The stock market may look expensive, but there are plenty of cheap, highly-rated stocks out there with attractive dividend yields. The S&P 500 (SPX) is trading at 24 times earnings, well above historical levels and understandably causing consternation for value-minded investors.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

But there are still plenty of bargains out there if you know where to look. For example, Organon (NYSE:OGN), AT&T (NYSE:T), and British American Tobacco (NYSE:BTI)(LSE:BATS) all trade at single-digit price-to-earnings multiples and feature dividend yields of over 5% (and in the case of BTI, much higher) making them compelling choices for value and dividend investors in an expensive market.

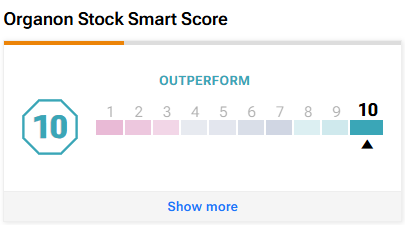

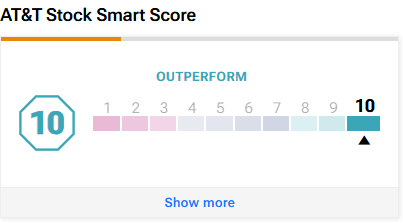

Additionally, all three “Perfect 10” Smart Scores from TipRanks’ proprietary Smart Score system. The Smart Score is a quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

I found these three high-yielding bargain stocks by using TipRanks’ free stock screener, which investors can use to screen for stocks based on market cap, upside implied by average analyst price targets, valuation, dividend yield, and more.

Organon (NYSE:OGN)

Organon, which was spun off from Merck (NYSE:MRK) in 2021, is a Healthcare stock that operates in three segments; Women’s Health, Biosimilars, and Established Brands (off-patent drugs).

While these aren’t necessarily the shiniest or highest-growth areas of the Healthcare market and thus not going to earn a huge multiple, Organon stock looks way too cheap at just 4.7 times 2024 earnings estimates. And while Organon is not necessarily a high-growth business, it’s not as if this is a business in decline, as the company grew revenue by 7% (ex-FX) year-over-year in the last quarter. Its Biosimilars segment looks especially compelling, as it grew revenue by 46% (ex-FX) year over year.

It should be noted that the company has considerable debt, but it is manageable, and it is slowly but surely paying it down. Furthermore, Organon bolsters its attractiveness with a 5.4% dividend yield.

Organon is rated highly by TipRanks’ Smart Score, earning a “Perfect 10” score.

All told, I’m bullish on OGN based on its jaw-droppingly cheap valuation, 5.4% dividend yield, and its steady business.

Is OGN Stock a Buy, According to Analysts?

Turning to Wall Street, OGN earns a Moderate Buy consensus rating based on two Buys, two Holds, and zero Sell ratings assigned in the past three months. The average OGN stock price target of $23.00 implies 11.7% upside potential from current levels.

AT&T (NYSE:T)

While AT&T is a widely-held large-cap stock, it has left a bad taste in the mouths of some investors in recent times. That’s because the stock price has languished for years and because the longtime dividend payer cut its dividend in 2022, sadly ending a streak of 35 years of dividend increases.

However, it always pays to be open-minded and to look forward rather than backward, and with this in mind, AT&T is quietly regained momentum with an impressive 26.5% gain over the past year, outperforming the S&P 500 in the process.

Even after this strong performance, the stock still features an inexpensive single-digit P/E multiple of just 8.5 times 2024 earnings estimates, and it still yields an attractive 6.0%.

Plus, Smart Score gives AT&T a coveted “Perfect 10” Smart Score rating.

I’m bullish on the telecom giant based on its renewed momentum, its valuation, which is just one-third of the S&P 500’s, and its significant 6.0% dividend yield.

Is AT&T Stock a Buy, According to Analysts?

Turning to Wall Street, AT&T earns a Strong Buy consensus rating based on nine Buys, three Holds, and zero Sell ratings assigned in the past three months. The average T stock price target of $21.50 implies 14.7% upside potential from current levels.

British American Tobacco (NYSE:BTI)

Like Organon and AT&T, British American Tobacco trades at an inexpensive single-digit price-to-earnings multiple of just 6.9 times 2024 earnings estimates.

BTI features an even larger dividend yield than both Organon and AT&T at a mouth-watering 9.1%. This 9.1% yield not only trounces the S&P 500’s yield of just 1.3%, but it’s also more than double the yield offered by 10-year treasuries (4.3%), making British American Tobacco a can’t-miss dividend stock.

While no one is going to mistake British American Tobacco for a high-growth business, BTI has a stable business with consistent demand from consumers, producing steady cash flow. Plus, the company knows that its bread and butter is rewarding income-oriented investors with its massive dividend payment. BTI also adds to its returns to shareholders through share repurchases. Additionally, BTI could have some upside from its newer smoke-free products like its glo heated products, Vuse vapor products, and Velo nicotine pouches.

Like the other stocks above, BTI receives a 10 out of 10 Smart Score.

Ultimately, I’m bullish on BTI based on its inexpensive valuation and its remarkable 9.1% dividend yield. Plus, its new smoke-free products may give it a bit more upside potential than the market anticipates.

Is BTI Stock a Buy, According to Analysts?

Turning to Wall Street, BTI earns a Moderate Buy consensus rating based on two Buys, zero Holds, and zero Sell ratings assigned in the past three months. The average BTI stock price target of $34 implies 7.5% upside potential from current levels.

The Takeaway: Opportunities Abound If You Know Where to Look

The general market may be expensive, but there are still plenty of bargains out there if you know where to look. I’m bullish on Organon, AT&T, and British American Tobacco based on their single-digit price-to-earnings multiples, which make them significantly cheaper than the broader market, and their substantial dividend yields of over 5%.

If you’re interested in finding more undervalued opportunities like these, one great way to start is by using TipRanks’ free Stock Screener tool.