three months, indicating rising investor interest. The ETF has $35.7 million of assets under management (AUM). Over the past year, the NVDQ ETF has plunged by more than 90%.

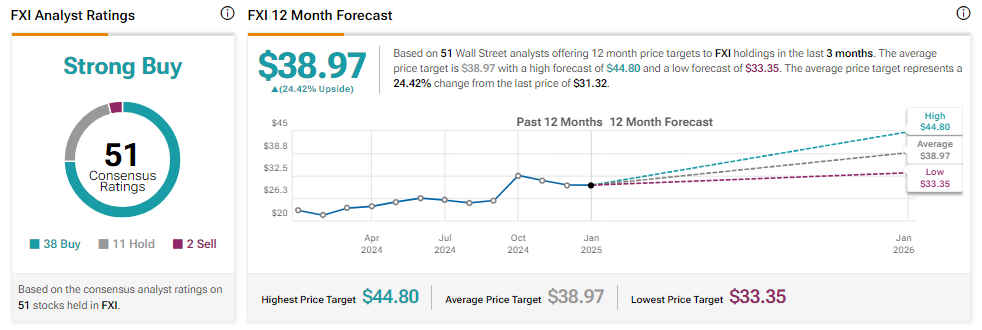

iShares China Large-Cap ETF (FXI)

iShares China Large-Cap ETF (FXI) tracks a market-cap-weighted index of the 50 largest Chinese stocks traded on the Hong Kong Stock Exchange. This ETF is currently trading at 1.28 times its average trading volume over the past three months, indicating rising investor interest. The ETF has $7.12 billion of assets under management (AUM).

Overall, analysts remain bullish about FXI stock, with a Strong Buy consensus rating based on 38 Buys, 11 Holds, and two Sells. Over the past year, FXI ETF has gained by more than 40%, and the average FXI price target of $38.97 implies an upside potential of 24.4% from current levels.

Key Takeaway

In summary, the Kraneshares CSI China Internet ETF and the iShares China Large-Cap ETF are seeing higher trading volumes, indicative of increased investor interest in Chinese stocks. Conversely, investors looking to bet against Nvidia stock are showing increased interest in the T-Rex 2X Inverse NVIDIA Daily Target ETF.