With ETFs competing for attention, finding true outperformers can be challenging. TipRanks’ ETF AI Analyst identifies three Outperform-rated ETFs with at least 10% upside potential.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

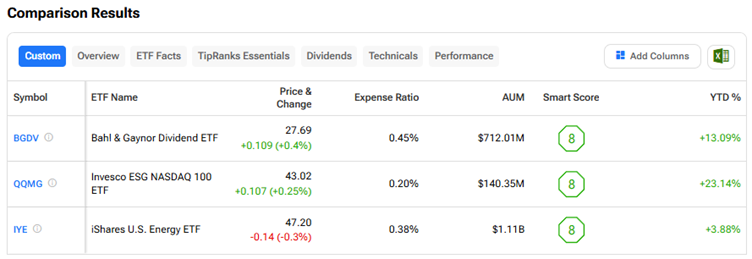

Let’s look at how they stack up against each other in the ETF Comparison Tool below.

- Bahl & Gaynor Dividend ETF (BGDV) — This fund invests primarily in dividend-paying U.S.-listed stocks of large-cap companies. The ETF AI analyst has a price target of $31 on the BGDV ETF, indicating an upside potential of about 12%. The AI Analyst’s Outperform rating is based on strong performance of top holdings, such as Alphabet (GOOGL) and Taiwan Semiconductor Manufacturing Company or TSMC (TSM).

- Invesco ESG NASDAQ 100 ETF (QQMG) — The QQMG fund tracks the performance of the Nasdaq-100 ESG Index, providing exposure to companies that meet environmental, social, and governance (ESG) criteria. The ETF AI analyst has a price target of $48 on the QQMG ETF, implying 11.6% upside potential. The AI Analyst highlighted strong contributions from holdings like Microsoft (MSFT) and Apple (AAPL).

- iShares U.S. Energy ETF (IYE) — The fund seeks to track the performance of the Russell 1000 Energy RIC 22.5/45 Capped Gross Index, composed of U.S. equities in the energy sector. The ETF AI analyst has a price target of $53 on the IYE ETF, indicating an upside potential of about 12.3%. The fund’s Outperform rating is based on its top holdings, including energy giants Exxon Mobil (XOM) and Chevron (CVX).

Power up your ETF investing with TipRanks. Discover the Best AI ETFs, carefully curated based on TipRanks’ analysis.