We used TipRanks’ ETF Comparison tool for selecting three Gold Miners ETFs based on their past one-year performance. The ETF Comparison tool enables investors to compare ETFs across several parameters like key technical indicators, analyst consensus and price targets, dividend information, assets under management (AUM), net asset value (NAV), expense ratio and more.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Exchange Traded Funds (ETFs) are a type of investment vehicle that pool together stocks or other assets with similar characteristics. ETFs are considered as safer investments since they provide diversification and can be easily traded like stocks. Gold Miners ETFs are ETFs that hold a portfolio of gold mining companies.

Investors are attracted to gold as a safe haven investment. However, not everyone has the capacity to hold this precious metal in physical form. Gold rates have been soaring in recent years, especially during the COVID-19 pandemic and beyond, as macroeconomic uncertainty pushed investors towards safer options. At such times, investors who still want some exposure to the yellow metal can consider investing in Gold Miners ETFs or Gold ETFs (track spot gold rates). With this background in mind, let’s learn more about the three Gold Miners ETFs.

#1 iShares MSCI Global Gold Miners ETF (RING)

RING seeks to track the investment results of an index comprising global gold mining companies. RING primarily has exposure to companies that derive majority of their revenue from gold mining. RING also boasts one of the lowest expense ratios (0.39%) that the funds charge for managing the ETFs, thus enhancing your returns. In the past year, RING has earned 16.47%.

On TipRanks, RING has a Moderate Buy consensus rating based on 24 Buys, 13 Holds, and one Sell rating. The average iShares MSCI Global Gold Miners ETF price target of $32.17 implies 11.4% upside potential from current levels.

As of date, RING has 38 holdings in its portfolio, with an AUM of $498.43 million. The three largest holdings include Newmont Mining (NEM), Agnico-Eagle Mines (AEM), and Barrick Gold (ABX), representing roughly 44.8% of the total portfolio.

iShares MSCI Global Gold Miners ETF has witnessed total net outflows (inflows less outflows) of $2.01 million in the past year.

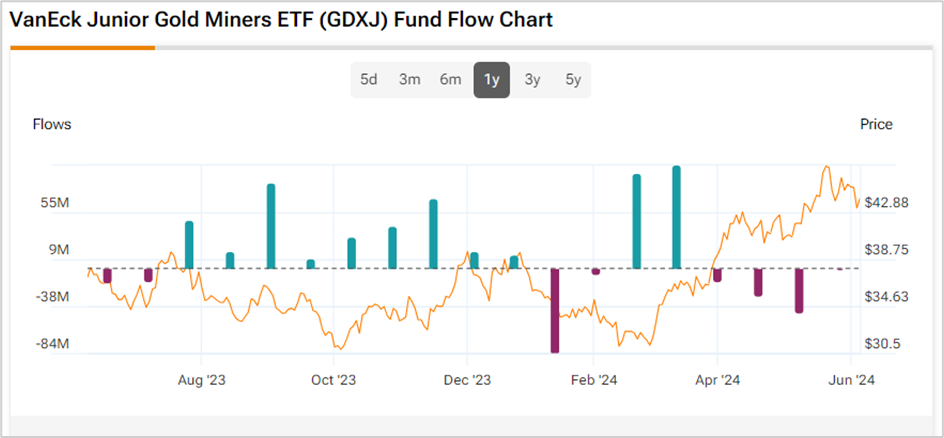

#2 VanEck Junior Gold Miners ETF (GDXJ)

GDXJ seeks to track the price and performance of the MVIS Global Junior Gold Miners Index, which in turn tracks the performance of small cap ($300 million to $2 billion) companies engaged primarily in the mining of gold and silver. GDXJ has a higher expense ratio of 0.52% than RING and has earned 16.36% in the past year.

On TipRanks, GDXJ has a Moderate Buy consensus rating based on 71 Buys, 16 Holds, and two Sell ratings. The average VanEck Junior Gold Miners ETF price target of $51.84 implies 14.3% upside potential from current levels.

As on date, GDXJ has 89 holdings, with an AUM of $5.21 billion. The three largest holdings are Kinross Gold (KGC), Pan American Silver (PAAS), and Alamos Gold (AGI), representing roughly 22.06% of the total portfolio.

VanEck Junior Gold Miners ETF has witnessed total net inflows (inflows less outflows) of roughly $314 million in the last one year.

#3 Sprott Junior Gold Miners ETF (SGDJ)

SGDJ seeks to track the performance of its underlying index, the Solactive Junior Gold Miners Custom Factors Index. The aim is to focus on junior gold producers with the strongest revenue growth and junior exploration companies with the strongest stock price momentum. SGDJ has an expense ratio of 0.50% and a year gain of 14.36%.

Similar to the other two ETFs, SGDJ has a Moderate Buy consensus rating based on 35 Buys and seven Hold ratings. The average Sprott Junior Gold Miners ETF price target of $43.68 implies 24.7% upside potential from current levels.

As on date, SGDJ has 42 holdings, with an AUM of $123.59 million. The three largest holdings are Seabridge Gold (SA), McEwen Mining (MUX), and Victoria Gold Corp. (VGCX), representing approximately 14.24% of the total portfolio.

Sprott Junior Gold Miners ETF has witnessed total net inflows (inflows less outflows) of $5.81 million in the last one year.

Ending Thoughts

Investing in Gold ETFs can be an apt choice for investors with moderate risk-return profile. Gold serves as a good protection against inflation. Investors can consider the above discussed three Best Gold Miners ETFs to boost their portfolio returns after thorough research. The TipRanks ETF Comparison tool enables investors to compare and contrast various ETFs based on different asset classes and genres. Currently, analysts expect higher upside potential from SGDJ ETF compared to GDXJ and RING ETFs.