We selected the 3 Best Cybersecurity stocks to buy in June 2024 based on analysts’ Strong Buy consensus rating and upside potential. We used the TipRanks Comparison Tool for Cybersecurity Stocks to choose the three companies. As per research from Statista, the global cybersecurity market revenue is forecasted to reach $183.10 billion in 2024, making it a lucrative sector to invest in.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The rising frequency and complexity of cyber threats have propelled the need for greater cybersecurity solutions across all industries. Cybersecurity companies offer various services and security solutions, including threat detection and prevention, encryption, and endpoint security. Their software offerings protect both individuals and businesses at the systems, devices, networks, and data levels. With this background in mind, let’s dive right into the three companies.

#1 Tenable Holdings Inc. (NASDAQ:TENB)

Tenable Holdings is a specialist in exposure management that offers several services, namely vulnerability management, cloud security, identity security, and external attack surface management. The company’s solutions reduce the threat of cloud attacks across infrastructure, identities, and workloads. Tenable is also integrating artificial intelligence (AI) technology into its offerings, making them more robust.

In Q1 FY24, Tenable’s revenue rose 14.4% year-over-year to $215.96 million, easily beating the consensus estimate of $213.56 million. Moreover, adjusted earnings per share (EPS) more than doubled to $0.25 and exceeded the consensus of $0.17.

Based on the continued business momentum, Tenable projects Q2 revenue in the range of $217 to $219 million and adjusted EPS between $0.22 and $0.24. In comparison, the consensus estimates for the second quarter’s revenues and adjusted EPS stand at $218.56 million and $0.24, respectively.

Importantly, Tenable is set to acquire Eureka Security, Inc., a leader in Data Security Posture Management (DSPM) for cloud environments. The acquisition will bolster the company’s cloud data security solutions and help capture the opportunities in the fast-growing DSPM segment within the security market.

Is Tenable a Good Stock to Buy?

With six Buys versus two Hold ratings, TENB stock has a Strong Buy consensus rating on TipRanks. The average Tenable Holdings price target of $56.14 implies 33.7% upside potential from current levels. In the past year, TENB shares have gained 5.4%.

#2 Zscaler (NASDAQ:ZS)

Zscaler is a cloud-based security solutions provider that accelerates users’ enterprise digital transformation by mitigating risks on all fronts. The company’s Zero Trust Exchange platform protects customers from cyberattacks and data loss by providing secure connections between users, devices, and applications.

The company reported a solid beat for Q3 FY24 and raised the guidance for the full-year Fiscal 2024. In the Fiscal third quarter, Zscaler’s revenue jumped 32% year-over-year to $553.2 million, while calculated billings grew 30% to $628 million.

Zscaler continues to strengthen its Zero Trust Exchange program with AI capabilities to enhance user experience. On Tuesday, the company announced a partnership with semiconductor giant Nvidia (NASDAQ:NVDA) to offer generative AI-powered copilot technologies.

What is the Future of Zscaler Stock?

Although several analysts lowered their price targets following the Q3 print, Wall Street remains highly optimistic about Zscaler’s long-term stock trajectory.

On TipRanks, ZS stock has a Strong Buy consensus rating, backed by 23 Buys and seven Hold ratings. The average Zscaler price target of $228.57 implies 21.8% upside potential from current levels. Shares have gained over 20% in the past year.

#3 Palo Alto Networks (NASDAQ:PANW)

Palo Alto Networks is one of the world’s largest cybersecurity players. The company enables organizations to shape their digital footprint without fear of cyber attacks and loss of data. Its services encompass a broad spectrum to secure the network, cloud, individual, and enterprise, supported by AI-infused technology.

Palo Alto outpaced analysts’ expectations on both the top and bottom lines for Q3 FY24. However, investors remained unimpressed by the company’s tepid guidance.

In Q3 FY24, Palo Alto’s revenue rose 15%, while adjusted EPS jumped 20% compared to the prior-year period. However, PANW’s revenue guidance for Q4 FY24 implies a 10%-11% increase, reflecting conservative projections.

What is the Target Price for Palo Alto Stock?

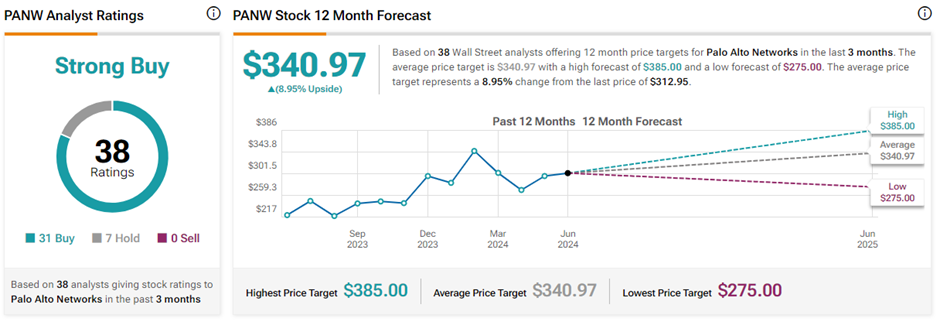

Analysts are highly bullish about PANW’s stock trajectory. Based on 31 Buys and seven Hold recommendations, PANW stock has a Strong Buy consensus rating on TipRanks. The average Palo Alto Networks price target of $340.97 implies 8.9% upside potential from current levels. PANW shares have gained 36.6% in the past year.

Key Takeaways

The cybersecurity landscape remains challenged due to macro headwinds. Yet, the three companies discussed above have shown strength in growing their revenues and customer base. The increasing sophistication of cyber threats has compelled enterprises to invest in cybersecurity solutions, with spending expected to grow in the times ahead. Investors looking for exposure to the dynamic sector can consider the aforementioned three cybersecurity stocks after thorough research.