Exchange-traded funds (ETFs) are an attractive investment vehicle for investors seeking lucrative returns with lower risk, as they offer diversification across several stocks, sectors, or asset classes. However, deciding which ETF to buy can be challenging. That’s where TipRanks’ ETF AI Analyst comes in!

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

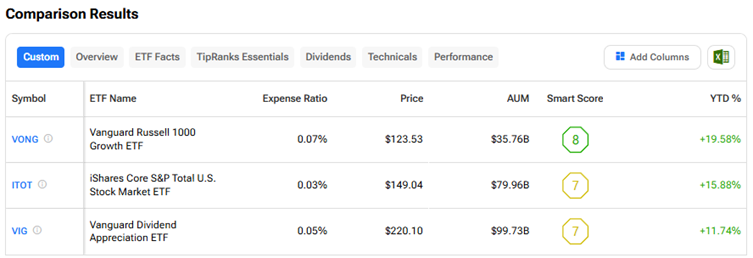

Below are three ETFs that TipRanks’ AI Analyst is bullish on. These ETFs have an Outperform rating and offer at least 10% upside. With the help of TipRanks’ ETF Comparison Tool, here’s how the three funds compare.

Vanguard Russell 1000 Growth ETF (VONG) — The VONG ETF tracks the performance of the Russell 1000 Growth Index. It offers exposure to a diverse portfolio of large-cap growth stocks across sectors like technology, healthcare, and consumer services. The VONG ETF has an expense ratio of 0.07%.

TipRanks’ AI Analyst has an Outperform rating on the VONG ETF with a price target of $138, indicating an upside potential of 11.71%. The AI Analyst’s bullish stance is based on VONG ETF’s solid holdings in companies like Nvidia (NVDA) and Microsoft (MSFT), both of which are gaining from artificial intelligence (AI) tailwinds. However, weakness in holdings like Tesla (TSLA), which faces valuation risks and regulatory challenges, slightly weighs on VONG’s overall rating.

iShares Core S&P Total U.S. Stock Market ETF (ITOT) — The ITOT ETF tracks the performance of the S&P Total Market Index. It offers investors broad-based exposure across several sectors and company sizes. The ITOT ETF boasts a low expense ratio of 0.03% and high liquidity.

TipRanks’ AI Analyst has assigned an Outperform rating to the ITOT ETF with a price target of $164, implying about 10.04% upside potential. The AI Analyst’s rating is based on ITOT’s solid exposure to high-performing companies like Nvidia and Microsoft. However, weakness in holdings like Berkshire Hathaway (BRK.A) (BRK.B), which faces challenges in revenue and cash flow growth, slightly tempers the AI Analyst’s overall score for the ITOT ETF.

Vanguard Dividend Appreciation ETF (VIG) — The VIG ETF tracks the performance of the S&P U.S. Dividend Growers Index. It offers investors exposure to high-quality, dividend-growing companies. The holdings of this ETF have a robust history of increasing dividends, reflecting financial health and sustainable profitability. The VIG ETF has an expense ratio of 0.05%.

TipRanks’ AI Analyst has an Outperform rating on the VIG ETF with a price target of $243, indicating about 10.40% upside potential. The AI Analyst highlighted that the VIG ETF gains from strong contributions from holdings like Microsoft and Mastercard (MA), which are well-positioned for continued growth, driven by their robust financial performance and strategic investments. However, weaker holdings such as Oracle (ORCL) and JPMorgan Chase (JPM) slightly weigh on VIG’s overall rating due to some concerns related to leverage, cash flow, and credit costs.