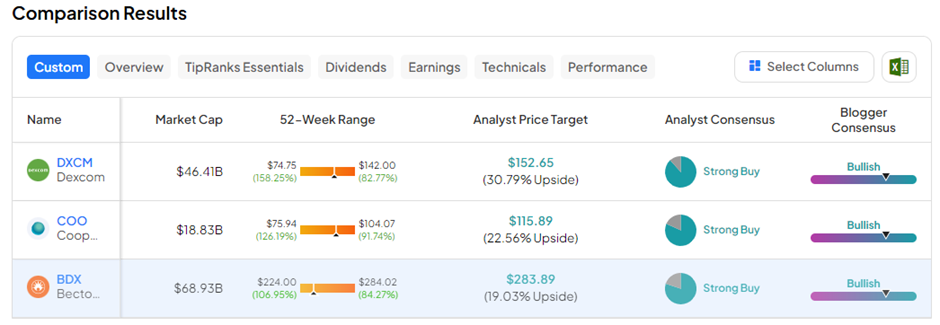

DexCom, Cooper Companies, and Becton, Dickinson and Company are the 3 Best Healthcare Stocks to Buy in June 2024, according to Wall Street analysts. We used the TipRanks Stock Screener Tool to select these three healthcare companies. The healthcare sector includes hospitals and medical facilities, biotechnology and pharmaceutical companies, medical equipment companies, and health insurance players.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

The three companies mentioned above are among the leading players in the medical technology space, each specializing in manufacturing medical devices and technology for advanced healthcare.

The healthcare sector is considered to be one of the best defensive plays in times of uncertainty. The demand for healthcare products and services is perennial and is expected to boom in the coming years. With the advent of artificial intelligence (AI), the services offered by healthcare players have considerably improved patient experience. With this background in mind, let’s dive right into the three MedTech companies.

#1 DexCom, Inc. (NASDAQ:DXCM)

DexCom is the leader in manufacturing continuous glucose monitoring (CGM) systems. The company’s key products include DexCom G6 and DexCom G7.

In Q1 FY24, DexCom exceeded analysts’ both revenue and adjusted earnings per share (EPS) estimates. Revenue rose 24% year-over-year with solid performance in both the U.S. and International markets. Based on the continued momentum, DexCom raised its full-year Fiscal 2024 revenue outlook to be between $4.20 and $4.35 billion. Also, adjusted EPS jumped 88.2% year-over-year to $0.32, as the company continues to manage its expenses efficiently.

The need for real-time CGM monitoring is increasing across the globe. This bodes well for DexCom as it is the pioneer in this field and continues to focus on innovation for diabetes care.

Is DexCom a Good Stock to Buy?

With 15 Buys and two Hold ratings, DXCM stock commands a Strong Buy consensus rating on TipRanks. The average DexCom price target of $152.65 implies 30.8% upside potential from current levels. In the past year, DXCM shares have lost 6.4%.

#2 Cooper Companies Inc. (NASDAQ:COO)

Cooper is a global medical device company focused on manufacturing devices for vision, women’s health, and surgical procedures. The company operates two segments: CooperVision, which has a dominant position in the contact lens market, and CooperSurgical, which is focused on fertility and women’s health.

In Q2 FY24, Cooper beat the adjusted EPS estimates but missed the revenue consensus. Revenue grew 7% year-over-year, while adjusted EPS rose 10% compared to Q2 FY23. The company also lifted its FY24 guidance in tandem with booming demand for its products. FY24 revenue is now projected between $3.863 and $3.905 billion, and adjusted EPS is forecasted in the range of $3.54 to $3.60.

With Cooper Vision returning to double-digit organic growth (constant currency) in Q2 FY24, the company is well-positioned to witness greater revenue momentum going forward. Plus, the upgraded FY24 guidance reflects the company’s higher confidence in its growth potential.

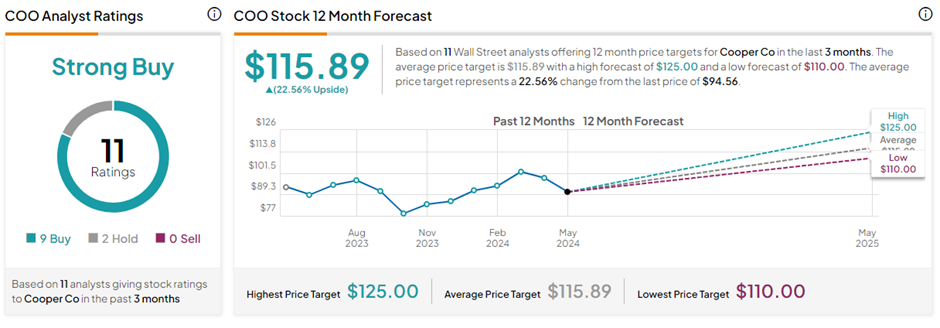

Is Cooper Companies a Buy?

On TipRanks, COO stock has a Strong Buy consensus rating, backed by nine Buys and two Hold ratings. The average Cooper Companies price target of $115.89 implies 22.6% upside potential from current levels. In the past year, COO shares have gained nearly 7%.

#3 Becton, Dickinson and Co. (NYSE:BDX)

Becton, Dickinson and Co. (BD) is one of the world’s largest medical technology companies. Its primary customers are healthcare institutions, physicians, life science researchers, and clinical laboratories. Notably, BDX pays a regular quarterly dividend of $0.95 per share, reflecting a yield of 1.56%.

In BD’s Q2 FY24 results, adjusted EPS outpaced the consensus while revenues came in line at $5.04 billion. Revenue grew 4.6% year-over-year and adjusted EPS increased by 10.8% compared to the prior-year period. BD also raised its FY24 adjusted EPS guidance, driven by solid margin execution. For FY24, BD now expects adjusted EPS in the range of $12.95 to $13.15, while total revenue is affirmed between $20.1 and $20.3 billion.

Importantly, BD is set to acquire the critical care unit of Edwards Lifesciences (NYSE:EW) for $4.2 billion. The unit is well known for its AI-backed advanced monitoring solutions, which are used by over 10,000 hospitals worldwide and contributed over $900 million in revenue in FY23. The acquisition and the accelerated demand for BD’s current offerings are poised to boost the company’s performance in the long run.

Is BDX a Good Investment?

BDX stock has a Strong Buy consensus rating on TipRanks, backed by eight Buys and two Hold ratings. The average Becton Dickinson price target of $283.89 implies 19% upside potential from current levels. BDX shares have declined 6.1% in the past year.

Ending Thoughts

The above three healthcare stocks have won analysts’ Strong Buy ratings, thanks to their sound financials and solid growth potential. Investors seeking exposure to the defensive healthcare sector can consider these three stocks to bolster their portfolios after thorough research.