These are the 3 Best REIT (real estate investment trust) stocks to buy in April 2024, as per Wall Street analysts. REIT stocks are a popular dividend investment vehicle. As per guidelines, REITs are supposed to pay at least 90% of their taxable income as dividends to shareholders. REITs have to follow certain guidelines, which exempt them from paying corporate taxes. This allows REITs to reroute more money into their business and earn more profits.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

A big advantage of REITs is that they give individual investors a chance to gain exposure to large-scale commercial properties, which is difficult for investors to do by themselves. There are several types of REITs under three main categories – equity REITs, mortgage REITs, and hybrid REITs. The three companies discussed below belong to different sub-sectors but have won analysts’ favor and high price targets, making them worth considering.

#1 Prologis, Inc. (NYSE:PLD)

Prologis is a logistics-focused REIT that invests and operates warehouses located close to huge urban areas. As of date, Prologis has over 6,700 customers. The company boasts that $2.7 trillion worth of economic value of goods moves through its facilities each year and 2.8% of the world’s GDP flows through its distribution centers annually. These numbers display Prologis’ gigantic presence in the logistics REIT segment and explain analysts’ bullish stance.

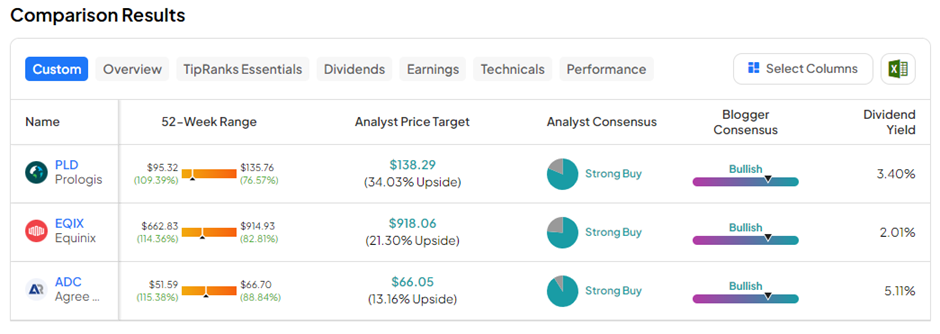

In February, PLD’s board approved a 10% annualized hike in its dividend. Accordingly, on March 29, PLD paid a regular quarterly dividend of $0.96 per share, reflecting a 3% yield.

PLD has outpaced analysts’ consensus in seven out of eight consecutive quarters. In Q1 FY24, Prologis reported diluted earnings per share (EPS) of $0.63, up 26% year-over-year. Revenue jumped 10.7% to $1.96 billion. Despite exceeding the consensus, PLD shares plunged 6% on April 17, as the company slashed its outlook for Fiscal 2024.

The uncertain macro environment and high interest rates are forcing customers to curtail costs and slowing the pace of leasing. Management expects PLD to face slower business momentum for the next one or two quarters. In the past year, PLD shares have lost 14.5% of their value.

Is PLD a Good Stock to Buy?

On TipRanks, PLD stock has a Strong Buy consensus rating based on 13 Buys and three Hold ratings. The average Prologis price target of $146.29 implies 41.8% upside potential from current levels.

#2 Equinix, Inc. (NASDAQ:EQIX)

Equinix is a digital infrastructure company that provides data center, colocation, and interconnection solutions across the Americas, Europe, Middle East and Africa, and Asia-Pacific. The company interconnects finance, manufacturing, retail, transportation, government, healthcare, and education across a digital-first world.

EQIX is set to benefit massively from the artificial intelligence (AI) wave as more and more companies rely on hyperscale data centers and digital infrastructure to train their AI models and undertake cloud initiatives.

In October 2023, EQIX’s board approved a 25% hike in the quarterly dividend to $4.26 per share. Accordingly, EQIX offers a current yield of 2.05%.

In Fiscal 2023, Equinix’s revenue jumped 13% to $8.19 billion, while diluted EPS increased 34% to reach $10.31. For FY24, EQIX expects revenue to be between $8.793 and $8.893 billion, reflecting a 7% to 9% growth. Meanwhile, for Q1 FY24, the company forecasts revenue in the range of $2.127 to $2.147 billion, indicating a 1% to 2% year-over-year growth. Equinix is set to release its Q1 FY24 results in the first week of May.

Is EQIX a Good Stock?

With 13 Buys versus four Hold ratings, EQIX stock has a Strong Buy consensus rating on TipRanks. The average Equinix price target of $918.06 implies 21.3% upside potential from current levels. In the past year, EQIX shares have gained 6.6%.

#3 Agree Realty Corp. (NYSE:ADC)

Agree Realty operates in the net lease of retail properties segment. As of March 31, 2024, ADC owned and operated a portfolio of 2,161 properties, located in 49 states and containing approximately 45 million square feet of gross leasable space. The company’s retail properties are net leased to some of the biggest omni-channel retailers in the U.S.

Interestingly, ADC pays a regular monthly dividend, unlike its peers. In March, the company’s board hiked the monthly dividend by 1.2% month-over-month to $0.25 per share. The current dividend reflects an attractive above-sector average yield of 5.2%.

On April 23, Agree Realty posted its Q1 FY24 results with diluted EPS of $0.43, which reflected a decrease of 2.4% compared to the prior-year quarter and fell short of analysts’ estimates of $0.45. In contrast, revenue rose 18% year-over-year to $149.45 million and exceeded the consensus.

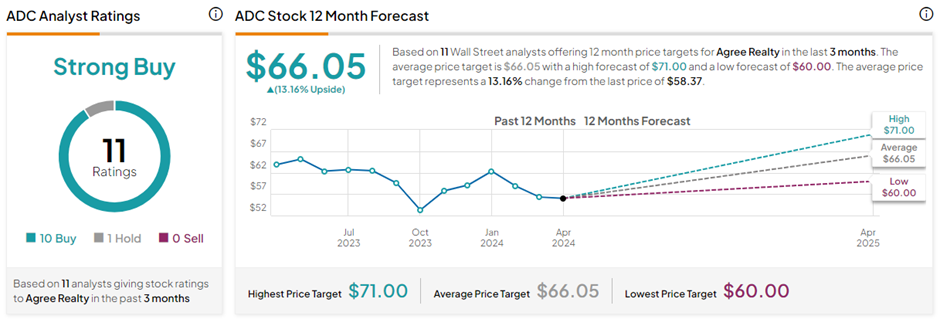

Is ADC a Good Stock to Buy?

With ten Buys versus one Hold rating, ADC stock has a Strong Buy consensus rating on TipRanks. The average Agree Realty Corp. price target of $66.05 implies 13.2% upside potential from current levels. ADC shares have lost 12.7% in the past year.

Key Takeaways

Primary advantages of investing in REITs include consistent dividends, high return potential, more liquidity compared to direct real estate investments, and lower stock volatility than other stocks. The aforementioned three REIT stocks are favored by analysts and can be considered to diversify and solidify your portfolio.